Tesla Stock Is Tanking on Missed Deliveries – Is It a Buy?

Tesla stock has been a hot topic in the investment world for years. The electric vehicle giant has been one of the most volatile mega caps in the United States since the pandemic.

Tesla’s stock performance is closely tied to its ability to deliver cars, innovate in autonomous driving, and expand into new markets. Although it does have a lot of growth verticals, automobiles at this point in time are its bread and butter.

The launch of the Cybertruck and advancements in self-driving tech could be game-changers for Tesla’s growth.

However, is it too pricey for a car company? Or is it fairly valued given its tech ambitions?

Lets take a deep dive.

Key Takeaways

- Despite having added growth segments, Tesla is very much still an auto producer

- The company’s valuation puts heavy emphasis on its non-auto growth segments

- The company’s recent miss on deliveries is a concern considering its valuation

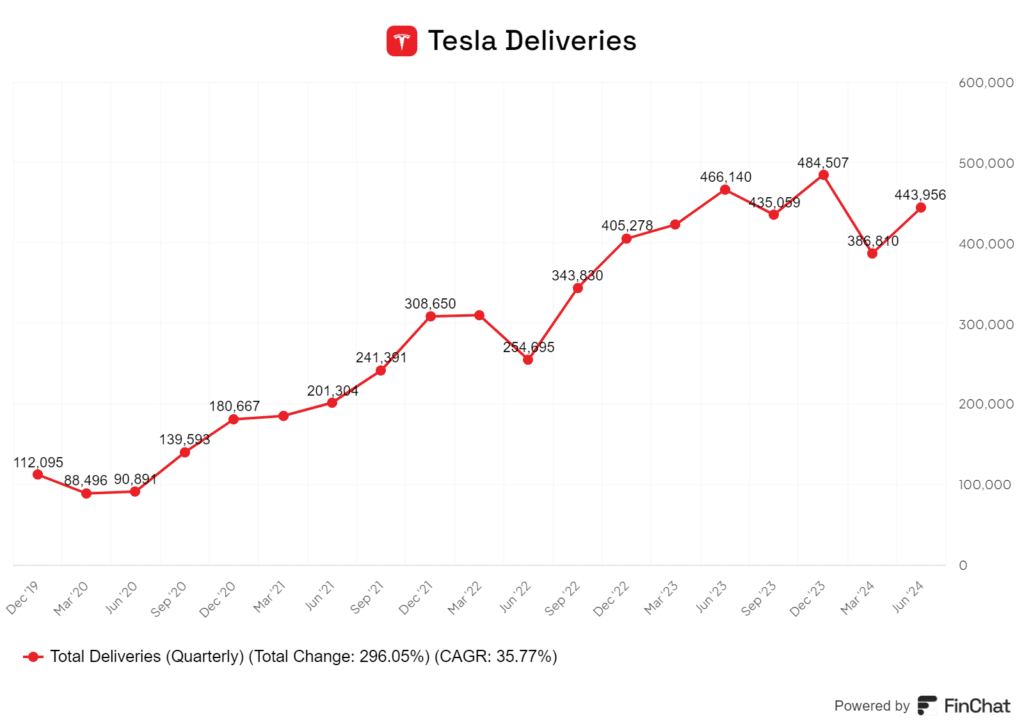

Economic downturn is impacting the company’s deliveries

Tesla’s delivery numbers are being affected by the current economic climate.

During the pandemic, when interest rates were low, electric vehicles were flying off the lots. Consumers had more disposable income and were keen to embrace the new technology, no matter how expensive.

Times have changed. With interest rates climbing and the economy softening, Tesla is facing challenges in meeting its delivery targets. Yes, they’re still growing, but considering how expensive the stock is, the growth isn’t good enough.

The cost of financing a new car has increased significantly, making potential buyers think twice before committing to a purchase.

Musk has even stated himself that interest rates are a massive driver of the auto industry. Low rates often equal low monthly payments, which incentivizes purchases.

Tesla’s recent delivery figures tell a worrying tale. The company delivered 462,890 vehicles in the third quarter, and although that represents 6% growth, it fell short of analysts’ expectations.

This miss isn’t just a minor blip – it could signal a broader trend of weakening demand.

To put this in perspective, Tesla now needs to deliver a staggering 516,344 vehicles in the fourth quarter to match last year’s total. In my opinion, this goal seems increasingly out of reach given the current economic headwinds.

Will the Cybertruck vault growth moving forward?

I believe the Cybertruck’s impact on Tesla’s future growth is uncertain. While it’s garnered significant attention, its ability to drive earnings remains questionable. Musk has even stated this himself, saying that it is going to be very difficult to get the truck into mass production and make it profitable.

In a recent consumer report, the Cybertruck faced some relatively harsh criticisms:

- Poor visibility (except forward view)

- Difficult manoeuvrability

- Unpredictable steering

- Not a lot of room in the bed of the truck

- Poor suspension

These issues could limit its appeal to mainstream truck buyers, potentially hampering sales growth.

The Cybertruck’s pricing is another concern. At $60,990 to $99,990, it’s not competitively priced against traditional pickups, especially in a poor economy.

Quality control is also worrying. Consumer Reports’ test vehicle arrived with errors and glitches. If widespread, these problems could increase warranty costs, adding another layer to a vehicle that is already hard to sell at a profit.

