TD Bank Stock Could Be Dead Money After New US Asset Cap

Unfortunately, something I had been predicting for quite some time now has come true.

US regulators have placed an asset cap on TD Bank’s US growth, which is likely to impact its overall ability to grow its assets south of the border. Considering this is a Canadian bank that relies heavily on US-based growth, I’m fairly confident this asset cap is going to impact earnings until it’s lifted.

And if we can learn anything from the Wells Fargo fiasco, nobody really knows when it will be lifted.

But, is TD Bank a buy today after a huge 6% drop in price based on the news? Lets talk about it.

Key takeaways

- TD Bank’s stock faces headwinds due to company-specific issues

- The current valuation doesn’t offer a compelling bargain for investors

- Other Canadian banks might present better investment opportunities right now

The worst possible scenario – An asset cap on TD Bank’s US segment

TD Bank is facing a major setback. US financial regulators have imposed an asset cap on its retail banking division south of the border. This is a serious blow to the bank’s growth plans.

I think this cap will significantly hamper TD’s ability to expand in the US market. It’s likely to put the brakes on any plans for acquisitions, opening new branches, and achieving a high level of earnings growth.

The bank’s strategy of growing through buying up smaller US banks is now off the table. We witnessed this earlier in 2023 with the failure of the First Horizon acquisition because of these AML issues.

TD may have to pay around $3 billion in penalties as part of this regulatory action. That’s a hefty sum that could impact dividends and capital allocation.

On the flip side, the fines are a bit lower than the provisions the company set aside. So it’s not all bad news.

This entire situation raises questions about the bank’s internal controls and oversight.

The timing couldn’t be worse for TD. The bank just announced a CEO change, a likely result of the anti-money laundering issues. The new leader will have their hands full dealing with these regulatory issues from day one.

In my view, this asset cap casts a long shadow over TD’s US operations. It may take years to resolve these issues and regain the trust of regulators.

Wells Fargo is an example of the impacts of a cap

I’ve seen this story before, and it’s not pretty. When Wells Fargo faced its asset cap in 2018, it became a financial albatross for years. Just take a look at its stock price since the cap was placed.

The bank’s stock price flat-lined, barely budging while competitors soared. Investors lost faith, and many jumped ship. It’s hard to blame them.

Wells Fargo’s earnings stagnated, unable to grow beyond the $1.95 trillion asset limit. This hampered its ability to take on new corporate deposits or expand its trading arm.

Regulatory pressures were relentless. The bank faced a gauntlet of consent orders and compliance hurdles. Each setback pushed the finish line further away.

For TD Bank, I worry we might see a similar pattern unfold. While not identical in scale or circumstances, the parallels are concerning:

• Restricted growth potential

• Increased regulatory scrutiny

• Potential loss of investor confidence

The timeline for TD’s remediation remains unclear. If Wells Fargo is any indicator, it could be a long, painful road ahead.

The bank doesn’t provide much of a bargain at these levels

TD Bank’s stock might seem tempting after recent dips, but I’m not convinced it’s a bargain at current levels. The ongoing anti-money laundering probe casts a shadow over the bank’s prospects.

Looking at valuation metrics, TD’s trailing P/E ratio of 20.16 is higher than some of its Canadian peers. Yes, the P/E ratio is inflated due to the AML issues and fines, but even if we normalize it and adjust these out, the bank is still too expensive for its expected growth in my opinion.

This premium seems unwarranted given the regulatory uncertainty.

While TD offers a solid 5.3% dividend yield, the payout ratio of 80%+ due to the fines plus the asset cap moving forward will likely impact dividend growth.

