The Returns on These Top Canadian Stocks Are Jaw-Dropping

Historically, the best Canadian stocks have combined strong fundamentals with a track record of steady performance, facing economic cycles with commendable stability. They may even pay a dividend, which has allowed the companies to compound their returns by investors reinvesting them.

These standout equities have not just shaped the Toronto Stock Exchange (TSX), but have also contributed significantly to the prosperity of individual investors, highlighting the overall benefits of buying and holding equities.

Have there been better stocks that have come along in recent years? Absolutely. A few that come to mind is Constellation Software (TSE:CSU) and Shopify (TSE:SHOP).

However, I wanted to highlight some of the best-performing Canadian stocks that have been around since at least the dot-com bubble.

While the definition of ‘best’ may vary depending on individual investment strategies and market conditions, in this piece, I want to review some of the stocks with the best returns over the last twenty years.

Some of these numbers are jaw-dropping.

Stella-Jones (TSE:SJ)

What the company does

Stella-Jones is a leading producer of industrial pressure-treated wood products, specializing in railway ties and utility poles.

Their operations serve the railroad, utility, and residential lumber sectors, ensuring essential infrastructure components are supplied across North America.

They often get lumped in with residential lumber producers, but it’s a relatively small portion of their business.

Why it has succeeded

The company’s success can be attributed to its strategic acquisitions and strong management team, which have expanded its market reach and operational efficiency.

In addition, the company has been able to capture a very niche market: railroad ties and utility poles. These products are constantly in high demand, and companies will pay a pretty penny for them.

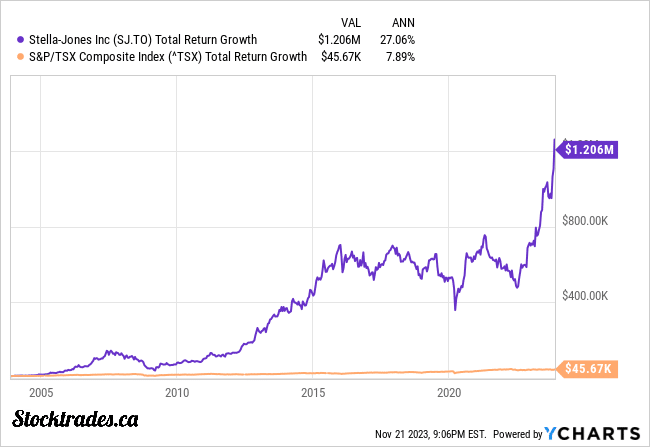

What does $10,000 look like in Stella Jones 20 years ago?

Stella Jones has some jaw-dropping returns for a boring lumber company. Over the last 20 years, if you reinvested the dividends, it has a CAGR of 27% on its share price.

This may not seem like much, but over a 20-year timeframe, it’s substantial. It would take a $10,000 investment and turn it into $1.206M.

In comparison, $10,000 in the TSX would be $45,600, while the S&P would be $65,170.

Boyd Group Services (TSE:BYD)

What the company does

Boyd Group Services operates in the automotive repair and maintenance sector, specifically in collision repair centres. They have a vast network of locations throughout North America. The company is renowned for providing high-quality services and has built a trustworthy brand in the automotive industry.

Its primary strategy is to buy mom-and-pop shops, integrate them into the Boyd system, and yield higher returns. Considering the market is so fragmented, it has done so with ease.

Why its succeeded

The success of Boyd Group Services can be attributed to its strategic acquisitions.

They have a proven track record of integrating new shops and standardizing services to ensure customer satisfaction and retention.

Their brand and efficiency allow them to scoop up inefficient shops on the cheap and turn them into cash machines.

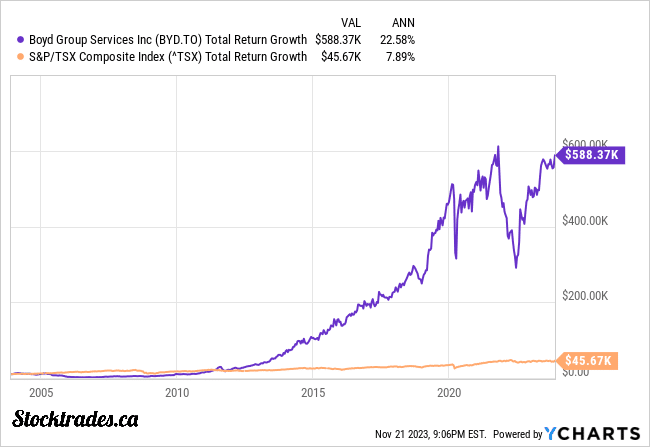

What are their total and 20-year annualized returns

Boyd has annualized returns of 22.58% over the last twenty years. This is more than triple the TSX Index and double the S&P 500.

If you had invested $10,000 into the company 20 years ago, you’d be sitting on $588,000 today.

In comparison, $10,000 in the TSX would be $45,600, while the S&P would be $65,170.

Stantec (TSE:STN)

What the company does

Stantec offers diversified professional services, mainly in the infrastructure and facilities sector. They cater to the public and private sectors, providing a suite of capabilities ranging from consulting to design and project management. Their operations span across Canada, the United States, and internationally.

Why its succeeded

Their success is attributed to a strong emphasis on community development and consistent efforts towards sustainability.

Stantec’s model integrates global expertise with local presence, enabling them to tailor solutions that meet the nuanced needs of their clientele.

