Things To Consider When Using ETFs for International Diversification

This article is sponsored by BMO Exchange Traded Funds

As an investor, diversification is crucial to reducing risk and achieving long-term growth. International investing is a great way to diversify your portfolio, but it can be challenging for Canadians to navigate the complex world of foreign stocks and currencies.

One solution is to use exchange-traded funds (ETFs) for international investing. In this article, we’ll be going over some of the benefits to utilizing international ETFs inside your investment strategy, along with going over a few options to consider.

Benefits of international ETFs

There are many advantages to using ETFs for international investing. First, they provide exposure to a broad range of international markets, including developed and emerging markets.

This diversification can help reduce risk (when one market zigs and another zags) and increase returns over the long term.

Second, ETFs are typically more cost-effective than other forms of international investing. They have lower fees than traditional mutual funds, and you can invest in them for no commission at many online brokerages in Canada.

Third, ETFs provide transparency and ease of access. You can easily track the performance of your international ETFs and adjust your portfolio as needed. Additionally, most ETFs are denominated in Canadian dollars, so you don’t have to worry about currency conversion fees or fluctuations.

Considerations when looking at international ETFs

Currency

Currency returns are an important factor impacting investors purchasing a non-Canadian asset. Foreign currency fluctuations can affect the total return of assets bought in that currency when compared to the Canadian dollar.

ETF providers offer both hedged and unhedged options giving Canadian investors more tools to efficiently execute their investment strategies. The objective of currency hedging is to remove the effects of foreign exchange movements, giving Canadian investors a return that approximates the return of the local market.

Taxes

It is important to understand whether the ETF you are selecting invests directly in the underlying securities, or is getting exposure another way, for example an ETF that holds a US-Listed ETF (that invests in international equities).

Dividends interest, and potentially other sources of income, received from non-Canadian investments may be subject to withholding taxes. These are applied before the investor receives the distribution.

Canadian-listed ETFs that hold their underlying securities directly, allow foreign tax credits to be claimed to offset the foreign withholding taxes. This benefit of foreign tax credits can only be claimed for investments held in taxable (non-registered) accounts.

Finding the right exposure when it comes to international ETFs

Precise ETF exposures can help investors express views on region and country-specific markets. Here are different options for investors looking to add international exposure to their portfolio depending on their goals;

International ETFs: invest only in foreign markets, excludes the United States

Global or world ETFs: Exposure to both foreign and U.S. markets

Regional ETFs: Invest primarily in a specific part of the world, like Europe as an example

Developed markets ETFs: Exposure to foreign countries with proven economies, like Japan, France, and the United Kingdom as examples

Emerging markets ETFs: Include investments in countries that are considered to have “developing” economies, like India, Brazil, and China.

“Ex” ETFs: Provide exposure to global or larger subsets of markets while excluding one or more particular countries. For example, an “Ex-Canada” global ETF would avoid exposure to Canada, while an “Ex-China” ETF would avoid exposure to China.

International ETF examples

When it comes to international ETFs, there are several options available to Canadian investors. If you’d like to learn more about either of these, I’ve linked their names to the BMO fund pages.

