Canadian Stocks

**This is a transcription of the video above. Watch our best Stocks to buy in September on Youtube here**

Hi everyone, Mat from Stocktrades here.

We’re officially in September, and fall is quickly approaching. So, it’s that time again to start looking at 3 of our top Canadian stocks for the month of September.

Savaria (TSX:SIS)

The healthcare industry is booming, and investors are increasingly interested in buying stocks in this area. If you are interested in Telehealth or Virtual Health, please go and check out our previous video. I did a video on the top 3 Telehealth stocks in Canada, and those 3 stocks are still relevant today so I would strongly consider you go and check out that video.

But today, we’re going to talk about Savaria. And Savaria is the global leader in accessibility and mobility solutions. It manufactures and sells these products to both residential and commercial customers.

Savaria is a former top growth pick on our premium side. The company operates in 3 segments, accessibility, patient handling and adaptive vehicles. It has a strong growth profile, and has achieved this by growth through acquisitions.

In 2019, the company struggled a little bit, as it had a difficulty integrating one of its latest acquisitions. As a result, margins dropped and the company’s stock price suffered as a result. However, the company is quickly jumping back.

As you can see, year to date the company is now up by approximately 9%. Far outpacing the TSX Index. The company’s main source of revenue is the accessibility segment. This business is comprised of things such as elevator and lift sales, and it has a dealer network of approximately 500, and 26 direct sales offices.

They do everything from sales, installation and maintenance. In terms of geographical breakdown, 60% of revenue comes from the States. But overall, 81% of the revenue is North American.

So even though it is a worldwide company, it really does generate the majority of its revenue here in North America.

Outside of strong growth prospects, why add Savaria to our pick list today? For one reason, the dividend.

Savaria stock has a strong monthly dividend

Savaria has a 7 year growth streak. This means it is a Canadian Dividend Aristocrat. Typically the company raises the dividend in September, independent of earnings.

This means that this month the company could be announcing a dividend increase, which would extend its dividend growth streak to 8 years.

Overall, it has typically averaged double digit growth rates. However, this year investors will have to temper expectations. Revenue in the second quarter did dip, although the company is positive on the outlook for the second half.

Will the company raise? At this point I’d say it’s 50/50. Pay attention to approximately the second or third week of September, this is when the company will announce their dividend raise.

If the company does raise dividends, it is a clear sign that the company has faith that the outlook is improving. If the company does not raise the dividend, most likely a sign that there is still considerable uncertainty and the company is taking a cautious approach.

Fortis (TSX:FTS)

Speaking of dividends, one of my favorite dividend stocks is up for a dividend raise this September. And that is Fortis, one of Canada’s largest utility companies and in my opinion one of the best dividend growth stocks on the TSX Index.

