Top Bitcoin ETFs in Canada to Gain Exposure To Cryptocurrency

There has been considerable interest in Cryptocurrencies recently, Bitcoin in particular. Tons of investors are frantically trying to learn how to buy cryptocurrency in an attempt to take advantage of price movements.

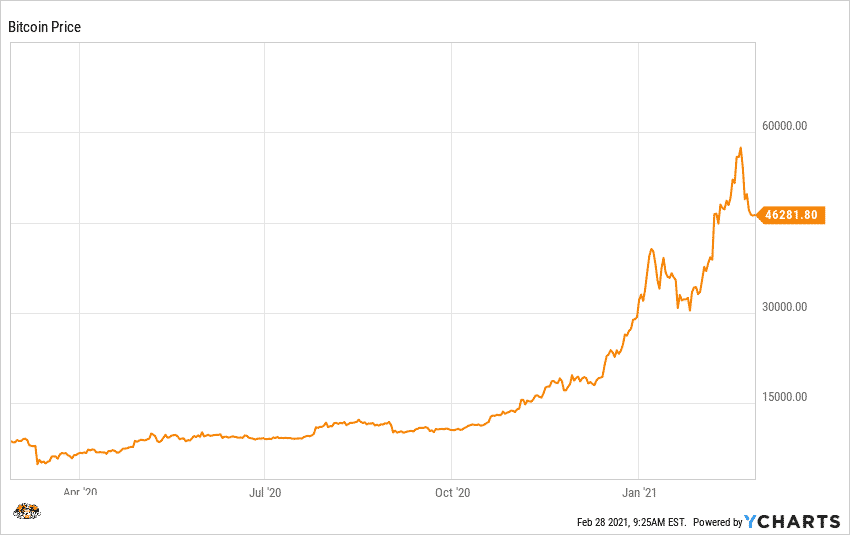

This is by no means surprising, as Bitcoin has been on a record run. While the price of Bitcoin has since cooled, the crypto story is far from over. There was a surge of people wanting to learn how to buy stocks in Canada due to the crash in 2020, and now they want a piece of Bitcoin.

So how does someone gain exposure to cryptocurrency, particularly Bitcoin?

Often, we get asked how investors can get exposure to Bitcoin and today, we are going to explain a few products available to investors, including Bitcoin ETFs and Bitcoin closed-end funds.

Worth noting, we are not going to go in detail about how to hold the crypto itself. There are a myriad of ways to buy and hold Bitcoin, and that is not the purpose of today’s article.

Secondly, we are not going to spend much time talking about the many publicly traded companies that have exposure to Cryptos. There are dozens in the space, and there are more entering the fray on a daily basis it seems.

Whether it be by turning their cash into Bitcoin – much like Tesla did recently to the tune of $1.5 billion, or by scooping up companies that operate in the space.

Today, our focus is going to be strictly on funds that are buying and holding Bitcoin and explain the differences between them.

As of writing, there are three notable Bitcoin ETF/funds that are available to Canadian investors and a fourth is on the way

Each of these funds can be held within a registered account such as a TFSA or RRSP and as such, the gains would be tax free.

It is one of the major benefits of holding the following products instead of buying and selling on crypto exchanges in which gains would be subject to taxes.

Bitcoin Closed-End Funds

Let’s start with closed-end funds of which there are three currently listed on the Canadian exchanges:

- 3iQ’s The Bitcoin Fund (TSX:QBTC)(TSX:QBTC.U)

- Ninepoint Bitcoin Trust (TSX:BITC.UN)(TSX:BITC.U)

- CI Galaxy Bitcoin Fund (TSX:BTCG.UN)(TSX:BTCG.U)

Each of these three closed-end funds have varying differences, but today we will dig deeper into 3iQ’s The Bitcoin Fund which is by far, the largest Bitcoin fund in Canada.

Of note, CI Global Asset Management has announced plans to merge its Fund into a Bitcoin ETF.

The Bitcoin Fund is structured as a closed-end fund that has a fixed amount of units.

The fund’s first units were offered back with the company’s IPO in April of 2020. Subsequent units have been offered in periodic overnight offerings and at-the-market offerings.

QBTC trades in Canadian dollars, while QBTC.U trades in US Dollars (USD). For all of these funds, the “.U” is the USD traded version of the fund.