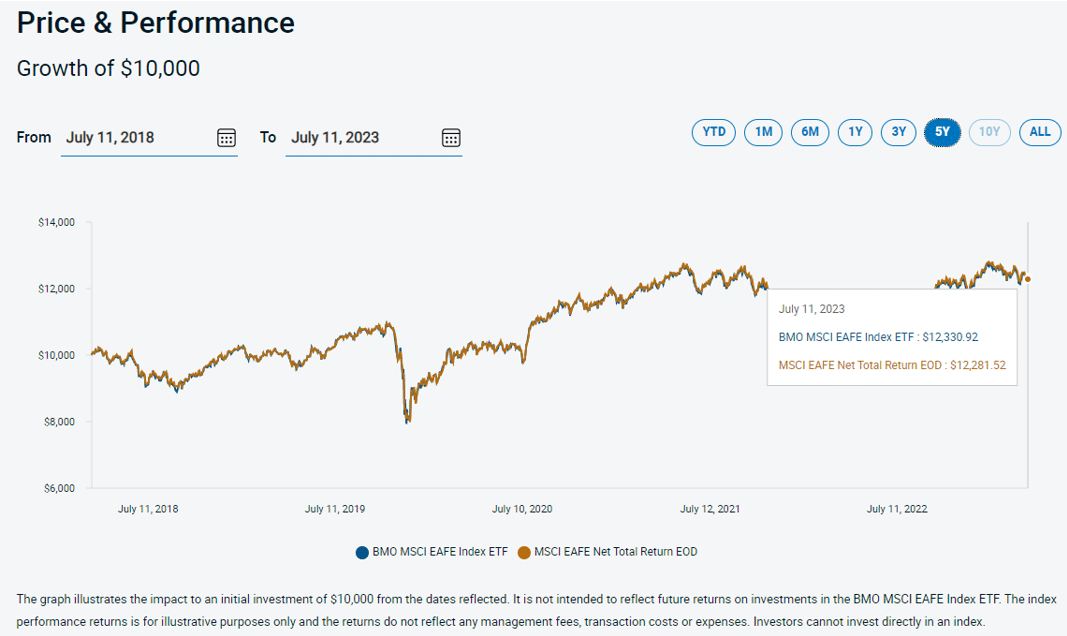

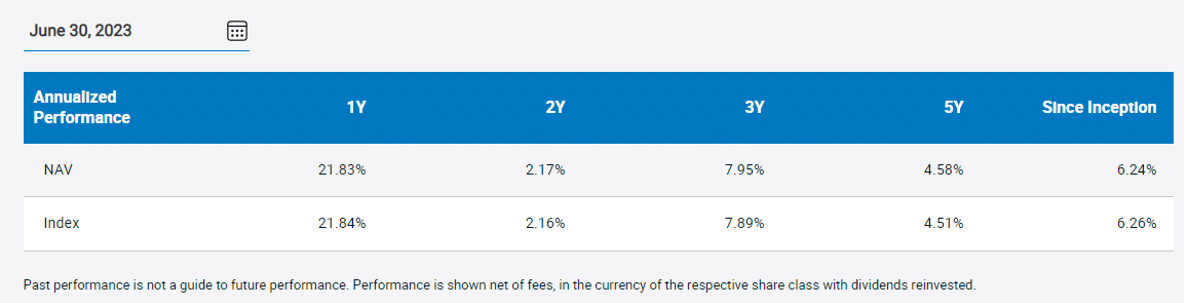

One example is the BMO MSCI EAFE Index ETF, which trades under the ticker ZEA.

This ETF tracks the widely recognized MSCI EAFE Index, which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada.