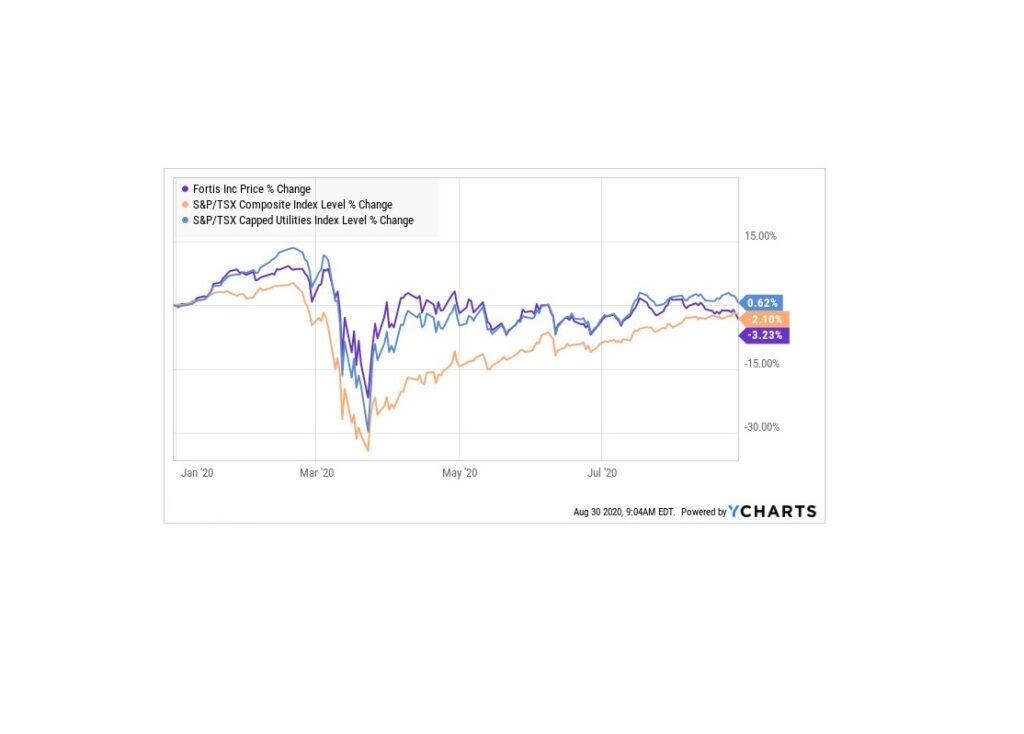

Fortis has a 46 year dividend growth streak, and it earns 99% of earnings from regulated utilities. It is one of the safest stocks to own in your portfolio, and it has been a top performer. I have two charts for you. The first one being year to date.

As you can see, the company is slightly underperforming. It has lost approximately 3% of its value whereas the TSX is only down like 2%. And the capped utilities index is up by approximately a percentage point.

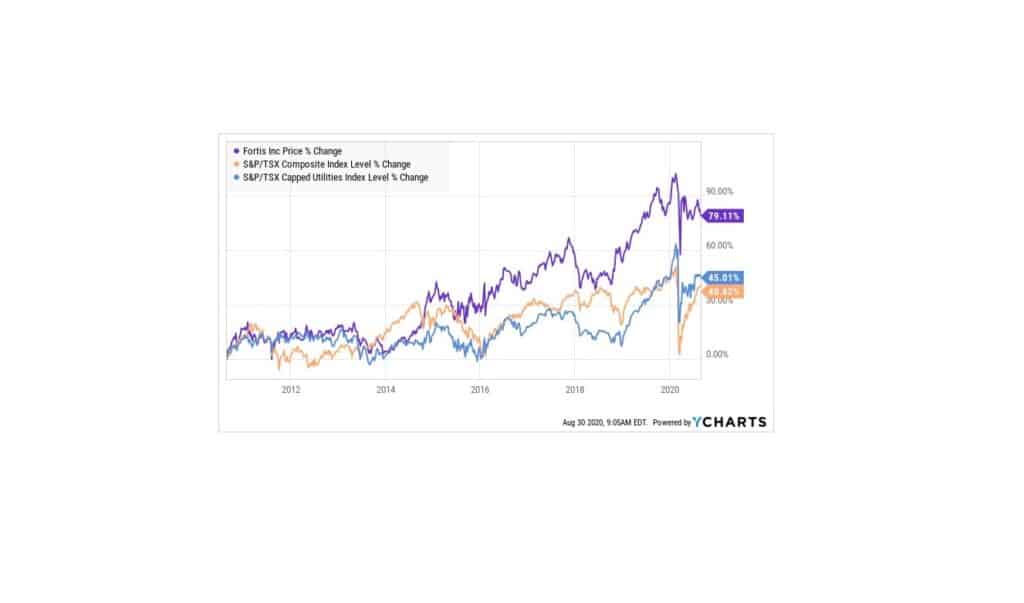

This is a rarity for the company, and as you can see, up until about May, the company was outperforming. Now, lets take a look at the second chart, and this is the chart where I really want you to focus on, the ten year chart. As you can see, Fortis has by far and above outperformed both its peers and the TSX Index.

