This Canadian Growth Stock Just Took a Huge Hit

When it comes to Canadian stocks and the markets in general, there are a few things that can send a company’s share price into a tailspin.

One catalyst could be a weak quarter. Quarterly earnings reports tend to shake out weak investors with a short term mentality.

Another catalyst, and one that tends to have a longer lasting impact than a weak quarter, is reduced guidance. Why? Primarily because a reduction in guidance is coming directly from the company themselves, straight from the horses mouth so to speak.

In this article I’m going to speak on a company that is going through a significant sell off right now due to a reduction in guidance and whether or not the company still provides any value. That company is NFI Group (TSE:NFI).

What does NFI Group (TSX:NFI) do?

NFI Group, or as the company used to be called, New Flyer Industries, is a manufacturer of transit busses and motor coaches.

Manufacturing represents a little more than half of the company’s revenue, while its aftermarket solutions include spare parts and servicing related to its transit buses and motor coaches.

Although the company is Canadian, most of the fabrication, manufacturing, distribution, and servicing of its products takes place in the United States, and as a result it derives most of its revenue from the US.

The key catalyst from the company as of late has been its mission to provide emission free busses, adding to the green movement in light of climate change.

Why has NFI Group stock plummeted in the last few days?

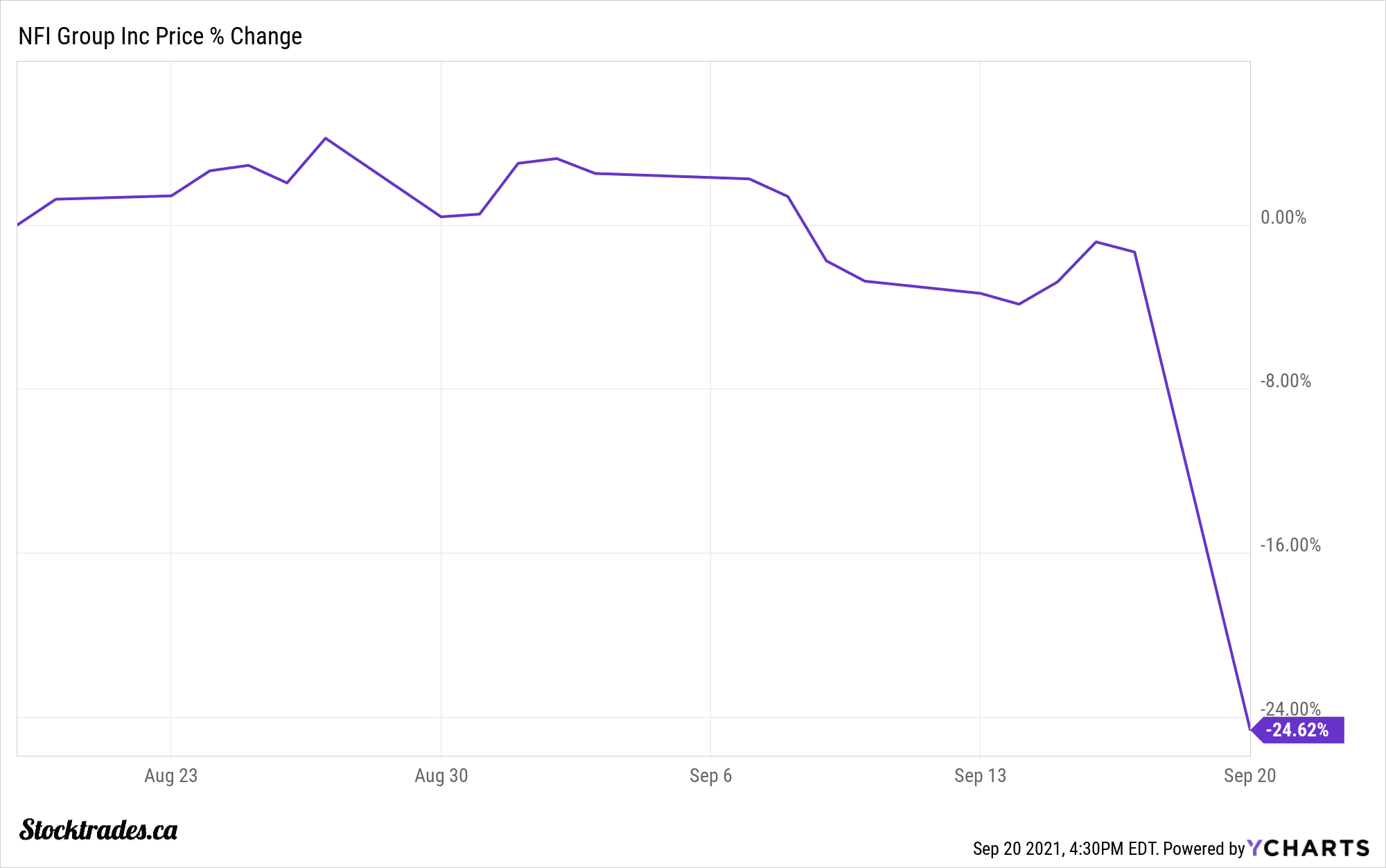

As mentioned, NFI Group is taking a significant hit in share price for one key reason, a reduction in full year 2021 guidance.

