Two Canadian Banks Soaring in 2025. Are They Still Buys?

Canadian bank stocks have long been a favourite among investors seeking steady growth and reliable dividends.

As a Canadian investor, these institutions make up a solid chunk of my portfolio. The top Canadian bank stocks offer a unique blend of stability, income, and growth potential that’s hard to match in other sectors.

The Big Six banks – RBC, TD, CIBC, BMO, National, and Scotiabank – are often the first names that come to mind.

Because of the heavy regulations in the Canadian banking sector, these companies form an oligopoly that is hard to penetrate.

I’ve been particularly impressed with how some Canadian banks have performed recently, especially considering how weak the Canadian economy is.

Lets dig into a couple of my favorites at this point. But first, a note on why some banks are doing well, and why others aren’t.

Banks with high Canadian exposure are excelling

There is no doubt that banks with more domestic focus are excelling, while those with big international operations are struggling.

Royal Bank of Canada and National Bank are standout performers this year. Their strong Canadian presence seems to be paying off big time. On the flip side, BMO, TD, and Scotiabank are having a rougher go of it.

Why’s this happening? A few factors are at play:

- Lower interest rates in Canada

- Renewed mortgages at higher rates

- Increased domestic borrowing

While this looks great now, I’m a bit wary. The Canadian economy isn’t exactly booming, and this trend could flip fast if things take a turn for the worse.

I’m also keeping an eye on increased lending, especially from businesses. It might seem positive, but it’s not always a sign of strength. Sometimes it means companies are borrowing just to stay afloat.

In my view, it’s crucial to keep a close eye on economic indicators and each bank’s individual performance. The landscape is positive for these companies right now, but it’s worth keeping a keen eye on.

Would I Still Buy The Two Best Performing Bank Stocks in Canada Now?

CIBC (TSE:CM)

CIBC is shaping up to be one of the top performers among Canadian banks this year.

Why is CIBC doing so well? I think it’s because they’ve got a bigger slice of the Canadian pie compared to some of their peers.

With the Bank of Canada cutting interest rates before the Fed, we’re seeing more borrowing activity here at home. This plays right into CIBC’s wheelhouse, as it has the largest Canadian exposure out of all the major banks as a percentage of their loan portfolio.

Another bright spot for CIBC is their provisions for credit losses. They’ve managed to report sharp declines in year over year PCLs, which is impressive in this climate. Because provisions come out of earnings per share, the decline in overall provisions is causing the company to post much higher earnings than expected.

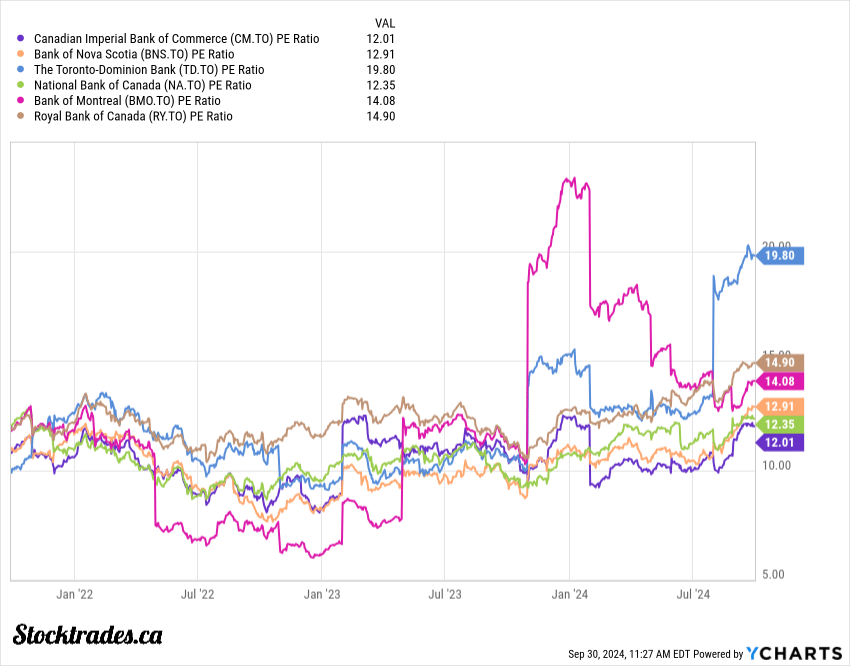

Let’s talk valuation. CIBC is trading at a price-to-earnings ratio that’s lower than some of its big bank peers. This suggests there might be room for the stock price to climb higher, especially if they keep delivering solid results. However, it is important to note that this company rarely does trade at the same valuations as the other major banks. If we look to the chart below, it’s still the cheapest bank on a price to earnings basis.

