Stock Market Crash? Shore up With These 2 Top Canadian Stocks

The stock market has been on a historic run over the last couple years. We’ve witnessed the absolute heights of the market in early 2020 followed by the quickest stock market crash in history.

Since then, we’ve been on a parabolic level of recovery, with stock market indexes returning significant levels of growth. To sum it up in a single sentence, you simply couldn’t have afforded to be sitting on the sidelines during this current bull run.

But, now more and more investors are hesitating when it comes to buying Canadian stocks as they feel the markets are overvalued. Which in most cases is correct. So although we do not advocate timing the market, there’s no doubt you should be looking to shore up your portfolio with defensive options if you’re a little light in that regard.

Lets go over two Canadian stocks that can be expected to do just that. Both of these stocks have exceptional economic moats, and although their stock prices would likely fall in the event of a market crash simply due to sheer panic, it is unlikely that their businesses would be impacted.

Telecom giant BCE (TSX:BCE)

When we think of economic moats and reliability, you could build a solid defense that the Canadian telecom sector is one of the strongest in the world.

We have 3 key players here in Canada that make up over 92% of the market share. Rogers Communications (TSE:RCI.B), Telus (TSE:T), and the one we’re going to talk about today, BCE (TSE:BCE), or otherwise known as Bell Communications.

So why Bell over the other two? Well, primarily due to exposure. Don’t get me wrong, you could own any one of those 3 telecoms and be absolutely fine. Rogers is primarily focused in eastern Canada while Telus is more prominent in the west. But BCE seems to have a country wide reach that simply cannot be matched.

What is BCE (TSX:BCE) made up of?

BCE is both a wireless and internet service provider. However, the company also does have a media division and licenses Canadian rights to movie channels such as HBO and Showtime. Last year its wireline segment accounted for 55% of EBITDA, wireless 38%, and media the remainder. So as you can see, although the company does have a media division, it’s quite small in the grand scheme of company operations.

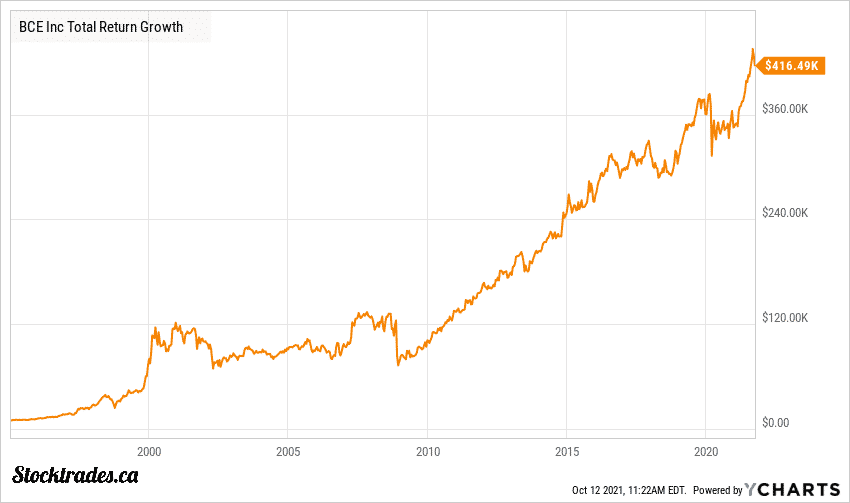

With a market cap of $56.9B, it is the largest telecom company in the country by a wide reach, and has provided exceptional returns for Canadians over the years. In fact, if you had invested $10,000 into BCE in the mid 1990’s and reinvested the dividends, you’d be sitting on total capital of $416,490.

BCE (TSX:BCE) dividend protected by economic moat

The company pays an excellent dividend, primarily because of this economic moat. Its dividend growth streak is smaller than other telecoms at 12 years, this is due to a failed acquisition attempt by the Ontario Teachers Pension Plan, during which time the dividend was frozen.

Is BCE going to be the fastest growing telecom? Unlikely. But, if you’re looking for the most stable and highest yielding telecom to add to your portfolio today in the case of some market turbulence, this is likely the company for you.

Canadian Pacific Rail (TSX:CP)

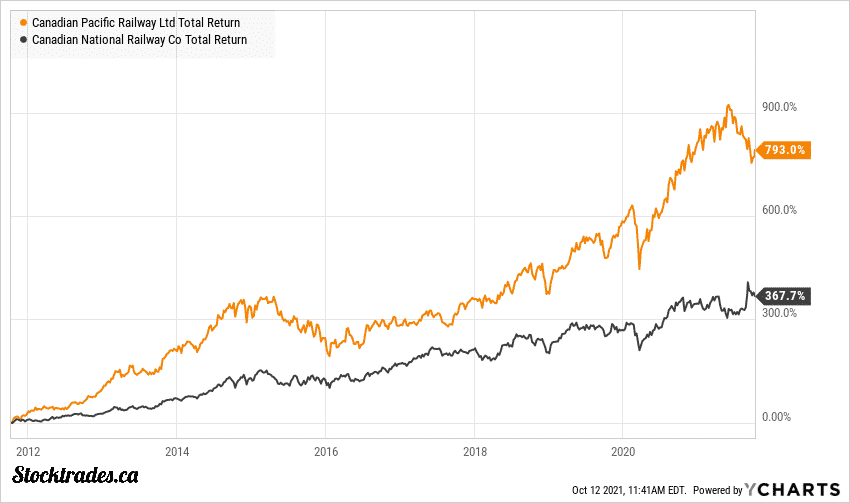

Canadian Pacific Rail (TSE:CP) had a rough go of things over the last decade. The company lost its Canadian Dividend Aristocrat status and went through some operational issues that soured investors. However, those times seem to be behind the company, and over the last while it has performed exceptionally well. In fact, better than its peer Canadian National Railway (TSE:CNR).

CP Rail and Canadian National Rail form a duopoly in Canada. Canada’s railway companies are known to have one of the most impenetrable markets in the world, making them outstanding investments in terms of reliability.

The company has recently been on a bit of a downtrend due to a feud with Canadian National Railway for the acquisition of Kansas City Southern that went on for months. Canadian National backed out, and the market viewed the acquisition as an overpayment by Canadian Pacific and as a result it has been spinning its wheels for the better part of 4 months.

CP Rail (TSX:CP) valuation consideration

However, this could be an opportunity for investors to add a defensive stock at a reasonable valuation. Canadian Pacific is currently trading at 19.75 times forward earnings and 23 times free cash flow, both of which are below the industry averages and its 3, 5, and 10 year median averages. Of note, its also much cheaper than its peer Canadian National, which is trading at 21.3 times forward earnings and 34.6 times cash flow.

Over the long term, both railways are likely to provide long standing returns for those who wish to invest in them. Wide economic moats, strong returns on capital, and an ever-growing population increasing shipping demand are strong tailwinds.

But, there’s no question that CP Rail on a valuation basis, primarily due to the negativity towards the Kansas City Southern acquisition, does provide better value right now.

Although there is a lot of moving parts to the deal, it could work out well for the company and this market reaction could end up being a short term opportunity that Canadians will thank themselves for scooping up.

Next, lets go over two top Canadian stocks that tick-off two important boxes.