The Bank of Nova Scotia (TSE:BNS) Dividend and Stock Analysis

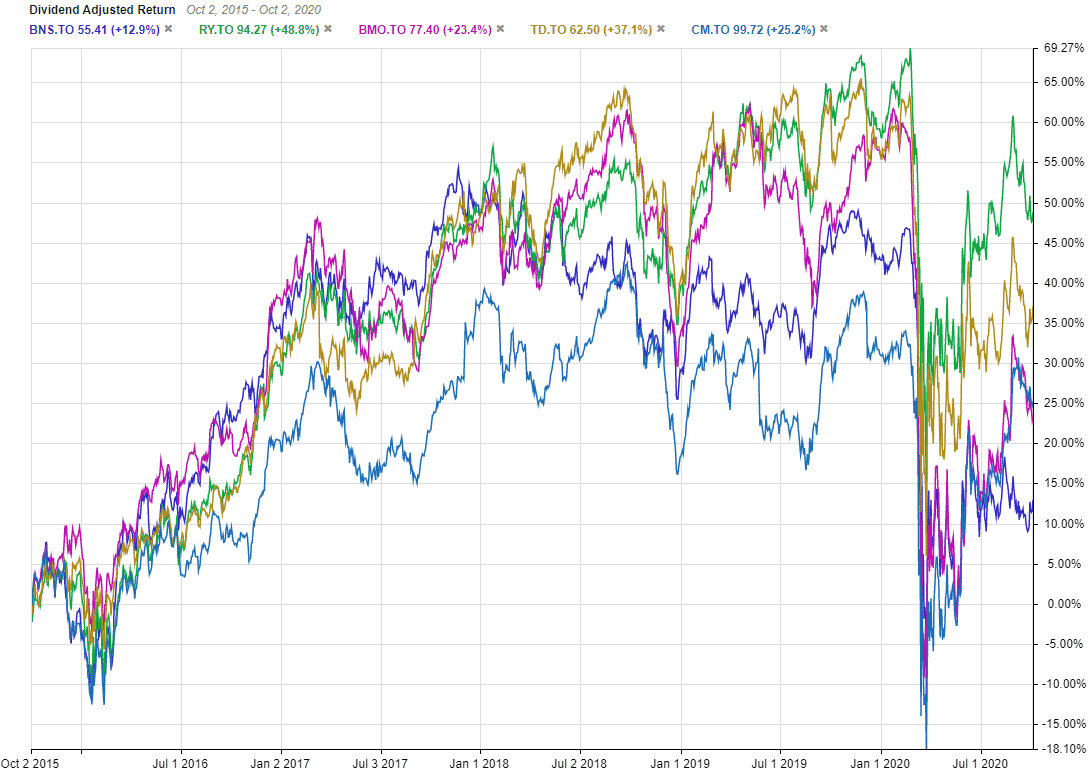

The Bank of Nova Scotia (TSE:BNS) has had a rough go recently. Looking at the chart below, one thing is pretty clear. Scotiabank has been the worst performing Canadian bank over the last half decade, by quite a large margin.

In fact, the second worst bank in terms of dividend adjusted performance, The Bank of Montreal (TSX:BMO) has outperformed the company by over 10.5%.

So why is that? Why have Canadian banks like Royal or Toronto Dominion thrived while The Bank of Nova Scotia has struggled? Lets take a deep dive into the popular Canadian dividend stock and see if this is a huge opportunity for those looking to buy stocks in Canada to grab an excellent dividend paying stock on the cheap, or a huge warning sign.

Bank of Nova Scotia (TSE:BNS) dividend and stock analysis

Market Cap: $67.95 billionForward P/E: 10.77Yield: 6.42%Dividend Growth Streak: 9 yearsPayout Ratio (Earnings): 81%Payout Ratio (Free Cash Flows): Premium Members OnlyPayout Ratio (Operating Cash Flows): Premium Members Only1 Yr Div Growth Rate: 6.40%5 Yr Div Growth Rate: Premium Members OnlyStocktrades Growth Score: Premium Members OnlyStocktrades Dividend Safety Score: Premium Members Only

The Bank of Nova Scotia was once known as Canada’s “international bank” but that title has since been given to the Royal Bank of Canada. In fact, I attribute a decent chunk of Scotiabank’s underperformance to its overall failures expanding internationally.

Although it does have a strong international presence, it has struggled with recent synergies and as a result has significantly underperformed. The company deployed a hyper-aggressive strategy in terms of acquisitions, making over $7 billion of them in 2017, but after significant struggles to generate expected returns, it has since cooled down.

Overall, the bank has 3 primary operating segments: Canadian banking, international banking, and global banking. Even with its recent underperformance, it is still the third largest bank in the country with a market cap in excess of $67 billion.

Speaking of its international operations, the Canadian bank has operations globally, but are primarily situated in Central and South America.

Bank of Nova Scotia dividend summary

In my opinion, there are two primary reasons Canadians purchase major Canadian banks. For one, they provide stability and security. These are some of the most highly regulated financial institutions in the world, and as such they are well capitalized.

