The Top Canadian eSports Stocks for November 2024

Esports is a rapidly growing industry and one that may not be well understood by traditional investors. In fact, it’s very likely that those who are brand new to buying stocks in Canada know more about the industry than experienced investors.

Over the past decade, video gaming has soared and as luck would have it, people love watching other people play video games.

It might be a foreign concept to some, but rest assured this is a booming industry. And fortunately, there are some Canadian stocks that you can buy to get exposure.

What is eSports exactly, and why are eSports stocks in Canada taking off?

In simple terms, it is competitive and organized video gaming.

There are a variety of different leagues and teams which compete in some of the most popular video games in the world.

Think games like Fortnite, League of Legends, Call of Duty, Overwatch and more. While there are competitions in sports game like Madden, it truly defies the notion of traditional sports. Esports includes different titles across different genres and multiple gamine devices.

Just how popular is eSports?

It is a billion dollar industry and according to Newzoo’s 2020 Global eSports report, more than 495M people watched worldwide – 11.7% growth over 2019. That pace of growth is expected to continue and reach 646M viewers by 2023.

Not surprisingly, the pandemic has also accelerated the time spent video gaming, which bodes well for the future of the industry and Canadian eSports stocks.

Perhaps the most interesting aspect – the younger generations spend more time watching eSports than they do watching traditional sports.

The younger the generation, the more eSports they consume. Considering that traditional sports viewership is in the billions, the runway for eSports is quite large assuming these trends continue.

At this point, there is no reason to believe they won’t as we are experiencing a generational shift.

The question is – how can investors take advantage? Unfortunately, many of the bigger players are listed on the U.S. exchanges or in Asia and there are few established eSports investment options in Canada.

That being said, here are some of the most notable Canadian-listed eSports stocks.

Worth noting, the three companies on this list are considered high risk and are likely to be highly volatile.

Be mindful of your risk tolerance if you chose to invest in any of the following companies.

The top Canadian eSports stocks to look at now

- Enthusiast Gaming (TSE:EGLX)

- Engine Media Holdings (TSXV:GAME)

- Real Luck Group (TSXV:LUCK)

Enthusiast Gaming (TSE:EGLX)

The most established publicly traded eSports company in Canada is Enthusiast Gaming (TSE:EGLX). Enthusiast is the largest gaming platform in North America.

It also has a global reach, with exposure to more than 300 million gamers on a monthly basis. It is zeroing in on GenZ and Millennials by creating a unique social network for gamers.

According the Enthusiast, the video game industry is currently valued at $160B and is expected to reach $305B by 2025.

Since the company is not yet profitable, it is best to focus on top line growth. In fiscal 2020, the company generated $72.96M in revenue, up from $12.29M in 2019. This topped analyst estimates which were calling for $68.35M in 2020.

The future also looks bright as analysts are estimating that Fiscal 2021 revenue comes in at $159.6M, a 118% increase. Revenue is expected to reach $238M by 2023.

As of writing, this gives Enthusiast a reasonable P/S ratio of 11.30 which drops to 5.62 on a forward basis. For a company growing at a triple-digit pace, these valuations aren’t nearly as crazy as we’ve seen in other hot industries.

Also worth noting, Enthusiast recently listed on the NASDAQ and that could be a catalyst to sent the Canadian eSports stock to new heights.

Enthusiast Gaming performance over the last year

Engine Media Holdings (TSXV:GAME)

Engine Media (TSEV:GAME) is focused

“on accelerating new, live, immersive eSports and interactive gaming experiences for consumers”

The company is engaged in eSports data provision and eSports tournament hosting. Its brand profile includes Eden Games, Allin sports, Stream Hatchet and UMG among others. It has a four pronged approach to revenue generation:

- Direct-to-consumer and subscription fees

- Data Software as a Service (SaaS) products

- Programmic advertising

- Intellectual property licensing fees.

Furthermore, it has been an industry consolidator and is more like an asset management company in the eSports space, as it has closed on several acquisitions.