In fact, on the release of the guidance, the company fell as much as 20%. Is it justified, or is this simply an overreaction? Lets look at how much this company was actually impacted before we make any decisions.

In terms of revenue, the company now expects $2.3-$2.5B, which is down from prior guidance of $2.8-$2.9B. Its electric busses as a total percentage of sales will now be around 20%, whereas the upper end of previous guidance had it at 25%.

In terms of adjusted EBITDA, this is arguably where it hurts to most. The company reduced EBITDA estimates from $220-$240M down to $165M-$195M. On the low end of things, this is a 25% reduction in adjusted EBITDA.

Overall, the situation is not unique to NFI Group. Any company slashing guidance by this much is going to face significant volatility in terms of share price, a near 20% dip on the report is not surprising.

With the current news, is NFI stock still a buy?

If one thing is certain, it is that the market is going to overreact on any news in either direction. Rarely is a report like this digested reasonably by the markets, and chances sometimes surface for investors to possibly grab a beat up stock at a discount.

Is the situation the same for NFI Group? It’s difficult to say. The company does reiterate its 2025 guidance for adjusted EBITDA in the range of $400M to $450M by 2025. This would be triple the EBITDA of its most recently revised Fiscal 2021 guidance, which would seem like an extremely difficult target to hit.

The company states that a rapid deterioration in the availability of critical parts is the primary reason why the reduction in guidance was issued, and is expected to be short term.

However, we expected the COVID-19 pandemic to be somewhat short term as well. Moving into the tail end of 2021, we will be closing in on two years of overall disruption globally as a result of the virus.