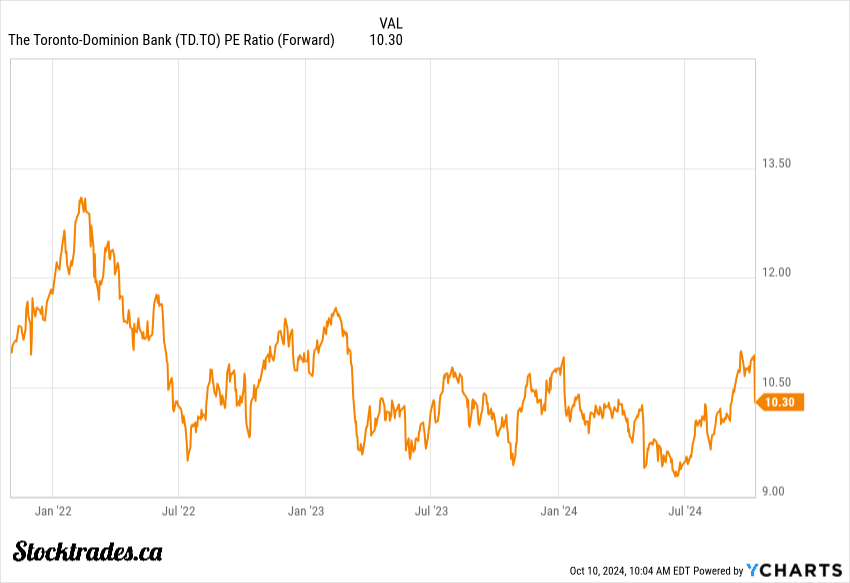

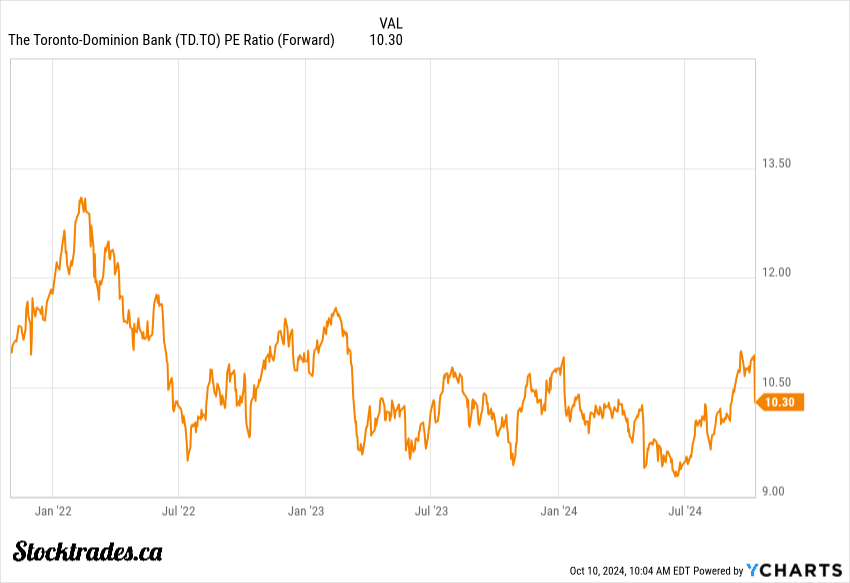

TD’s forward P/E of 10.3 may appear attractive, but it is important to note that analysts likely haven’t adjusted their earnings expectations for the asset cap. I expect them to be downgraded and thus the forward P/E will rise.

TD’s price-to-book ratio of 1.51 is reasonable, but other Canadian banks offer similar or better valuations without the regulatory overhang.

I’d be a buyer of other institutions before TD

When looking at the Canadian banking landscape, I find several alternatives more appealing than TD Bank right now.

RBC and National stand out as stronger options in my view.

RBC’s balance sheet quality, brand, and strong underwriting team make it one of the best banks in the country. Their diversified revenue streams and strong capital position make them a safer bet in some uncertain economic times.

Looking beyond Canada, I see potential in select US regional banks. Some faced challenges in 2023, but they have since emerged stronger and offer better valuations than TD.

Overall, there is too much uncertainty here for me to ever pull the trigger on Toronto Dominion. This asset cap had been rumored and guess by me for quite some time, and now that it’s in place, I’m glad I sold my shares earlier in the year to buy other institutions.