Should You Buy Suncor Energy Stock Despite Soft Oil Prices?

Suncor Energy has been a major player in Canada’s oil and gas industry for decades.

As one of the country’s largest energy companies, it has faced its share of ups and downs. The global pandemic is one I can think of right off the top of my head.

Despite challenges, the company has shown resilience, adapting to changing market dynamics and environmental concerns. Its integrated business model, which includes upstream production, midstream transportation, and downstream refining and marketing, has helped buffer against some of the industry’s volatility.

The company has also been investing in cleaner energy technologies and setting ambitious environmental targets.

However, is the blue-chip energy company a buy at this point, or are you better off avoiding the oil and gas sector as a whole?

Key Takeaways

- Suncor’s stock routinely reflects the volatile nature of the energy sector. Investors have to accept this

- The company’s integrated business model helps buffer against industry fluctuations

- Suncor’s Strong Q2 report shows major improvement despite lower prices

Suncor Energy’s Q2 Earnings: An Overview

Suncor Energy delivered a strong Q2 2024. The company’s adjusted operating earnings reached $1.626 billion, or $1.27 per share, surpassing analyst estimates.

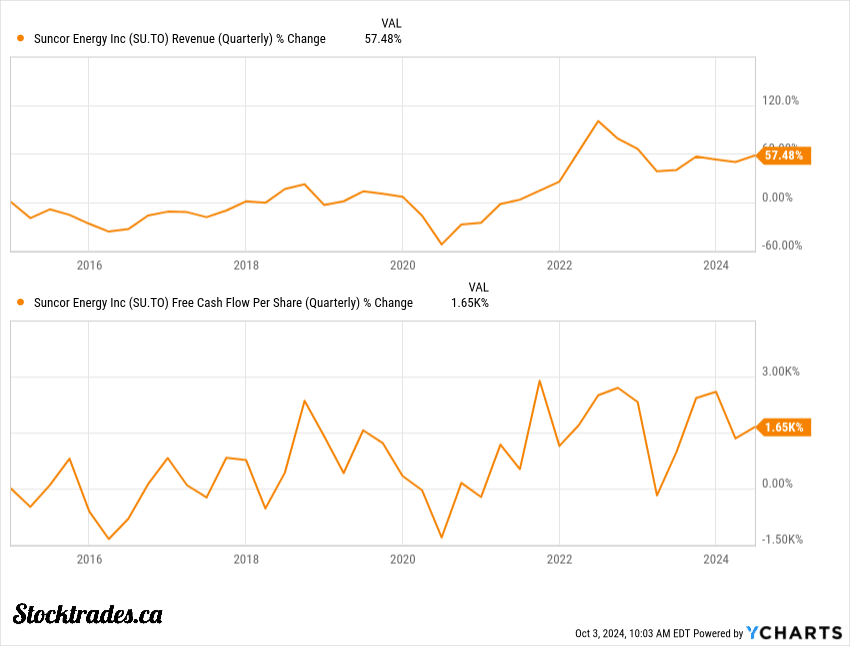

I’m impressed by Suncor’s ability to generate substantial cash flow regardless of prices. The company reported adjusted funds from operations of $3.4 billion, demonstrating that it can operate in a wide variety of environments.

Suncor’s upstream production hit 770,600 barrels per day, a notable increase from the previous year. This growth was driven by record-breaking performances at key assets like Fort Hills and Firebag.

The company’s refinery utilization rate of 92% is exceptional, especially considering the major turnaround activities completed during the quarter.

As most other oil and gas companies do in this day and age, the company distributed over $1.5 billion to shareholders through dividends and share repurchases.

Suncor’s ability to reduce net debt to $9B~ is another positive sign. This improved financial flexibility positions the company well for future growth and weathering market volatility.

Positive Impact of Heavy Turnaround Activities

Suncor Energy’s recent turnaround activities have yielded impressive results. The company’s dedication to major maintenance and upgrades across its oil sands and refinery operations has paid off handsomely.

I’m particularly impressed by how Suncor managed production downtime during these activities. Their careful planning and execution minimized disruptions, allowing for higher upstream production and refining throughput than initially expected.

These turnarounds have set the stage for future operational improvements. I believe Suncor is now better positioned to:

• Increase production efficiency

• Reduce unplanned downtime

• Enhance overall asset reliability

The cost savings from these efficiency upgrades are likely to be substantial. By modernizing equipment and streamlining processes, Suncor can potentially reduce operating expenses and boost profitability in the long run.

