The Top Canadian Small Cap ETF to Look at in December 2024

The promise of **getting rich** quick by investing in small-cap stocks can **entice** many investors to make poor choices and **ultimately** lose money.

However, there is no doubt that small-cap stocks can be extremely profitable. We provide them to Stocktrades Premium members on a monthly basis.

But, they require extensive research, and mistakes can be amplified due to their overall volatility. As such, for beginners who are just learning how to buy stocks in Canada it can lead to some large losses if you’re wrong.

So, how does a normal investor, who doesn’t have the time, knowledge, or skill level to pick small cap stocks gain exposure to some of these diamonds in the rough?

Well, they can buy a small cap ETF. And, if you’re looking for a Canadian ETF that holds small cap stocks, the iShares S&P/TSX Smallcap Index (TSE:XCS) is where to look.

What is the best Canadian small cap ETF?

Currently, the iShares S&P/TSX Smallcap Index (TSE:XCS) from Blackrock is your only option for a small cap ETF in Canada.

We’re fairly limited in Canada when it comes to small cap ETFs. In fact, we’ve really only got one.

But, this isn’t because there is a negligence towards creating small cap ETFs here in Canada, it’s just we don’t have enough small cap stocks to justify it.

As a result the iShares S&P/TSX Smallcap Index is going to be your only option.

So how has this small cap ETF performed?