This is the type of performance that investors can expect out of Fortis over the long term. It is simply put, one of the best utility stocks and one of the best stocks on the TSX Index in terms of safety, there is perhaps none better.

Now I say this, but I also must admit my bias. I am a long term shareholder of Fortis, it has rewarded me quite well and it is one of my top 5 holdings. It has consistently delivered mid to high single digit growth, and I expect the company to continue to do so over the next 10 years.

Now lets change focus and look at the dividend.

Fortis has one of the best dividends in the country

There is no question that Fortis is one of the best dividend stocks on the TSX. Its 46 year streak is the second longest dividend growth streak in the country.

In terms of stability and reliability, there is perhaps none better. Through 2024, the company expects to average 6% annual dividend growth. Not too many companies can deliver this kind of consistency, nor can they project this type of growth over the next 5 years.

Fortis is unique in that sense, and that it always provides dividend growth guidance. We know that a long term dividend growth streak is not the be all and end all in terms of dividend safety. However, if you look at Fortis’s dividend history, you’ll see consistency.

Over the past decade, the company’s payout ratio has been between 70% and 73%. Today, the company’s payout ratio is 71.9%, right in line with historical averages and there is absolutely no risk at this point that the dividend gets cut.

Will the company raise this September? I don’t see why not. Is there a risk that the company doesn’t raise dividends? Of course, there is always a risk.

In fact, since the pandemic began, there has been several Aristocrats which have chosen not to raise the dividend. However, I find it very unlikely.

Why?

Because since the pandemic began, there have been a handful of Aristocrats that have raised. And of those, 2 have been utility companies. Both Algonquin Utilities and Capital Power came through with a raise for investors. Given this, I fully expect Fortis to also deliver on their promise of 6% dividend growth.

Typically the company announces the dividend near the end of September. So I would look to the dividend raise during the last 2 weeks. Now that the company has been consolidating, it is an excellent opportunity for investors to either add to, or start a position in Fortis.

Royal Bank of Canada (TSX:RY)

Since Canada’s big banks just finished reported earnings, we can’t do a video without mentioning at least one. And in my opinion, Royal Bank of Canada was the clear winner this past quarter. It absolutely crushed earnings.

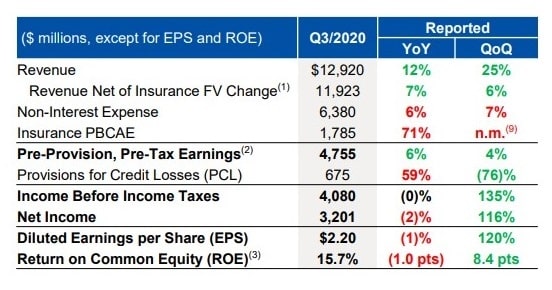

So lets take a little time and dig into these impressive quarterly results. First, lets focus on revenue. Revenue came in at $12.9 billion, that is an increase of 12% year over year. Let that sink in for a moment. Canada’s largest bank grew revenue by 12% in the midst of a pandemic.

That to me is very impressive. Equally as impressive, the company’s adjusted earnings per share of $2.23 was only down by 1% year over year. In effect, it was flat. That is once again very impressive during the pandemic, a time in which the banks were expected to struggle in a big way.

Thirdly, provisions for credit losses on loans ratio came in at 40 basis points. This is 125 basis points lower quarter over quarter. Once again, very impressive here. The majority of Canada’s big banks did see a decrease in PCL’s quarter over quarter. The only exception being Bank of Nova Scotia, which increased PCL’s quarter over quarter by approximately 28%.

This was not surprising. If you go back to last quarter, the Bank of Nova Scotia came in with the least increase, so not surprisingly it underestimated the impacts and now had to increase their loan provisions.

Royal Bank, all is good here. It actually decreased loan provisions.