CIBC does face some challenges. Their U.S. operations aren’t as large as some of their competitors. This could be a drag on growth if the Canadian economy starts to slow down and the US economy picks up.

Another thing to keep an eye on is their exposure to the Canadian housing market. If we see a significant downturn in real estate, CIBC could be more vulnerable than some of its peers. More than 50%+ of their portfolio is allocated to Canadian mortgages.

Despite these risks, I’m generally bullish on CIBC. Their strong performance in the Canadian market, coupled with their improving credit quality, makes them an attractive option in my books.

Royal Bank of Canada

Royal Bank’s recent performance has been stellar, especially compared to some of their banking peers.

Let’s dive into why Royal Bank stock is doing so well in 2024.

First off, much like CIBC, RBC’s provisions for credit losses are stabilizing. This is a big deal.

It means they’re getting a handle on potential loan defaults and aren’t expecting things to get much worse. That’s a great sign for the bank’s financial health, and the market is generally going to react positively to this.

The Canadian economy has been surprisingly resilient, and RBC is reaping the benefits. Their strong presence in the Canadian market is paying off big time.

But unlike CIBC, Royal has plenty of international exposure to offset a potential shift in the Canadian economy. RBC has operations in over 40 countries.

Let’s talk dividends. RBC’s dividend is rock-solid. I’d argue it’s one of the safest among the major Canadian banks.

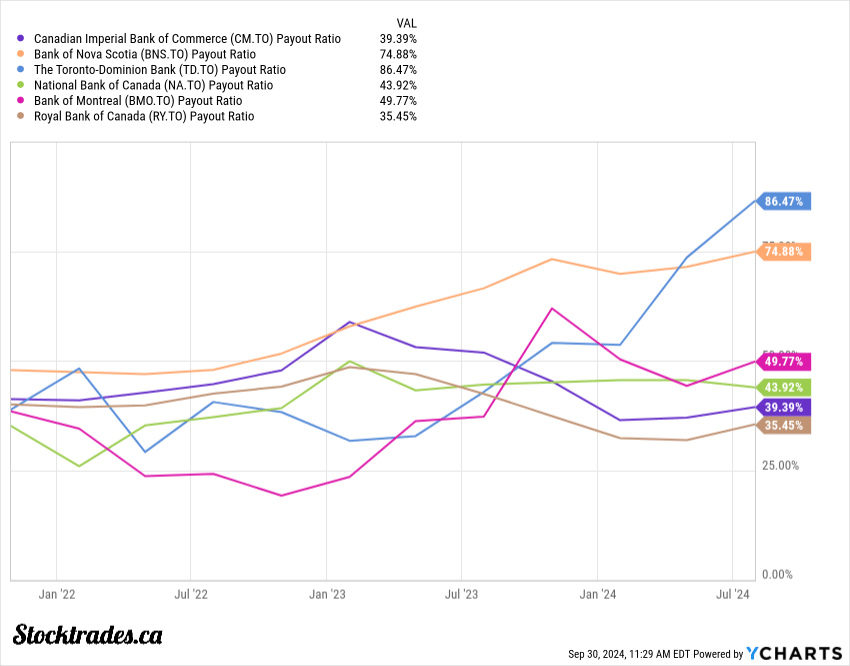

They’re also in a prime position to grow their dividend faster than their competitors in the coming years. Just look at the payout ratio chart below and you’ll see what I mean. While stocks like Toronto Dominion and Scotia struggle in terms of payout ratios, RBC’s 35%~ ratio should mean high single digit dividend growth moving forward.

That’s music to the ears of income-focused investors like myself.

Brand strength is another factor that can’t be overlooked. RBC’s brand is practically synonymous with Canadian banking. This strong reputation helps them attract and retain customers, even in tough times.

Their earnings have been outstanding, frequently topping estimates. For that reason, numerous analysts are upgrading their projections for the year. It is one of the only Canadian banks seeing this in 2024.

Looking at the bigger picture, RBC’s mix of Canadian and international exposure seems to be hitting the sweet spot.

They’re benefiting from the strong Canadian market while still having room to grow globally.