TD Bank Stock – I’d Opt for Higher Quality Banks Instead

TD Bank, one of Canada’s largest financial institutions, has long been a staple in many investors’ portfolios. However, its stock performance has been lacklustre in recent times, caught up in weak performance in the US and money laundering scandals.

TD Bank stock showed a minor 0.4% decline this year. This tepid performance stands in stark contrast to the broader Canadian banking sector’s impressive gains. Canadian Imperial, Royal Bank, and National Bank have all witnessed 40%+ gains this year.

Given the current market conditions and TD Bank’s recent performance, investors are questioning whether TD stock represents a compelling buy, sell, or hold opportunity.

I’m going to get into my opinion on the matter in this piece.

Recent earnings – Rising provisions and AML fines a concern

TD Bank’s latest financial results have raised eyebrows among investors. The bank reported a loss of $181 million in its most recent quarter, marking its first quarterly loss in over two decades.

The primary culprit? A massive $2.6 billion charge related to ongoing anti-money laundering (AML) investigations in the United States. This provision was shocking, no doubt, as the company has now blown through initial fine estimates for their AML scandal.

TD’s woes stem from weaknesses in its AML controls, which have caught the attention of U.S. regulators. The bank is now facing scrutiny from multiple agencies, including the Department of Justice and the Financial Crimes Enforcement Network.

The fallout from these investigations could be significant. TD may face hefty fines and potential reputational damage.

Beyond the AML issue, TD’s core business performance has been mixed. The bank has seen growth in some areas but faces headwinds from economic uncertainty and rising interest rates.

Because of the scandal, TD Bank prepares for a leadership transition. CEO Bharat Masrani is set to retire in April 2025. It is likely this “retirement” was a bit forced, at least heavily suggested.

Investors are closely watching how this change might impact the bank’s strategy and stock performance. The upcoming shift in management could potentially bring fresh perspectives and new growth initiatives into play.

Is an asset cap a risk at this point?

TD Bank faces a real possibility of regulatory sanctions, including a potential asset cap. This situation bears striking similarities to Wells Fargo’s predicament in 2018, when the U.S. bank was slapped with an asset cap due to its fake accounts scandal.

TD’s recent actions suggest they’re bracing for significant penalties:

• Setting aside $2.6 billion for potential fines

• Selling a portion of its Charles Schwab stake

• Investing $500 million in anti-money laundering (AML) improvements

These moves indicate TD is taking the threat seriously. The bank’s alleged involvement in facilitating money laundering for Chinese drug traffickers is a grave concern that regulators won’t overlook.

An asset cap would severely hamper TD’s growth strategy in the U.S. market. It could prevent the bank from expanding its retail presence and limit its ability to capitalize on opportunities south of the border.

Considering this is the Canadian bank with the largest US exposure, it would be most impacted by a cap.

Investors should be wary. While TD’s capital ratio remains healthy, the potential for an asset cap looms large. This regulatory risk could significantly impact the bank’s future performance and shareholder value.

The bank’s heavy US exposure is causing it to lag Canadian peers

TD Bank’s significant presence in the United States is proving to be a double-edged sword. While it offers growth potential, it’s currently causing TD to underperform compared to its Canadian counterparts.

The American banking sector has faced recent turmoil, with several institutions faltering. This instability has cast a shadow over TD’s US operations, making investors wary.

In contrast, banks like National, Royal, and CIBC, with their stronger focus on the Canadian market, are thriving. The Canadian banking system has shown remarkable resilience, largely avoiding the pitfalls that have plagued US banks.

In addition to this, the Bank of Canada lowering interest rates faster than the Federal Reserve is fueling Canadian-focused banks.

Investors are questioning whether TD’s US-centric strategy will pay off in the long run. The bank’s management faces the challenge of navigating the volatile US market while maintaining its strong Canadian foundation.

The dividend – will growth stop or continue?

TD Bank has long been known for its impressive dividend yield, currently sitting at 4.66%. However, recent developments have cast doubt on the future of this generous payout.

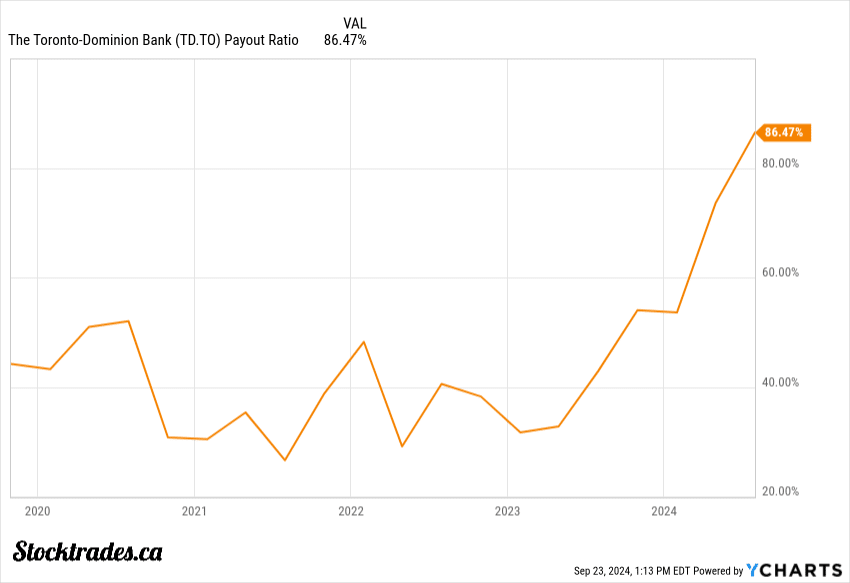

The bank’s dividend payout ratio has crept up to over 70%, a level that’s typically considered unhealthy for financial institutions. This high ratio leaves little room for error and could potentially jeopardize future dividend growth.

TD’s anti-money laundering issues have dealt a significant blow to its earnings. These regulatory challenges have resulted in substantial fines and one-off expenses, causing a sharp spike in the payout ratio.

It’s a tricky situation for TD’s management. They must decide whether to pause dividend growth while dealing with these one-off expenses or continue their long-standing tradition of dividend increases.

The bank might opt to maintain its dividend growth streak, banking on the belief that the worst of the fines and expenses are behind them. On the other hand, prudence might dictate a temporary pause in dividend hikes.

Investors should keep a close eye on TD’s upcoming quarterly results. It typically announces its dividend raise in the fourth quarter. I’m saying it is 50/50 at this point whether they raise or not.

Is the stock a buy at this point? I think there are better options

TD Bank stock currently trades at $84.54 per share, offering a 4.6% dividend yield. While this may seem attractive, there are reasons to be cautious.

TD’s provisions are among the weakest of the Big Six Canadian banks. This could leave the bank more vulnerable to economic downturns or credit risks.

The bank’s significant exposure to the US market may be a disadvantage in the current environment. As Canada is expected to lower interest rates faster than the US, banks with heavier Canadian exposure could outperform TD.

Competitors like Royal Bank, CIBC, and National Bank, with their greater focus on the Canadian market, may be better positioned to benefit from anticipated rate cuts, along with a telecom company like Telus.

From a valuation perspective, TD’s current price doesn’t offer enough of a discount compared to its peers to justify choosing it over other options.