The fund carries a MER fee of 1.95% and the proceeds raised are used to buy and store actual Bitcoin. In other words, the fund is backed by actual Bitcoin and its purpose is to closely track the price of Bitcoin.

Bitcoin is held in trust by Gemini Trust Company, a digital currency exchange and custodian.

As a closed end fund however, it is more volatile than Bitcoin itself. Why?

Because it has a fixed amount of units and high demand can result in the fund trading above its net asset value (NAV). The opposite is also true as low demand can result in a discount to NAV.

As per regulations, any new offerings cannot be issued below NAV which protects the existing unit holders. There are a few other important details, but we’ll discuss them a little later.

Next, let’s take a look at two Bitcoin exchange-traded funds (ETFs) which were recently launched.

Bitcoin Exchange Traded Funds (Bitcoin ETFs)

I’m going to speak about them as a duo as very little sets them apart.

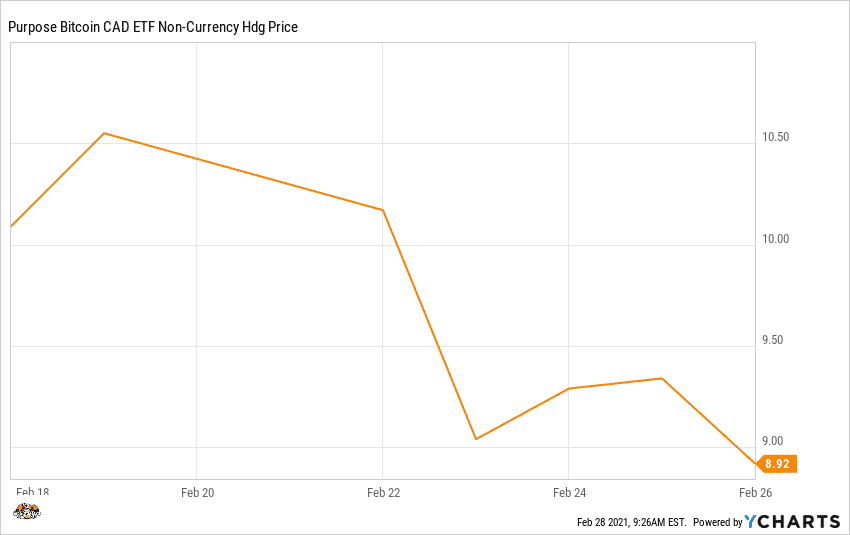

The Purpose Bitcoin ETF (TSX:BTCC)(TSX:BTCC.B)(TSX:BTTC.U) first began trading on February 18, 2021 and became the first world’s first Bitcoin ETF.

The fund saw record net inflows and reached $421.8 million in assets under management in only two days. While BTCC and BTCC.B trade in CAD, the BTCC ticker is hedged to the USD. For its part, BTTC.U is traded in USD.

The Evolve Bitcoin ETF (TSX:EBIT) began trading only a day later and just like that, investors had a few products to choose from. Much like Purpose, Evolve has USD (EBIT.U) and CAD (EBIT) versions of their ETF.

At the start, there was very little to separate these two Bitcoin ETFs

Both are backed by Bitcoin and are expected to track the price of the crypto.

Unlike closed-end funds, ETFs more closely track the daily price movements of the commodity they track – in this case, Bitcoin. The fund is unlikely to trade at big premiums, or discounts to NAV and typically carry lower fees.

The Purpose and Evolve ETFs both launched with MER fees of 1% and much like 3iQ, the Bitcoins are held in trust by Gemini. To be honest, there was very little to set these two ETF’s apart.

As the first to the market, Purpose’s ETF launch came with big fanfare and captured the attention of retail investors. Evolve – while essentially offers the same product – flew under the radar and hasn’t attracted the same level of inflows.

As of writing, Purpose’s ETF holds $602M assets under management (AUM) while Evolve’s only has $40M in AUM.

The early launch and publicity clearly had a positive impact on Purpose, while Evolve did not keep pace.

In response, Evolve upped the ante as it cut MER fees to 0.75% only a week after listing. A ‘price war’ as BNN/Bloomberg described it, is great for investors as it lowers the fees.

Given that nothing materially separates the two, lowering the fees is one way to make one product more attractive over the other.

