How Bad Will the Asset Cap Hit Toronto Dominion Bank Stock?

TD Bank’s recent $3 billion penalty and guilty plea for violating U.S. anti-money laundering laws have shaken investor confidence and put pressure on its stock price.

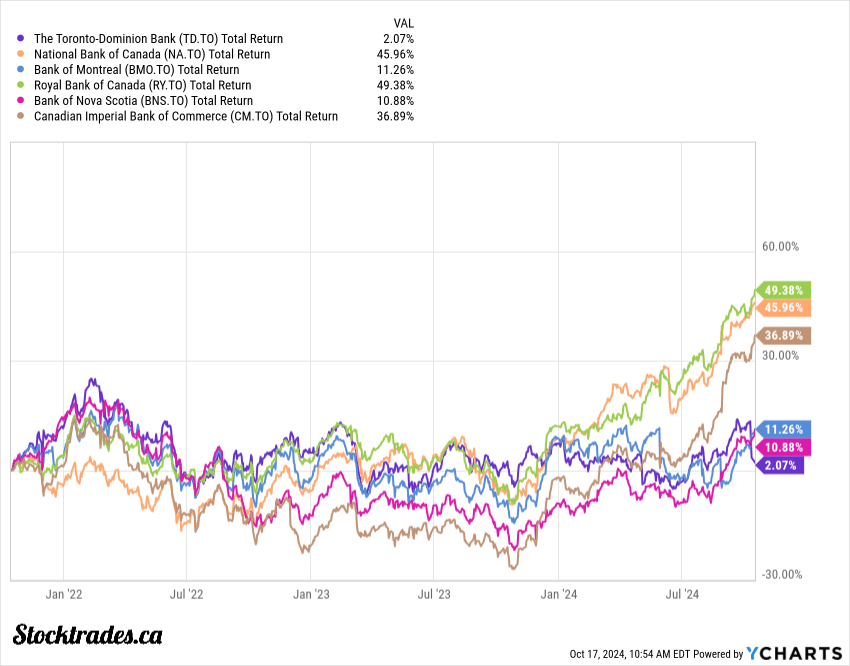

Its stock is down from all-time highs in the $109 range to just $77 today. Over the last 3 years, it’s been the worst performing institution in Canada. See the chart below.

The bank’s upcoming leadership change adds another layer of uncertainty. With CEO Bharat Masrani set to retire, TD Bank is preparing for a transition that will shape its future. This shift comes at a crucial time as the bank grapples with restructuring plans and increased regulatory scrutiny.

As TD Bank works to address these issues, investors are left wondering about the stock’s potential. Is TD Bank stock still a solid investment despite these setbacks?

Let’s take a deeper look at the bank’s current situation.

Key takeaways

- TD Bank faces significant challenges following recent legal troubles and leadership changes

- The bank’s stock price has been impacted by these recent announcements

- TD’s restructuring plans and future strategies will be critical in determining its stock performance

TD prepares for restructuring in 2025 after $3 billion U.S. penalty

TD Bank plead guilt and has agreed to pay over $3 billion to resolve U.S. charges related to money laundering violations. This is no small matter and is reminiscent of the hammer coming down on Wells Fargo several years ago.

The penalty’s magnitude is staggering. It’s the largest fine ever imposed on a Canadian bank and marks a significant moment in Canadian banking history. TD Bank’s guilty plea to violating anti-money laundering regulations is also a serious blow to its reputation.

For those who believe international expansion will be an easy transition for TD Bank now that its US assets are capped, think again. Countries will no doubt think twice about welcoming the company in considering its AML issues were drug related.

The compliance failures that led to this situation are troubling. It raises questions about the bank’s internal controls and risk management practices.

I, along with many investors, wonder how long it will take for TD to rebuild trust with regulators, customers and investors alike. In terms of the latter, it can take years for companies to recover from reputation damage, but the extent of those impacts is usually not known till years later.

Looking at the broader picture, this case might prompt other banks to reassess their own anti-money laundering protocols. The ripple effects could be felt across the entire banking sector, with increased scrutiny and potentially stricter regulations on the horizon.

TD’s plan to focus on restructuring its balance sheet in fiscal 2025 is now a must. However, I’m curious to see how this will impact the bank’s profitability, dividend growth, and stock performance moving forward.

CEO Bharat Masrani to retire

TD Bank Group is also facing a significant change as Bharat Masrani announced his retirement effective April 10, 2025. This news marks the end of an era for TD, as Masrani has been at the helm for over a decade.

Masrani’s tenure has been marked by both growth and challenges. While TD expanded its US operations under his leadership, he was also CEO while these anti-money laundering (AML) failures were taking place that resulted in hefty fines. In fact, they started at the same time he did.

I believe the timing of this transition is crucial. TD’s stock performance has been lacklustre recently, the worst out any major Canadian bank stock, and a new CEO is a must if they are to begin working to reassure investors.

Being realistic, I’m not sure how they didn’t simply fire him over letting him retire. It would have looked like the more serious move considering the circumstances.

