TC Energy or South Bow Stock – What Should You Buy Today?

Key takeaways

- TC Energy’s spinoff creates two niche focused entities for investors to pick from

- The dividend structure is changing

- The drop in TC Energy’s share price wasn’t really a “drop”

TC Energy just completed a significant spinoff, creating a new entity called South Bow.

The spinoff aims to unlock value for shareholders by separating TC Energy’s core business, primarily natural gas, from its non-core assets, that being crude oil.

This strategic decision could lead to improved performance and more focused operations for both companies. It is an interesting move, one I feel was done last year in an effort to get some positive PR on the company, as its stock price had taken a large hit, along with many other pipelines.

The spinoff also brings changes to TC Energy’s dividend structure.

I’ll break down the key points and offer my thoughts on whether TC Energy or South Bow might be the better buy

TC Energy’s spinoff is complete

TC Energy has finished spinning off its Liquids Pipelines business into a new company called South Bow Corporation.

The spinoff allows TC Energy to focus on its core strengths in natural gas infrastructure and power solutions, while South Bow will focus on the oil side of the business.

For shareholders, the spinoff offers potential benefits:

- More specialized investment options

- Improved clarity on each business’s performance

- Potential for increased value as each entity pursues targeted growth strategies

TC Energy shareholders received 0.2 South Bow shares for each TC Energy share they owned. This gives investors a stake in both companies moving forward. Unless you choose to sell one, of course.

Trading for the new South Bow shares began October 2 on the Toronto Stock Exchange under the symbol SOBO. New York Stock Exchange trading is expected to start around October 8.

In my view, this spinoff positions both TC Energy and South Bow to thrive in their respective areas. TC Energy can now fully leverage its natural gas and power assets, while South Bow can pursue opportunities in the oil pipeline sector.

TC Energy plans to share more about its strategy at an Investor Day on November 19. \This event should provide valuable insights into the company’s post-spinoff direction.

What will the spinoff, called South Bow, do?

South Bow will focus on liquids pipelines and storage.

South Bow’s main business will be operating 4,900 kilometres of pipelines across Canada and the US. These aren’t just any pipelines – they’re crucial links between Alberta’s oilsands and major US markets.

The crown jewel of South Bow’s assets is the Keystone pipeline. This vital artery transports about 20% of western Canadian oil to the US. It’s a big deal for our energy sector.

But South Bow isn’t just about moving oil. The company also owns 7.6 million barrels of tank terminal storage.

I think this spinoff is a smart move. It lets South Bow zero in on the liquids business, while TC Energy can focus on its natural gas and power operations. Each company can now pursue its own strategy without competing for resources.

The market seems to agree. South Bow’s recent $7.9 billion debt offering was oversubscribed six times. That’s a strong vote of confidence in the company’s future.

I believe this new entity could become a major player in North America’s energy infrastructure landscape.

How will this unlock value for shareholders?

I believe the spinoff of TC Energy’s liquids pipeline business into South Bow Corporation has the potential to create significant value for shareholders. Here’s why:

Focused operations: Each company can now concentrate on its core business, potentially improving efficiency and performance.

Tailored strategies: TC Energy and South Bow can pursue distinct growth strategies suited to their specific markets.

Investor choice: Shareholders can now invest in either natural gas infrastructure or oil pipelines, or both, based on their preferences.

Potential for higher valuation: Separate entities often attract higher valuations than combined businesses, as investors can better assess each company’s merits.

In TC Energy’s case, I think the separation makes sense. The Keystone pipeline, South Bow’s main asset, has different risk and growth profiles compared to TC Energy’s natural gas infrastructure.

This move might also attract new investors who were previously hesitant due to the mixed business model.

How will the dividends work?

The dividend situation for TC Energy stock is a bit murky right now. It’s not entirely clear how things will shake out after the South Bow spinoff.

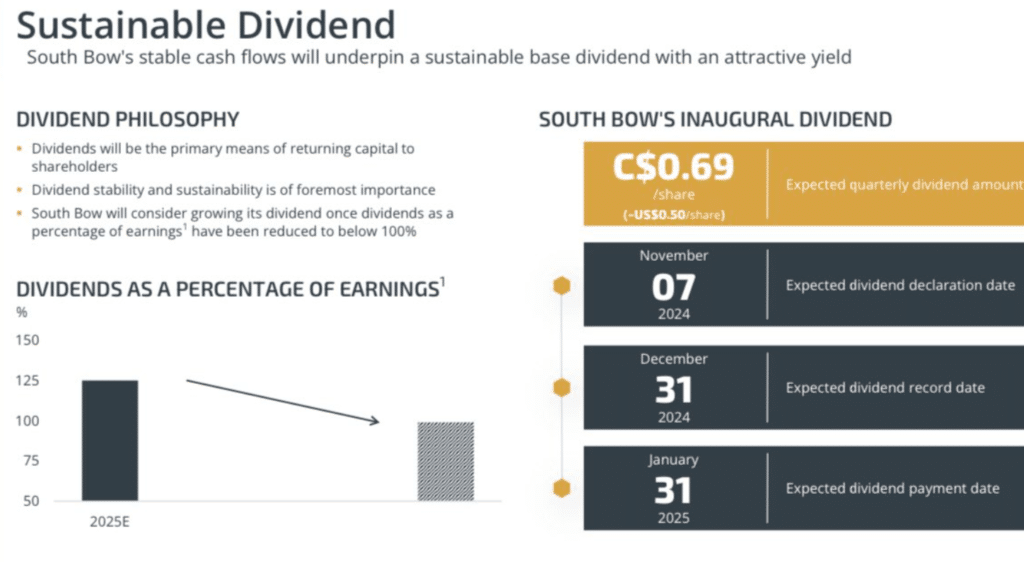

By the looks of it, South Bow will look to pay out around $2 USD a share, or at the time $2.75 CAD a share. This works out to be a whopping 10%~ yield.

In my view, the most likely scenario is that the combined dividends from South Bow and TC Energy will roughly equal the old full dividend of TC Energy. This would help maintain income for existing shareholders.

A key date to watch is November 7th, 2024. That’s when South Bow is expected to declare its first dividend. This announcement should provide much-needed clarity on the new dividend structure.

With South Bow yielding nearly 10%, I don’t expect much dividend growth out of that segment of the business for now.

Which stock should you buy, TC Energy, or the spinoff?

The decision between TC Energy and its upcoming spinoff, South Bow Corporation, isn’t straightforward. Both stocks have their merits and potential drawbacks.

TC Energy will remain focused on natural gas pipelines after the spinoff. This business provides stable cash flows and supports dividend growth. The company has a long history of increasing payouts, which is attractive for income-seeking investors.

On the other hand, South Bow will concentrate on oil pipelines. While potentially more volatile, this sector could offer higher growth prospects. The spinoff might appeal to investors looking for exposure to the oil industry.

In my view, there’s no need to choose between the two. Owning both TC Energy and South Bow could provide a balanced exposure to different energy sectors.

This strategy allows investors to benefit from the stability of natural gas and the growth potential of oil pipelines.

However, if you’re more of an income-seeker, you might like the draw of the high dividend from South Bow. If you want the more stable natural gas business with some total return potential, TC Energy could be the play.