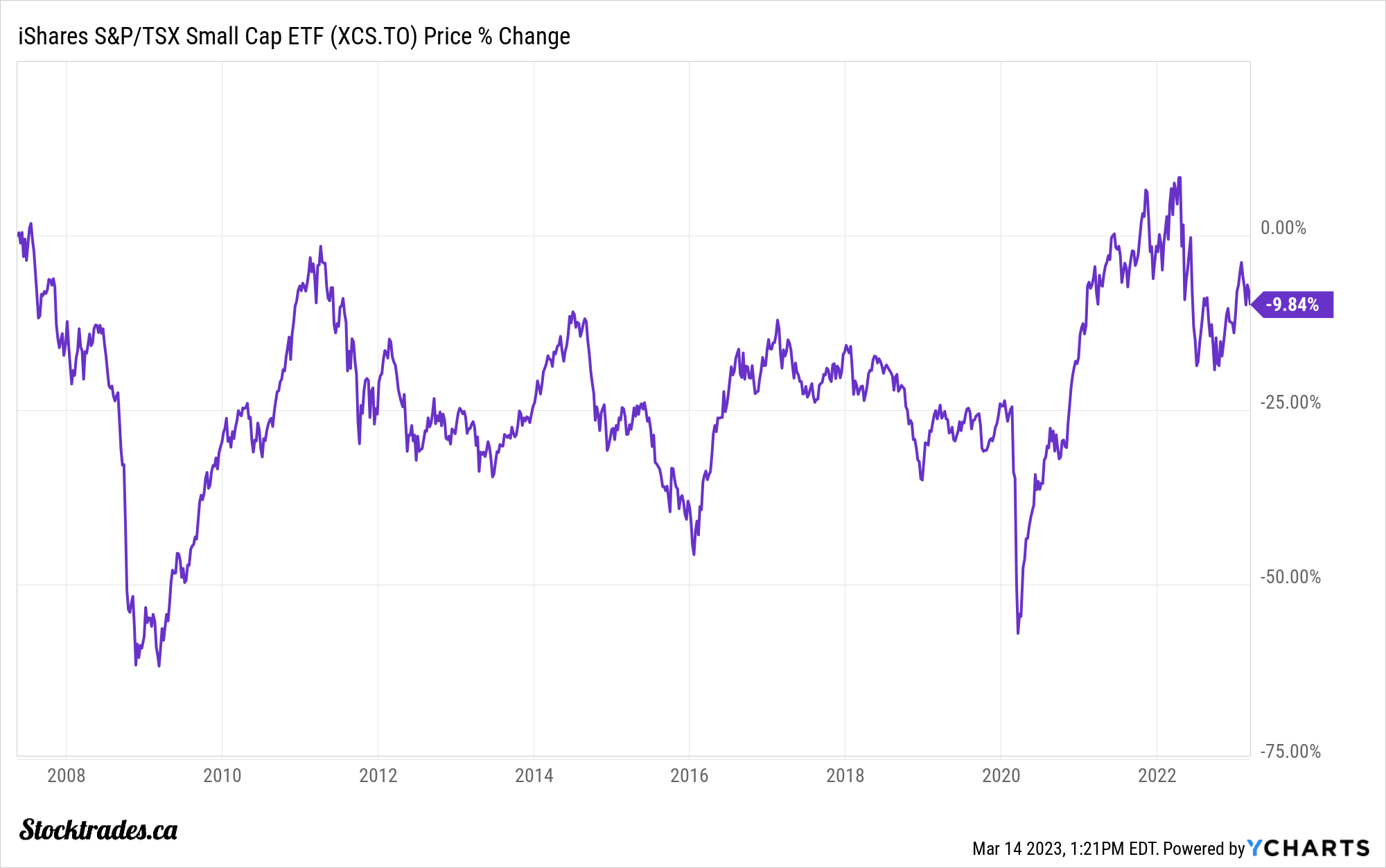

Unfortunately, the past performance of this small cap ETF has been, to put it lightly, underwhelming.

As you can see the total returns of this ETF have been lacklustre for the better part of 13 years. In fact, its historical annual rate of return since its inception is just 1.79%. That return also would have required you to reinvest the dividends.

Now, the ETF got off on the wrong foot due to no fault of its own. It simply debuted right before the financial crisis and a $10,000 investment in the ETF quickly ended up being worth around $4000.

Since it’s recovery from the financial crisis, the small cap ETF has traded relatively sideways for the last decade and has provided little long-term capital growth and ultimately incentive for Canadians to invest.

It rebounded in a post-pandemic environment as speculation reigned supreme. But in 2022, a significant selloff of small cap stocks in North America caused this ETF to underperform yet again.

iShares small cap ETF holdings

The fund’s portfolio contains a little more than 230 equity securities, and its top holding is currently Eldorado Gold (TSE:ELD). Keep in mind this is an index fund. So, the investment strategy is to ultimately track its benchmark index, the performance of the S&P/TSX SmallCap Index, net of expenses.

Although Eldorado is the ETFs number one holding, it still only makes up 2% of the funds allocation. This is a diverse ETF, with its top 10 holdings making up only around 14% of assets.

The top ten holdings in this small cap ETF used to be diverse. However, as of this latest update it is extremely concentrated in mining companies. OceanaGold Corp, Ero Copper, Athabasca Oil, Dundee Precious Metals, and Torex Gold Resources are all in the top 10 holdings.

Overall, the ETF has around 30% exposure to the material sector and nearly 20% exposure to oil and gas. So you can definitely expect this ETF to be cyclical.

With this large of exposure to gold, silver, and copper miners along with oil and gas producers, both of which have suffered through extreme bear markets over the last ten years, it’s no wonder the ETF has done poorly.

This iShares small cap ETF comes with an expensive price tag

When it comes to ETFs, fees are critical. And paying an extensive management expense ratio (MER) for a severely underperforming ETF is a tough pill to swallow.

XCS has a management fee of 0.60%, indicating you’re going to pay $6 for every $1000 invested in this fund.

Considering it’s been able to turn $1000 into a meager $1250 over the last 13 years in terms of capital appreciation, this is essentially a break even investment when it’s all said and done.

However, the ETF does pay a dividend, and more than you’d expect from a small cap ETF. At the time of writing, XCS pays a 1.3% yield.

This doesn’t make up for it’s lackluster performance, but it’s an added bonus for sure.

An important thing to note about the fund’s distribution. It can be made up of a wide variety of types of income. Return of capital, dividends, capital gains distributions, and more. If you’re thinking about buying, it is very important you understand the impact on your income taxes before doing so.

This Canadian small-cap ETF has just had exposure to the wrong companies

There are plenty of small cap options here in Canada. As I said, we bring them to Stocktrades Premium members all the time.

However, XCS has just had exposure to all of the wrong ones.

In my opinion, it is too cyclical, and in order for Canadians to take advantage of the small cap options we have here, and ETF filled with 50%+ exposure to the material and oil and gas sector is likely not going to bode well.

Overall, I’d be passing on it moving forward

As an investor who purchases individual Canadian small cap stocks on a fairly regular basis, I know there’s potential here in Canada for outsized returns.

However, this small cap ETF has performed relatively poorly since inception, and unless gold and oil continue to maintain strength, it’s likely it will continue to underperform moving forward.

I don’t like the ETF’s excessive exposure to the material and oil sector. Small exposure to gold in terms of a hedge for uncertainty is one thing, but over half of this ETF is either exposed to material or oil stocks, both of which are prone to cyclical activity based on commodity prices.

Just keep in mind however, if you do decide to avoid this ETF and instead try your skills at investing in individual small cap stocks or even other ETFs that might be smaller, such as the Blockchain Technology ETFs, these do come with much more risk than say a blue-chip option.

Always understand how a particular investment fits in to your overall risk tolerance, and decide whether or not its right for you from there.