The second reason? Well, it’s for their dividends.

And while I try to tell investors not to get tunnel vision when it comes to dividend yield, Scotiabank has overtaken CIBC as the highest yielding big 5 bank in the country and currently sports a huge dividend yield of 6.42%.

This is something that’s really, really hard to look away from. So, is the dividend safe? Lets have a look.

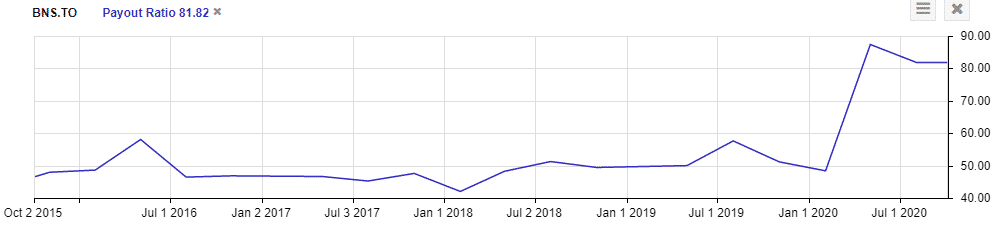

On a trailing 12 month basis, the company’s payout ratio is currently sitting in the low 80% range. As you can see from the chart, this is the highest The Bank of Nova Scotia’s payout ratio has been in quite some time, and by a very large margin.

Now, this isn’t surprising by any stretch of the imagination. The company is a global financial institution, and we’re currently in the midst of a global pandemic. However when we look at the company’s payout ratio when compared to the other major banks, it’s pretty clear that the Bank of Nova Scotia has the highest payout ratio by a significant margin.

When a payout ratio gets in the 80% or higher range, we start to get nervous. Especially considering the banks payout ratio has come nowhere close to this percentage in quite some time.

So, most investors stop here. But, it’s pretty important that we look at why the bank is paying out so much. And that comes from Provisions for Credit Losses.

Without going too much into what PCL’s are (head here for a really great explanation) lets just say that it’s money the bank has to put away for loans they expect (expect being a key word) to go unpaid. These provisions then have to come out of the company’s profits.

Considering a company’s payout ratio is calculated by taking annual dividends and dividing them by earnings per share, PCL’s have a significant effect on a company’s payout ratio.

Scotiabank had been accused of significantly underestimating the amount of provisions it needed to set aside in the second quarter.

While other major financial institutions all saw a significant decrease in PCL’s during the third quarter, Scotiabank actually reported an increase. While the Royal Bank of Canada reported only $675 million in PCL’s in Q3 2020, Scotiabank’s came to a whopping $2.18 billion.

As a result, profits dipped significantly, down from nearly $2 billion in Q3 2019 to $1.3 billion in 2020. Again, if we look to Royal Bank, the company reported a year over year decrease in earnings per share of only 1% in the third quarter. Scotiabank saw earnings plummet by nearly 33%.

So, is the company’s dividend safe? I’d say yes.

However, is the Bank of Nova Scotia’s dividend the riskiest out of the major 5 banks? I’d say yes as well.

The Bank of Nova Scotia’s international results

The company had significant setbacks, particularly in Latin America. In fact, profits of $844 million a year ago quickly evaporated and the company posted a loss of $28 million.

Why so drastic in the third quarter?

Well, the company attributes most of this to the fact that a lot of countries in the Latin American region were exposed and shut down due to COVID-19 later than North American and European countries.

Failed synergies by the company have left it in somewhat of a mess with its international operations, and I think its going to take a while for it to recover.

Despite owning the company I’m just not too hot on it right now. In fact, the Bank of Nova Scotia is the last Big 5 bank that I purchased, and I severely regret not going the National Bank (TSX:NA) route.

Bank of Nova Scotia stock valuation

Scotiabank’s underperformance has resulted in the company being the cheapest major bank in the country, by a large margin. The Bank of Nova Scotia is trading at a forward price to earnings of only 9.86. Over the last half decade, the bank has historically traded in the 10.5 to 11 range.

So, there is no questioning The Bank of Nova Scotia is cheap. But, it’s cheap for a reason.

It’s performance has been underwhelming. So much so that the bank is still down 21% year to date, lagging the TSX Index in terms of recovery by over 15%.

Overall, there are better dividend options out there

Historically, the worst performing bank out of the Big 5 has rebounded to be one of the best performing moving forward. However, we’ve never been presented with a situation like we’re currently in.

Developed countries will more than likely have a quicker recovery and faster path to GDP growth after COVID-19 has subsided. This is why I have more faith in stocks like Toronto Dominion Bank (TSX:TD) and the Royal Bank of Canada (TSX:RY).

Toronto Dominion is currently lagging the index in terms of recovery as well due to its strong exposure to the United States. However I have more faith in the United States to rebound economically than regions in Latin America, and as such I’d expect Scotiabank to be one of the worst performing banks out of the Big 5 over the next while.