Another factor that separates the two is price per share

The un-hedged CAD versions of BTCC and EBIT are currently trading at $8.82 and $24.61 per share. While the price per share should be irrelevant as they are dependent on the amount of Bitcoin the fund holds, there is a psychological effect here.

Retail investors tend to be more attracted to lower prices per share. The reasoning is simple – one could almost buy 3 BTCC shares for each share of EBIT. However, that logic is flawed and the price per share comparison is irrelevant.

Why?

Since both Bitcoin ETFs track the daily price movements of Bitcoin, they will each rise and fall accordingly

If the price of Bitcoin rises or falls by 5%, than $1,000 invested in either BTCC or EBIT will also rise and fall by ~5%.

Bottom line, the price differential should have little impact on investors’ decision.

MER fees on the other hand, is a key factor. It is one of the main reasons why 3iQ’s Bitcoin Fund saw significant outflows as a result of the launch of these two ETFs.

Why would an investor pay 1.95% in fees, when there is an alternative and more liquid product trading with half the fees?

At one point, the outflows led to big price drop for QBTC. In fact, the fund traded at pretty significant discount to NAV once those ETFs launched.

When this was happening, we cautioned Stocktrades Premium members not to sell their QBTC at such a discount.

Remember, QBTC also holds the crypto itself and those holdings didn’t suddenly disappear. The discount to NAV was pretty significant at one point (around 15%) and astute investors would have bought more QBTC instead of buying the newly listed ETFs.

Selling QBTC at such a discount to buy the ETFs would be like selling your $100 bill to your neighbor on the left for $85.00, only to turn around and buy the exact same $100 bill from your neighbor on your right for $100. Minus small fees of course.

Sure, the discounted MER is certainly attractive but selling at such a discount does not make sense.

You don’t make money by selling at a discount to re-buy at market price

In fact, you are losing out.

To further the point, 3iQ came out with news of a normal course issuer bid (NCIB) in which it could purchase for cancellation up to 10% of the public float.

The move was a smart one and since it has a finite number of shares, the discount to NAV has since narrowed. However, the point of all of this, considering you could be reading this a year down the line, is to keep an eye on the NAV of these Bitcoin ETFs and Bitcoin funds.

Outside of the obvious stated above, another reason why QBTC investors should not be selling at a discount?

According to QBTC’s prospectus, once a year (in June) investors have the opportunity to exchange their shares at NAV.

This means that if the discount persists, shareholders have a better exit option rather than selling at a discount to NAV.

Finally, 3iQ also has plans to launch a Bitcoin ETF of its own

Although nothing is confirmed, there are rumors that QBTC holders will be able to exchange their holdings for shares of the new ETF product. There is also the possibility that the fund goes the same route as CI Financial and merges the two together.

All this to say, investors should not be selling their QBTC holdings at a discount. Same reasoning applies to the other Bitcoin close-end funds trading at a big discount to NAV.

Which product should investors chose, the Bitcoin ETFs or Bitcoin fund?

There are a few factors to consider. The most often cited are fees and the lower the MER the better.

This is where the ETF’s hold the advantage as they usually have lower fees than closed end funds. All else being equal, the ETF with the lower fee is likely to be the most attractive.

However, as we alluded to earlier – fees are but a part of the equation. The maximum upside from these ETFs is the increase in the price of Bitcoin (minus fees).

For their part, closed-end funds have a few tools at their disposal to maximize returns for unit holders

When NAV is at a discount, they can buy back units and reduce the float. This has the net effect of increasing the # of Bitcoin per unit and increasing the value of units.

The opposite is also true. The fund can issue shares when NAV is at a premium and buy up Bitcoin at a discount to the offering which once again, benefits unit holders.

All this to say, extra returns can be made as the returns aren’t solely dependent on the price movements of Bitcoin.

Leaving reasons for owning Bitcoin itself aside, if an investor is bullish on the crypto then both ETFs and closed-end funds are excellent and easy ways for investors to get exposure.

Furthermore, don’t automatically discount closed-end funds because of the higher fees and lower liquidity.

When they are trading at a significant discount to NAV, then the argument can be made they are a much better investment for those looking to have Bitcoin exposure for the long-term. If however, you are looking to hold shorter term and day-trade, ETFs are the better option as they are likely to be more liquid.

If you are looking to invest in Bitcoin for the long term it is important to compare all these products against each at the point in time you are ready to invest.

Why? The answer to “Which product should investors chose?” can change from day-to-day.