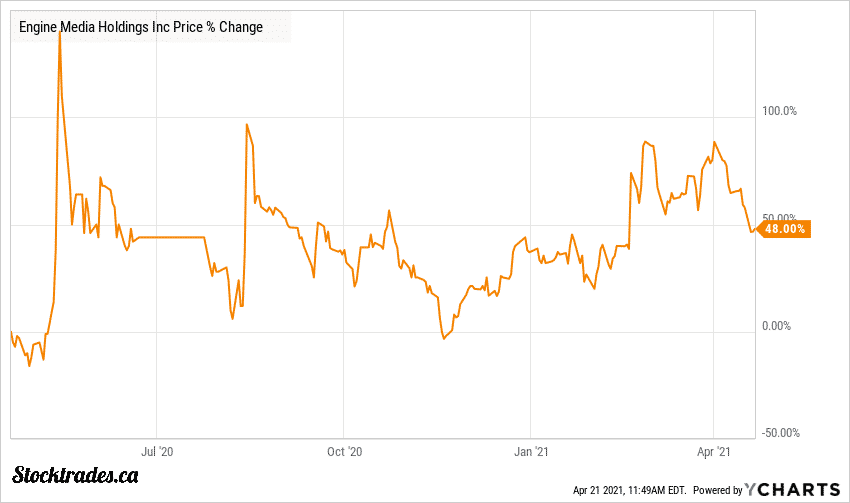

The company has been rapidly increasing revenue. In 2020 it exited the year with $11.1M in revenue from continuing operations. This is up 164% from the $4.2M it generated in 2019.

One of the biggest drawbacks is the company’s high debt load. While it has since taken steps to reduce its debt – notably paying its $10.7M convertible debt – it exited the year with $42M in current liabilities against only $12.1M in current assets.

Given this, access to liquidity could be an issue for the company and it is something investors should monitor. Compounding the issue, the company is burning through considerable cash. In 2020, it posted negative cash from operations of $18M. It is a trend that is continuing through the early part of 2021.

Thus far, it looks like the company is raising capital through private placements and share offerings to improve liquidity. While this is acceptable as a short term solution, it is not a long-term strategy.

It is likely why the company has been unable to breakout over the past year.

Until the company can resolve its liquidity issues and reduce cash burn it will be faced with this constant need to raise cash.

While this is typical of early-stage companies, the rate at which the company is diluting shares is quite high (more than double last quarter).

A trend certainly worth monitoring.

Engine Media Holdings performance over the last year

Real Luck Group (TSXV:LUCK)

Changing gears a little, Real Luck Group (TSEV:LUCK) is a betting company that offers legal, real-money betting, live streams, and statistics on all major eSports tournaments.

While there are other companies in this space, Real Luck is the most exposed to the eSports industry.

Between 2017 and 2020, it is estimated that eSports betting grew at compound annual growth rates of 44% and topped $18B in 2020. Led by Generation XYZ, the popularity in legal eSports betting is booming.

The company’s Luckbox platform is live in more than 80 countries, available in multiple languages and 80% of its users are in the 18-35 age range.

Luck is licensed in the Isle of Man for Business-to-Consumer (B2C) & Business-to-Business(B2B) eSports betting which provides it with a competitive advantage.

In short, it is a mid-range license that takes between 1-2 years to set up and is for the most part in good standing with most global financial institutions.

Having the right license is key to success in the industry.