Upgrades often include improvements in energy efficiency and emissions reduction technologies. This demonstrates Suncor’s commitment to balancing production growth with environmental responsibility.

Looking ahead, I expect these turnaround efforts to positively impact Suncor’s long-term production forecasts.

The improved operational performance we’re seeing suggests that Suncor may be able to consistently meet or exceed its production targets in the coming years.

Strategic Initiatives and Future Growth Prospects

The company’s focus on enhancing its oil sands operations through innovative technologies has paid off handsomely.

The partnership with Imperial Oil to test Enhanced Bitumen Recovery Technology is a game-changer. This collaboration could significantly reduce costs and emissions while increasing bitumen recovery. It’s a smart move that aligns with global energy transition trends.

Suncor’s financial performance has been stellar. Strong cash flows have put the company in an enviable position. I expect this will lead to increased shareholder returns through dividends and buybacks.

Key initiatives to watch for the company moving forward will certainly be:

- Expansion into renewables (wind, hydrogen, biofuels)

- Efficiency improvements in oil sands and refining

- Carbon reduction efforts

- Capital expenditure ramp ups

Rising Dividends and Share Buybacks

Suncor Energy has been making waves with its commitment to shareholder returns. I’m impressed by the company’s recent moves to boost dividends and ramp up share buybacks.

The energy giant boosted its dividend by more than 160% since 2021. Sure, it had to cut the dividend in 2020, and much of this growth was to get back to normal. However, it’s growth nonetheless.

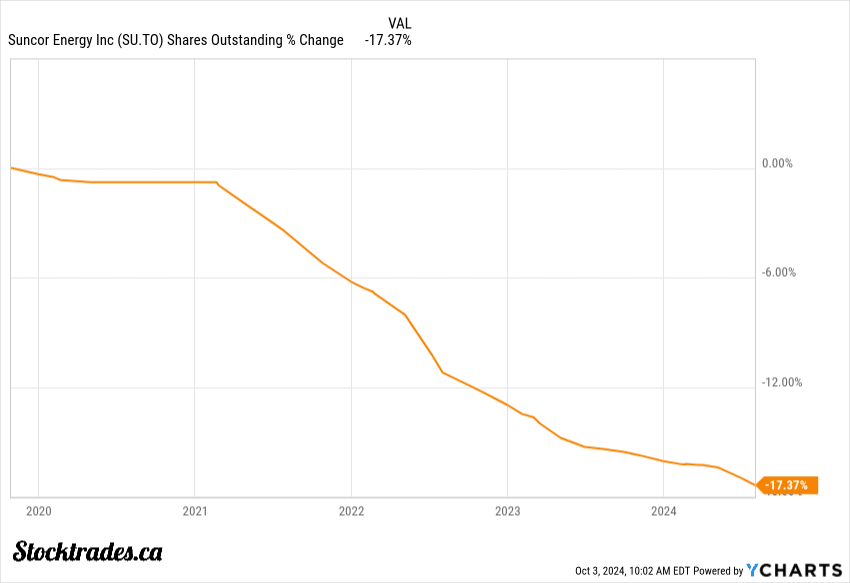

The company’s share buyback program is equally impressive. Suncor has been aggressively repurchasing its stock, which can help boost earnings per share over time, especially when shares are bought at a discount.

These shareholder-friendly actions stem from Suncor’s strong balance sheet and cash flow generation.

For income-focused investors, Suncor’s growing dividend makes it an attractive option. The current yield of around 4.2% is competitive within the energy sector.

Is Now the Right Time to Buy Suncor Energy Stock?

I believe Suncor Energy presents a compelling buy opportunity at current levels. The company’s stock has gained 23% year-to-date, outperforming the broader energy sector.

Suncor’s valuation metrics look attractive. Its price-to-earnings and price-to-cash flow ratios are lower than many peers, suggesting potential upside.

The long-term outlook for oil demand remains strong, despite the energy transition. Suncor is well-positioned to benefit from this trend as a major player in Canadian oil sands.

Suncor’s balance sheet is solid, giving it the ability to weather downturns and invest in growth opportunities. This financial strength is a key advantage.

For income investors, Suncor offers an appealing dividend yield. The company has a solid history of dividend growth outside of a pandemic blip, which I expect to continue.

Its combination of value, yield, and growth prospects make it an attractive choice for energy sector exposure.