Top Canadian Financial Stocks for Passive Income

**The article below is a transcribed version of our latest Youtube video. Click to see our video on 3 Top Canadian Dividend Paying Financial Stocks directly on Youtube!

What’s up everybody, welcome back to another Stocktrades.ca Youtube video.

Whether you’re new to buying stocks or you’ve been here before, this is a channel where we go over Canadian stocks and Canadian stocks only.

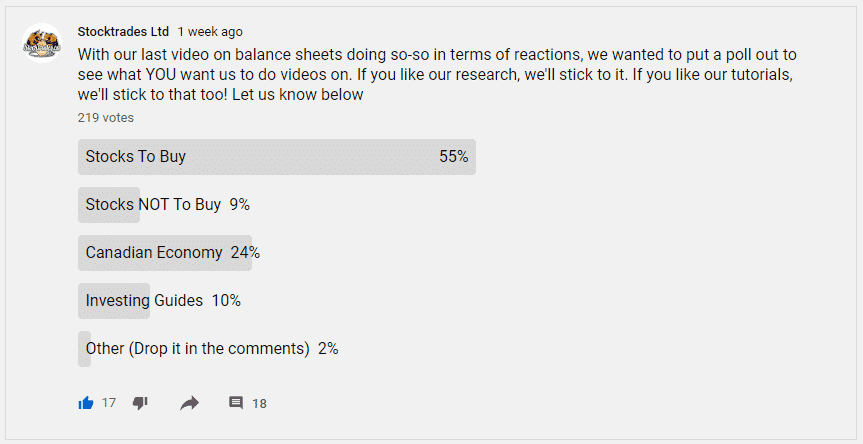

We also dive in to a little investment strategies and fundamental analysis, but with a recent poll we’ve taken you clearly just want to see Canadian stock research, so that is definitely what we’re going to bring you, and what we’re going to bring you this week.

So what are we going to be speaking on this week? Well, we’re going to be speaking on 3 top Canadian dividend stocks that are A) poised to grow and B) maintain their dividend through this unprecedented recession that we’re already in, and will probably continue to be in for some time now.

These stocks have a history of maintaining their dividends through other market crashes and recessions, and are also trading at some pretty low valuations. You’re not only going to see major Canadian banks in this video, you’re going to see some obviously, they are the best stocks in the country, but we’re going to be adding a mix of other financial companies as well.

With that being said, lets get started.

So the first stock we’re going to speak on and one that is still trading well below its 2020 highs due to a fear of the recession and inevitably a housing crash is Genworth MI. They trade under the ticker MIC on the TSX. In 2020 this stock is still down nearly 44%.

Genworth has an extremely easy business model. Essentially what they do is sell mortgage insurance to people looking to buy homes. One interesting thing about this is I actually recently sold a home a year ago and when we went to buy our new one, we had the 20% down.

If you have more than 20% you don’t need mortgage insurance, if you have less than 20% you need to get mortgage insurance through a company like Genworth.

So we planned to put 20% down, but the reality of it was it was better to put less than 20% down and pay the mortgage insurance, because the bank was willing to offer us a significantly lower interest rate if we had our mortgage backed by a company like Genworth.

So we ended up paying thousands of dollars in mortgage insurance, but in the end it’s going to save us interest on our mortgage. And the reality of it is the vast majority of Canadians will never have 20% to put down on a home.

Most homes will be backed by an insurance company like Genworth.