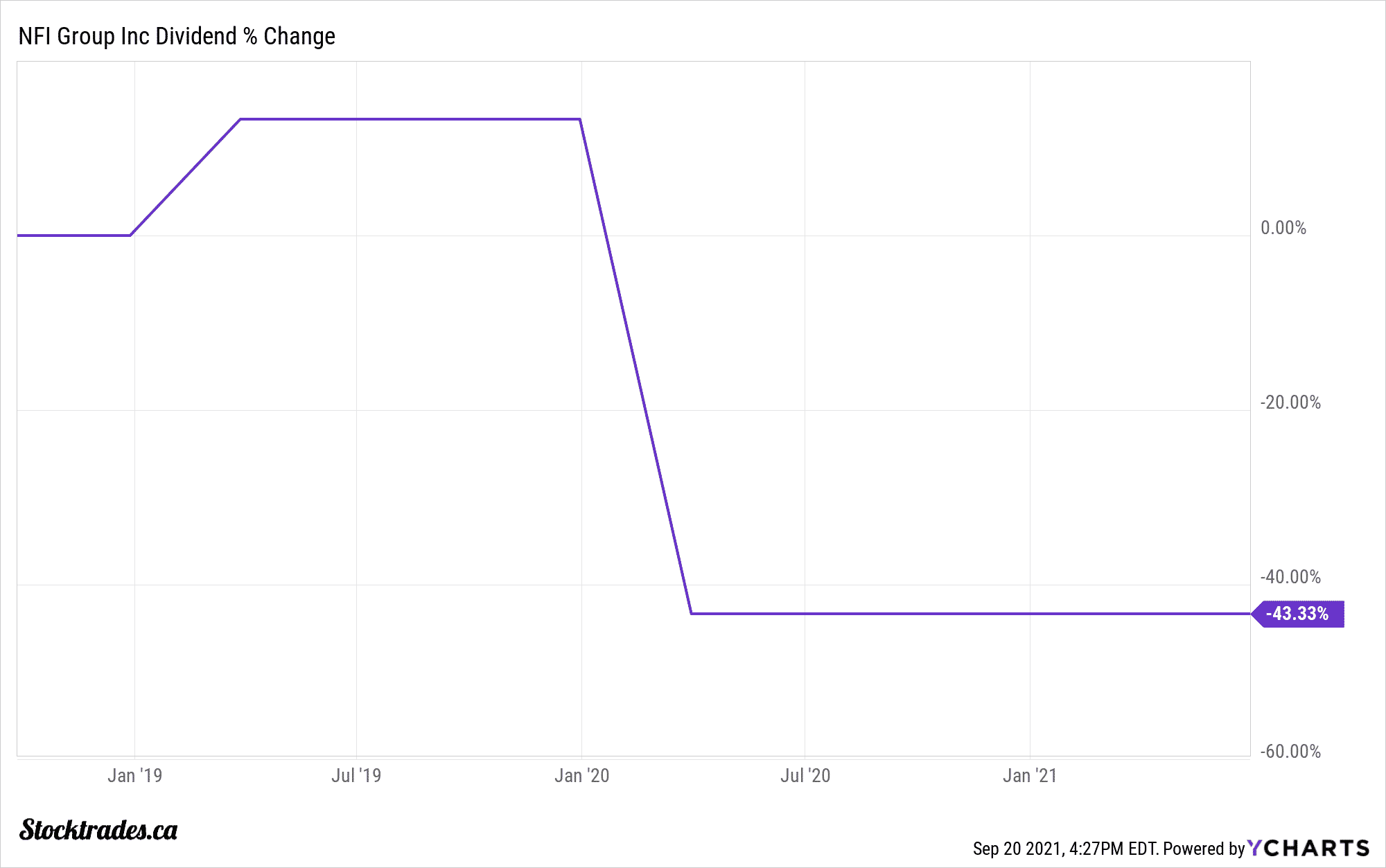

So, there’s really no estimation of how long this will impact NFI Group, and the longer it does, the worse off shareholders will be. Why? It will put the company’s dividend at risk yet again, and if the dividend were to be slashed, its share price would surely fall further.

The company has stated that the dividend will be maintained through this. However, the issue is that NFI Group is only about 16 months removed from slashing its dividend in the heat of the pandemic. So, I don’t think much reliance is being placed on the company’s confirmation of the dividend at this point.

From a buyers standpoint, the company poses significantly more risk now than it did even a month ago. The bulk of the risk comes from a seemingly unknown future because of the pandemic.

Overall, this is a solid company, impacted by events outside of its control

Just one month ago, I posted about NFI Group and how it was starting to turn things around after it posted outstanding results that topped expectations by wide margins. And now we’re presented with this. On one side, it shows you the impacts that the pandemic is having on industrial/production style companies nearly 2 years in, and on the other side it shows you the true risk of investing in the equity markets today.

This is a solid company that has taken a significant hit due to events completely out of its control. Those who are buying stocks now must have a long term mentality. Optimally, one that is looking 5 or more years out, as the next 1 or 2 years could be tough sledding for NFI Group.

As with most situations where a company revises guidance, analysts are now changing their tune and downgrading the company. It looks cheap right now on a forward looking basis, however we can likely expect earnings and revenue estimates to trend downwards.

For right now, I’d have NFI Group firmly on my watchlist, but wouldn’t be pulling the trigger until there is a little more certainty in the company’s future.

Next, we see if Cargojet (TSE:CJT) has any gas left in the tank in terms of growth.