There have been a multitude of consulting firms that have witnessed skyrocketing returns due to a general boom in infrastructure, and Stantec is one of them.

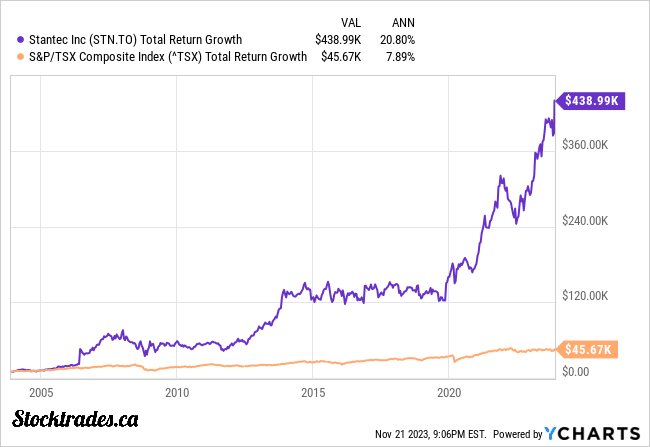

What are their total and 20-year annualized returns

Stantec has annualized returns of 20.8% over the last twenty years. This is nearly triple the TSX Index and more than double the S&P 500.

If you had invested $10,000 into the company 20 years ago, you’d be sitting on $439,000 today.

In comparison, $10,000 in the TSX would be $45,600, while the S&P would be $65,170.

Alimentation Couche-Tard (TSE:ATD)

What the company does

Alimentation Couche-Tard operates a network of convenience stores and fuel retail points under several banners and brands across the globe.

The company’s establishments primarily offer a range of daily necessities, including food, beverages, and other retail products and services.

Why its succeeded

The company’s success can be attributed to strategic acquisitions, efficient operations, and a focus on convenience and customer service. Through various well-executed integrations, Alimentation Couche-Tard has expanded its footprint, allowing it to benefit from economies of scale and a broadened market reach.

The market is so fragmented that it was able to capture extensive levels of growth over the past two decades.

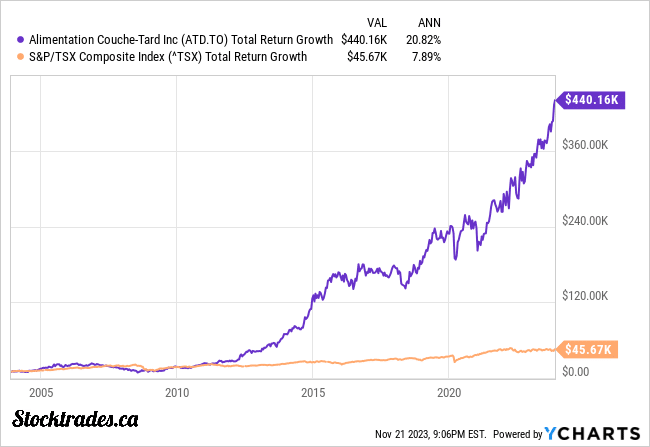

What are their total and 20-year annualized returns

Couche-Tard has annualized returns of 20.7% over the last twenty years. This is nearly triple the TSX Index and more than double the S&P 500.

If you had invested $10,000 into the company 20 years ago, you’d be sitting on $438,000 today.

In comparison, $10,000 in the TSX would be $45,600, while the S&P would be $65,170.

Descartes Systems Group (TSE)

What the company does

Descartes Systems Group specializes in providing cloud-based logistics and supply chain management solutions.

The company’s offerings are crucial for enabling trade, shipping, and turnkey logistics around the globe. Its Logistics Technology Platform is pivotal to streamlining the operations of logistics-heavy businesses.

Why it has succeeded

The company has consistently delivered innovation at the core of its success. By developing a suite of interoperable web and wireless solutions, Descartes has stayed ahead in the game, meeting the ever-evolving needs of the global commerce landscape.

The firm’s commitment to R&D and customer-oriented services are key differentiators that cemented its leadership status.

As the world becomes more complex, so do supply chains. So it makes perfect sense the company has been rock solid.

What are their total and 20-year annualized returns

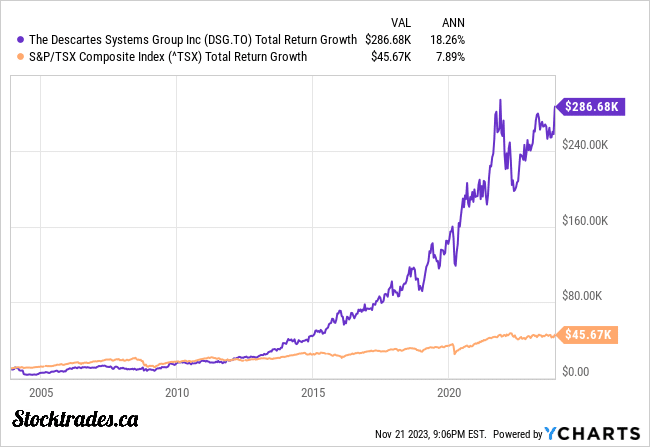

Couche-Tard has annualized returns of 18.26% over the last twenty years. This is nearly triple the TSX Index and double the S&P 500.

If you had invested $10,000 into the company 20 years ago, you’d be sitting on $286,600 today.

In comparison, $10,000 in the TSX would be $45,600, while the S&P would be $65,170.