The board has named Raymond Chun as Masrani’s successor. Chun’s appointment as Chief Operating Officer on November 1, 2024, suggests a carefully planned succession strategy. This move no doubt allows for a smooth transition period.

In my opinion, TD’s choice of an internal candidate for the top job indicates a desire for continuity. Yet, I wonder if Chun will introduce new approaches to address the bank’s recent challenges, particularly in risk management and compliance.

What does the asset cap mean for TD Bank

What’s particularly concerning about the recent news, is the growth cap now placed on TD’s U.S. retail operations. The fine itself, while hefty, is not the biggest concern.

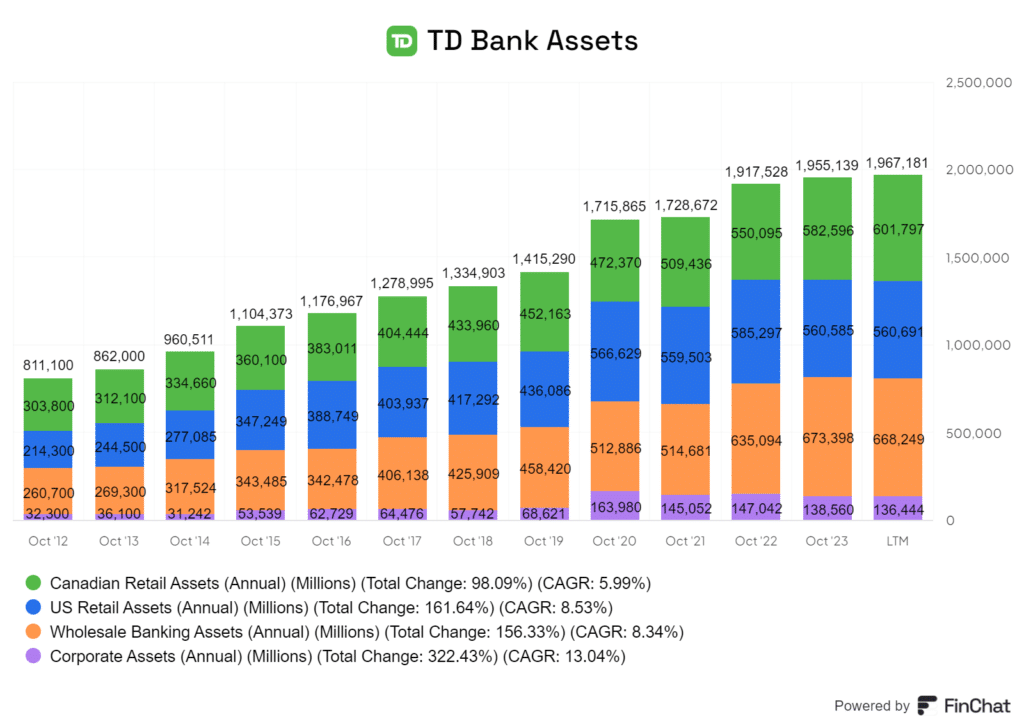

This restriction will hamper the bank’s expansion plans south of the border, potentially affecting its competitiveness in the lucrative U.S. market. If you look to the chart below, a fairly large chunk of the business is currently US retail assets.

I believe this setback will impact investor confidence in TD’s American strategy. The bank had ambitious plans to grow south of the border (look to the fallout of the First Horizon acquisition), but those are now on hold.

The problem is, that is where TD Bank set itself apart from the other Big Six banks.

TD will need to focus on improving its regulatory compliance before it can think about expansion again. This could take years, putting the bank at a disadvantage compared to its rivals. US regulators are harsh, and I don’t feel they’ll be in any rush to remove the asset cap.

It begs the question, what does TD Bank offer investors now that their U.S. growth strategy will effectively stall?

The competitive landscape in North American banking just got tougher for TD. While other Canadian banks push forward with U.S. growth, TD will be stuck in neutral. It is also likely that TD’s U.S. division will lose market share during this period of restricted growth. Rebuilding that position once the cap is lifted won’t be easy.

I expect TD to shift its focus to other areas of its business while working to satisfy regulators. But make no mistake – this is a major setback for the bank’s long-term strategy.

TD Bank stock faces significant uncertainty because of the above issues

TD Bank’s stock is in choppy waters. The recent $3 billion penalty coupled with the restrictions on U.S. growth, spells trouble for the bank’s near-term prospects.

Investor confidence is shaky at best. The stock tumbled 4.8% on news of the settlement, and I expect this downward pressure to continue. It’s not just about the money – the impact to TD’s reputation is significant.

Leadership transitions add another layer of uncertainty. With regulatory scrutiny intensifying, there is risk related to the bank’s ability to navigate these choppy waters effectively.

While some might view this as a buying opportunity, I’m not convinced. The risk of further legal challenges looms large, and I think the stock will remain volatile for some time. It might be best to sit this one out and see how everything shakes out before jumping into the stock.