This Top Canadian Stock Just Broke All Time Highs

In the current market environment, finding undervalued stocks is becoming an increasingly difficult task to pull off.

So as a result, we’re left to either keep cash on hand, or find attractive opportunities despite the TSX Index hitting all time highs.

One of the strongest brands among Canadian stocks recently broke through to new all-time highs after the pandemic put the spotlight on its outstanding business operations and resiliency. That company is Canadian Tire (TSE:CTC.A).

So, does the Canadian retail giant still provide value today despite touching all time highs, or should you be avoiding it? There are a lot of bear thesis’s on Canadian Tire, and many investors are betting against this company to this day. Are they wrong?

Canadian Tire’s (TSE:CTC.A) finally learning to adapt

Despite business operations coming to a complete standstill during the height of the lockdowns in 2020, Canadian Tire still managed to pull off a relatively flat year in terms of the company’s top and bottom line.

Why? Well, primarily its e-commerce segment. Canadian Tire has often been criticized for having an archaic business model. The game is changing, and people don’t want to go into the store anymore.

The shift in consumer demand was supposed to bury Canadian Tire. When instead, the company came up massively in 2020, increasing e-commerce sales by over 250% year over year.

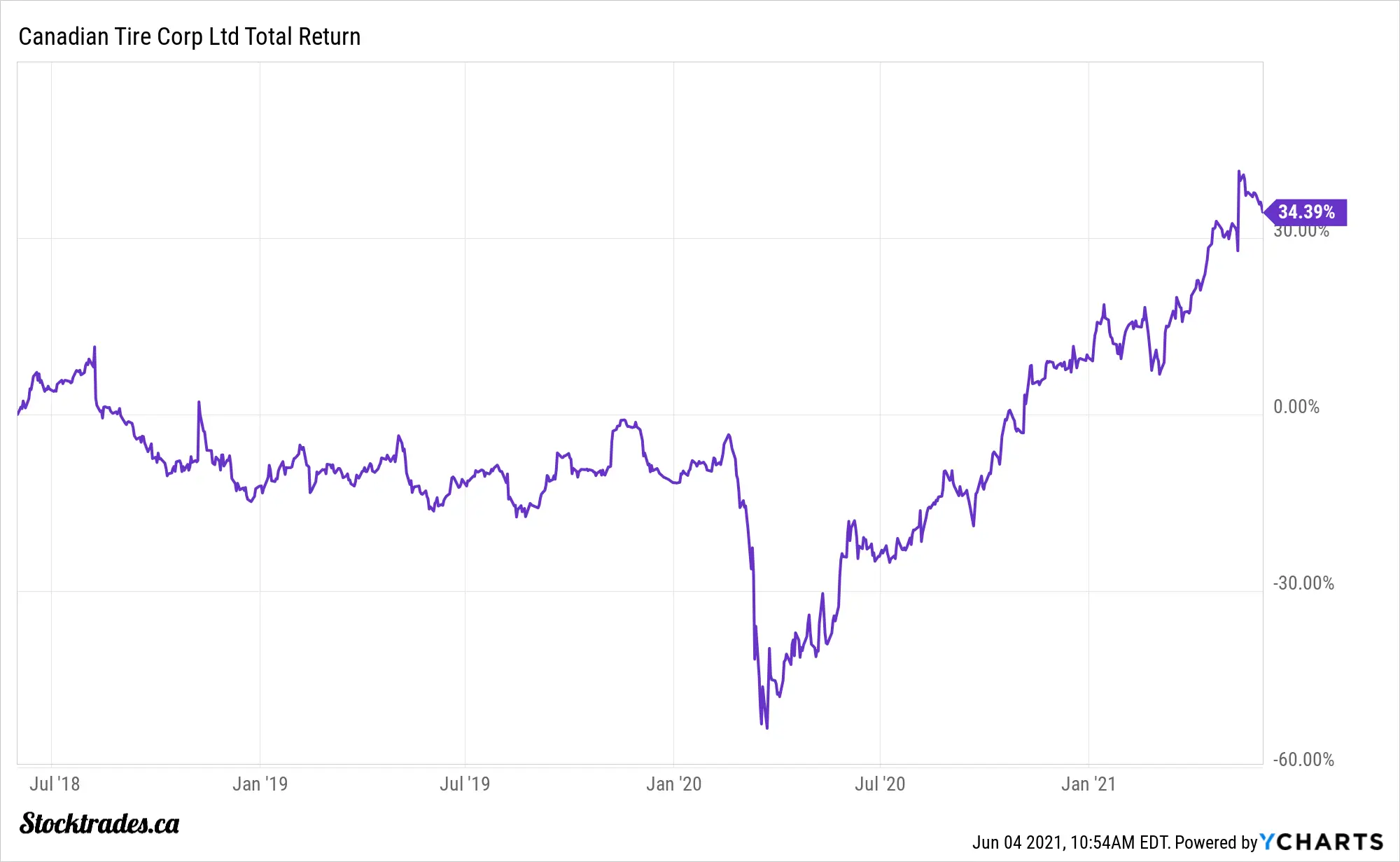

Canadian Tire (TSE:CTC.A) 3 year total return

Canadian Tire reported online sales were 5 times higher year over year in its most recent quarter.

There’s no questioning the fact that the pandemic fueled a lot of the growth. However, many consumers who once felt Canadian Tire was a store that you “had to go into” because of the products it sells are realizing that you can just as easily order online and either have it delivered or pick it up in store.

This trend is becoming more evident by the fact that despite extensive lockdowns in the same quarter last year, Canadian Tire reported online sales were 5 times higher year over year in its most recent quarter.

Canadian Tire still does lag behind some counterparts in terms of e-commerce, especially when it comes to the fact that it doesn’t offer free delivery. However, this is likely something they’ll introduce in the future.

First quarter earnings make this stock look cheap

Canadian Tire, to put it lightly, crushed analyst estimates when it comes to the first quarter of 2021.

The company reported earnings per share of $2.70 when analysts expected $0.637. When you look further back, the company has significantly outperformed market estimates for the last 3 quarters and it is clear analysts are undervaluing the strength of this company.

If we look to 2021 annual estimates, Canadian Tire is expected to earn $16.01 per share. Not only would this represent 27% growth from 2019 (I’m ignoring 2020 due to one-off pandemic conditions) but it also leaves the company trading at an attractive 12.4 times forward earnings.

Canadian Tire, despite touching all time highs, is trading under its 3, 5, and 10 year historical averages when it comes to both trailing and forward earnings.

Overall, the company is still attractive

Whether or not it fits your individual portfolio is another question entirely. But, looking at Canadian Tire right now, the company looks to be in a position to fuel stronger growth due to the rapid evolution of its e-commerce segment and overall consumer demand for its goods.

We cannot discount the power of this company’s brands either. Canadian Tire, Helly Hansen, and Mark’s Work Warehouse to name a few are Canadian staples, and stores that many head to to buy tools, work clothes, Barbeques, appliances, and more.

Whether or not you believe it can drive further e-commerce growth while also keeping foot traffic heading in and out of its store will be a key catalyst to continued price momentum.

The company was a Stocktrades Premium recommendation in 2019, and members have enjoyed 40% gains at the time of writing. Not bad for a blue-chip dividend payer in the midst of a global pandemic.

Lumber prices have you looking at stocks benefiting from renovations and construction? Don’t get too excited about some stocks that already have the growth priced into them. Lets look at Richelieu Hardware (TSE:RCH).