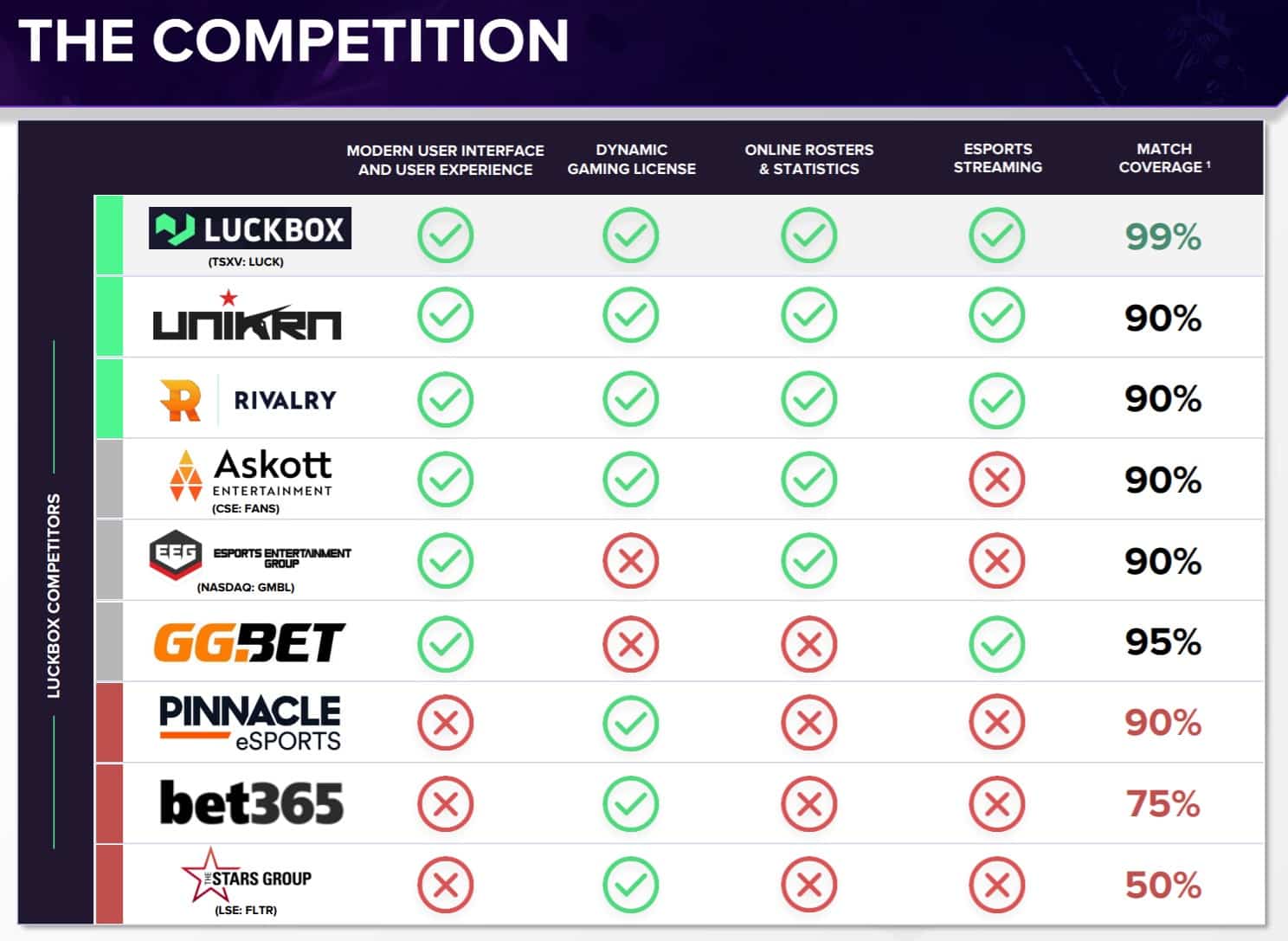

Here is a nice snapshot of the Real Luck Group and how it stacks up against the competition.

As you’ll notice, it has a 99% eSports match coverage – tops in the industry. In other words, if you are looking to bet on eSports, Luckbox is the most likely to have the match available.

While there are publicly traded companies in the eSports betting industry, Luckbox is the leading eSports betting platform which is why it made our list over some of the others – most notably FANS which is listed on the Canadian Securities Exchange (CSE).

Worth noting, LUCK only listed on the TSX Venture in late December, 2020 and has yet to release its first set of quarterly results as a publicly traded company.

That adds yet another level of risk to the company, evident by the fact it lost more than 50% of its value since February highs. This will likely be the most volatile company of the three listed.

How it performs in relation to expectations over the next few quarters will provide insight into whether or not LUCK is worth the gamble.

Real Luck Group performance since going public

Another area that has shown some promise during the Covid-19 pandemic is health and wellness related entities. It is hard to tell what the future holds for this sector, but we took a look at one contender, Jamieson Wellness (TSE:JWEL). Time will tell if the 2020 pandemic will bring about lasting change in Canadian’s lives in regards to our perspectives on health and wellness.