Here’s another table that more accurately describes the provision for credit losses. As you can see, provision for credit losses did increase by 59%, to be expected. However, quarter over quarter it actually dropped by 76%. This is a strong sign that credit quality is improving, and perhaps the outlook is not as dire as once thought.

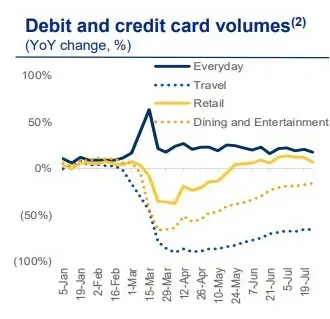

Speaking of outlook, lets take a quick look at the company’s debit and credit card volumes. I like this because it shows investors how the economy is responding to the current pandemic. As you can see, everyday expenses spiked in March as there was a significant level of panic buying. Over the course of the past 6 or 7 months, you see that every day buying has stabilized and retail and dining entertainment are slowly making a rebound.

Retail is starting to see positive growth year over year whereas dining and entertainment is still lagging year over year. The big laggard here is obviously travel. We are a ways away from seeing a complete rebound in the travel industry. And these credit card transactions here are proof of that.

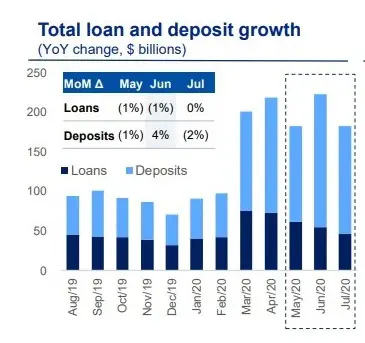

Another interesting chart is total loan and deposit growth. This is reflected in year over year change, and in billions. As you can see, an interesting phenomenon has occurred. Since the pandemic began, deposits have increase significantly, whereas loans have actually dropped.

Not surprisingly, if you think about it, consumers are spending less, and by that very nature are likely depositing more. Regardless, in either case, the banks are making money.They are either making money on the loans that they send to you, or they are also making money on the deposits.

Investors are gaining interest in the stock market, and Royal Bank is benefiting

In the quarter, Royal Bank had record numbers in the capital market segment. In terms of earnings and revenue, it has outperformed in a big way. It’s also a big reason why the company beat on earnings and revenue. The most telling chart is this one here. Direct Investing trading volumes.

Since the pandemic, year over year changes have been astronomical. In fact, they have jumped by more than 100% in most months.

That means that investors are tapping the markets. In fact, the pandemic has increased investors interests in the stock markets in general. We’ve seen this across the board. We’ve seen this with traffic at Stocktrades, we’ve seen increased interest on our Youtube videos.

People just have the general interest in the stock markets. That can be a function of many things, perhaps its a function of having more time, more time to dedicate to researching stocks, it’s an interesting phenonminon and it is one that is actually driving revenue growth for the banks, and RBC in particular.

RBC’s strong earnings are a good sign for the entire industry. Financials remain depressed and are still trailing the index year to date. However, I can see this changing. I’m not the only one. Analysts believe that over the next few months financials are going to start to outperform.

They are currently value stocks, trading at discounts to historical averages and have not benefited from the market rebound as much as say growth stocks have. So, we think that now is the perfect time to start increasing your holdings in financial companies. And especially one like the Royal Bank of Canada, which is bar none at this point the best bank to own.

It has outperformed year to date, and we expect it to outperform moving forward, especially after delivering one of the best sets of quarterly results this past quarter.

And with that, we’re at the end of our video. We have 2 stocks that are on watch for a dividend raise, Savaria, a smaller cap high growth stock in the healthcare sector who may or may not raise dividends in September. And Fortis, one of the most reliable dividend growth stocks on the TSX Index.

Finally, we have Royal Bank. Simply put, one of the best banks to own in Canada, it’s one of the best stocks to own in Canada. The company delivered exceptional results, and the outlook for financials looks quite positive. If you’re looking for stronger growth, consider checking out alternative lending stocks.