On the positive side, the Cybertruck might create a halo effect for the Tesla brand. This could indirectly boost sales of other models.

Ultimately, I’m skeptical that the Cybertruck alone will significantly vault Tesla’s growth.

Will autonomous driving and AI fuel growth moving forward

Now this is a segment of the business I like.

Tesla’s push into autonomous driving and AI looks promising for future growth. The company is shifting focus from vehicle sales to AI and self-driving tech, which could open up new revenue streams.

I believe Tesla’s latest Full Self-Driving developments put them ahead in the race for autonomous vehicles. This tech could revolutionize transportation and create massive value.

Tesla’s AI ambitions go beyond just cars. They’re investing billions in AI training, which could lead to breakthroughs in robotics and other fields.

What sets Tesla apart:

• Years of real-world driving data

• Vertical integration of hardware and software

• Strong brand recognition

These factors give Tesla a significant edge over competitors. If they can deliver on autonomous driving promises, it could fuel substantial growth.

But there are risks, as always. Regulatory hurdles and public trust issues around self-driving cars could slow adoption. Tesla needs to balance AI development with its core EV business, along with create a bullet proof product that has been rigorously tested so it can gain consumer trust.

In my view, Tesla’s AI and autonomous driving push has huge potential. It could transform the company from a carmaker into a leading tech innovator.

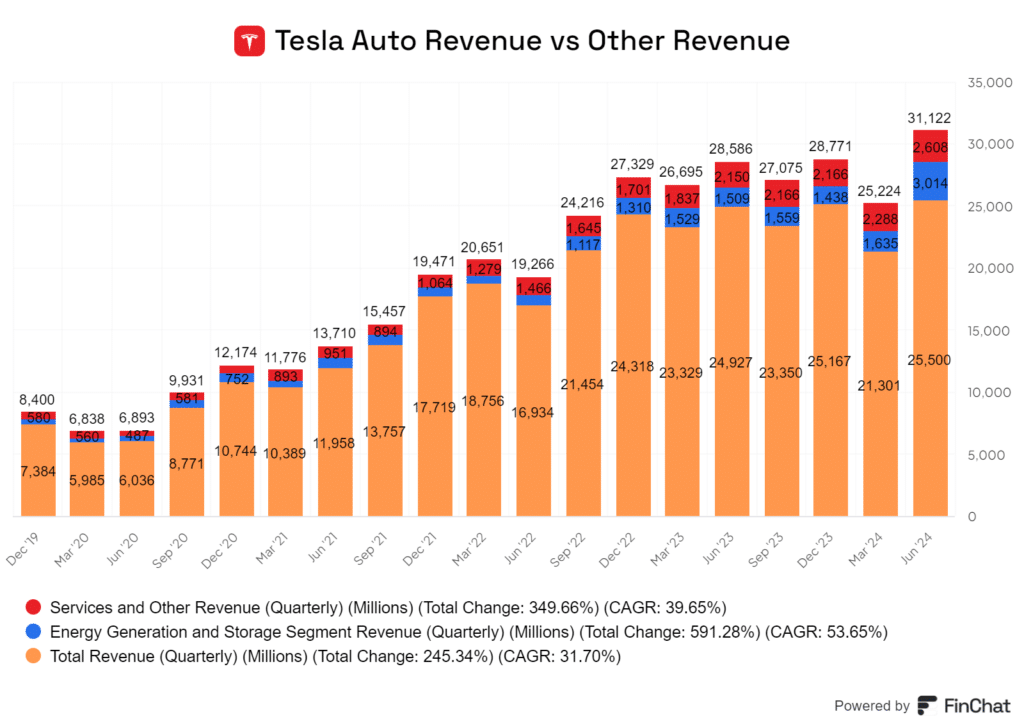

Is the company too expensive for an automobile company?

Tesla’s stock price has soared in recent years, leading many to question its valuation. When we look at traditional metrics, Tesla does appear quite pricey for a car maker.

The company’s forward price-to-earnings ratio is around 74, far higher than most automakers. This suggests investors are pricing in significant future growth.

I believe Tesla’s premium valuation stems from its potential in other areas, and not necessarily its auto business:

• Autonomous driving

• Energy storage

• Solar power/battery tech

For Tesla to justify its current share price, these growth segments need to deliver strong results. The company can’t rely solely on car sales.

My view is that Tesla is expensive as a pure auto stock, which is what many should be considering it as with 80%+ of its sales coming from that segment. However, if it does hit on its growth verticals, the valuations could no doubt be justified.

Would I buy the stock at this point?

I’m cautious about buying Tesla stock at its current valuation.

Tesla’s price-to-earnings ratio is quite high compared to other automakers. Yes, it has plenty of other growth verticals, but the bulk of the company’s earnings and sales come from the auto industry. Case in point, it is witnessing some of the exact same headwinds as other auto producers.

On the flip side, Tesla has potential growth areas that could launch its earnings:

- Electric vehicle market expansion

- Energy storage solutions

- Self-driving technology

If these ventures succeed, they could boost earnings significantly, and it may realistically grow into its valuation.

The broader economic situation also plays a role. An improving economy might benefit Tesla, potentially leading to increased sales and profits.

Still, I find the risk-reward balance tilts towards caution.

For my investment strategy, I prefer companies with more predictable earnings and lower valuations. Tesla’s volatility and high expectations make me hesitant to buy at current prices.