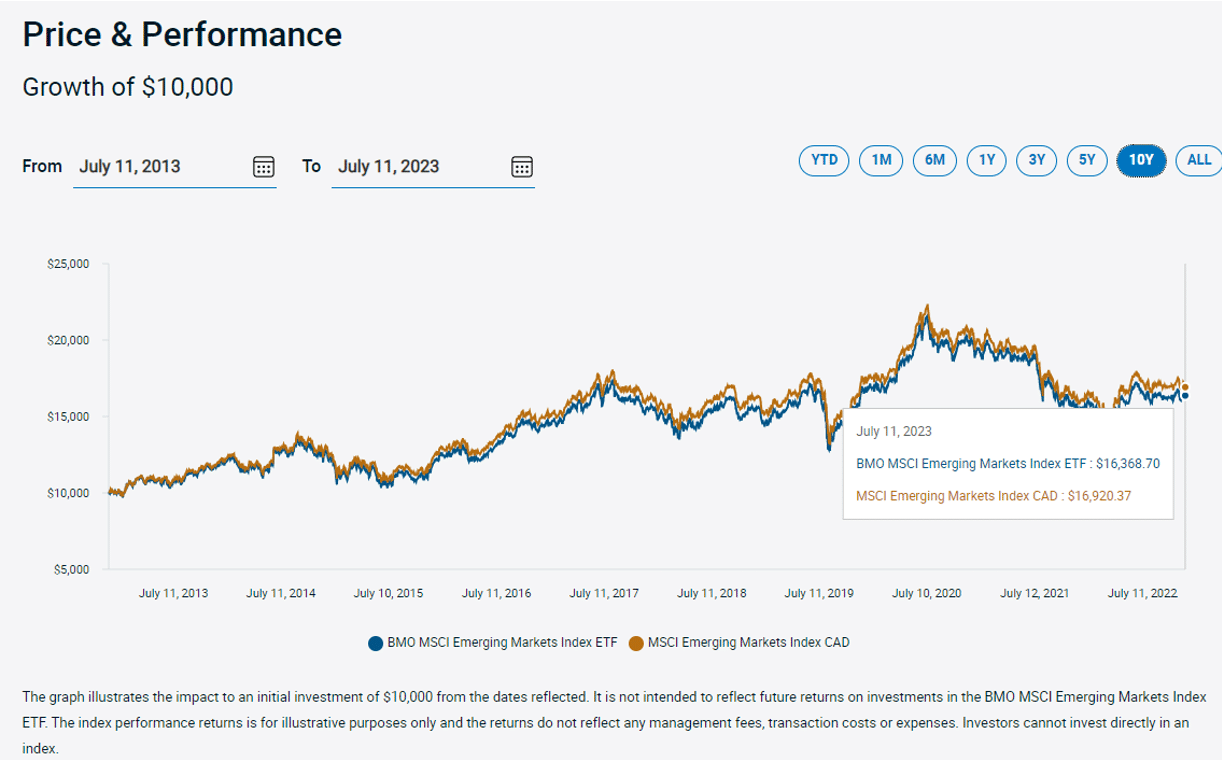

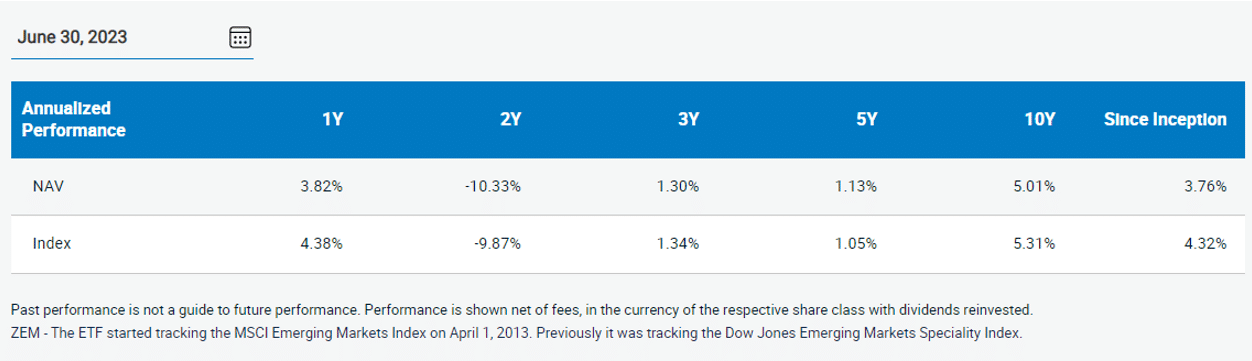

For investors looking for exposure to emerging markets, there are several ETFs to choose from including the BMO Emerging Markets Index ETF, which trades under the ticker ZEM.

This ETF tracks the widely recognized MSCI Emerging Markets Index ETF, which gives investors exposure to large and mid-cap representation across 26 Emerging Markets countries.

ETFs provide effective exposure to a broad range of international markets, are cost-effective, and provide transparency and ease of access.

While there are risks associated with international investing, a diversified portfolio of international ETFs can help mitigate these risks and provide attractive returns over the long term.

Disclaimer:

Commissions, management fees and expenses (if applicable) all may be associated with investments in BMO ETFs and ETF Series of the BMO Mutual Funds. Please read the ETF facts or prospectus of the relevant BMO ETF or ETF Series before investing. BMO ETFs and ETF Series are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs or ETF Series of the BMO Mutual Funds, please see the specific risks set out in the prospectus. BMO ETFs and ETF Series trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

The ETF referred to herein is not sponsored, endorsed, or promoted by MSCI and MSCI bears no liability with respect to the ETF or any index on which such ETF is based. The ETF’s prospectus contains a more detailed description of the limited relationship MSCI has with the Manager and any related ETF.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal. ETF Series of the BMO Mutual Funds are managed by BMO Investments Inc., which is an investment fund manager and a separate legal entity from Bank of Montreal.

This communication is for information purposes. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.