Genworth’s quarterly report

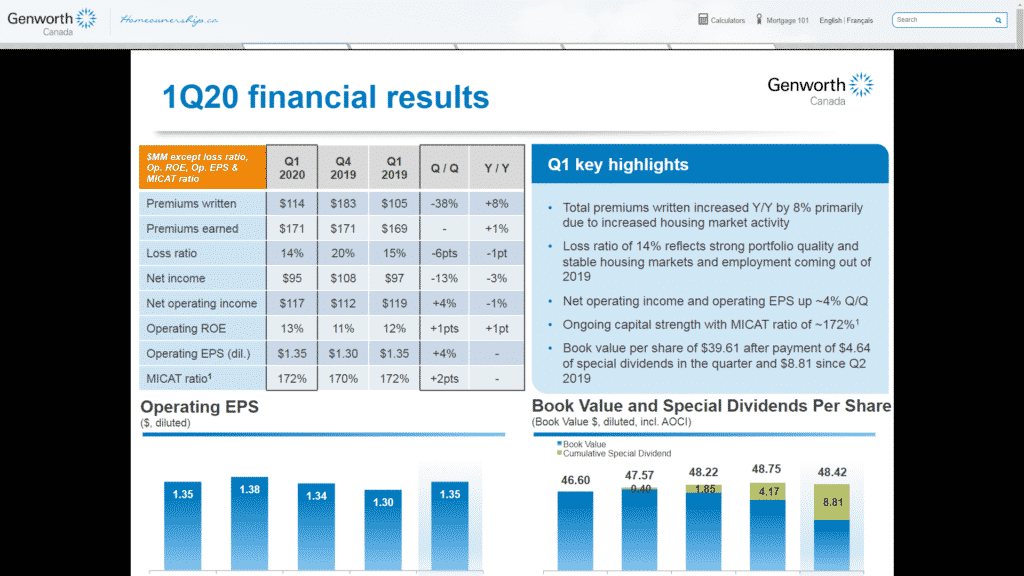

So if we look to Genworth’s first quarter 2020 report, everything pretty much points to the company being in extremely good financial shape. You can see that premiums written of $114 million dollars are actually up 8% YOY although it was a pretty drastic drop quarter over quarter, considering in Q4 2019 they had written about $183 million dollars in premiums.

But, the year over year growth is pretty strong. And if we see premiums earned, they’ve actually remained relatively steady. And if we look at the loss ratio, it’s actually decreased its loss ratio year over year by a percent, and quarter over quarter it’s actually by 6%.

So obviously the lower the loss ratio, the better quality the portfolio. These mortgages are getting paid more often. We’re seeing an increase in return on equity quarter over quarter and year over year, which is very good.

Quarter over quarter earnings per share are actually up 8%. The company states they have a book value of $39.61, and that’s after a special dividend of $4.64 and a $8.81 since the second quarter of 2019.

So if we look at the average cost of homes here in Canada, the price is actually going up fairly significantly. In June 2019, the average cost of a home in Canada was around $505,931. Fast forward to last month, June 2020, and we’re looking at a total home value of $538,831.

This is a 6.5% year over year change, and considering Genworth makes their money off the purchase price of the home, the more real estate prices go up, the better off they are.

So if we take this average home price and head over to Genworth’s calculator to see what your premium would be, a purchase price of $538,831 requires at minimum a down payment of $28883.

What I’m trying to drive home is the fact that on a $538,000 purchase, if a Canadian has only the minimum down payment, you will pay to Genworth a total of $20,398 in terms of insurance fees.

This is a significant premium, and as long as housing prices keep going up, Canadians will continue to struggle to find that money for a down payment. Which, although unfortunate for Canadians, will ultimately help to drive revenue for MIC.

Genworth’s Valuation

So before we get to the dividend, which is the most important thing about Genworth, lets have a look at their current valuation. The stock is currently trading at only 7.45 times earnings, 3.27 times sales, and 0.81 times book value.

We already discussed book value in the investor presentation I just showed, but in terms of overall valuation, they are trading at a 21% discount to its 5 year average price to sales, a 16% discount to its 5 year average trailing price to earnings, and a 10% discount to its 5 year average forward price to earnings.

So pretty much what I’m trying to say is Genworth, by all measures, is cheap.

So as of filming, Genworth pays around a 6.4% dividend yield. And a dividend yield like this for most investors is going to cause them to look twice. A company yielding this high, there has to be something wrong. Their payout ratio is too high you know, a dividend cut is looming, they don’t have enough money to pay the dividend.

But with a payout ratio in terms of earnings of only 40.22% and in terms of cash flows only 31%, this is a company that has lots of room left to grow.

And over the last 11 years, they have consistently grown the dividend. Now there are financial stocks in the sector that have faster growing dividends, Genworth has a 5 year dividend growth rate of around 7.5% annually. But, it is also one of the highest yielders and it has one of the lowest payout ratios in the sector.

Genworth provides a little bit of unique situation because we can expect the housing market to maintain strength moving forward in 2020, just because interest rates are low. But i still wouldn’t expect this stock to shoot back up to its $60 range pre-covid.

But, if low interest rates remain low going into the future, which they probably are going to, and housing sales maintain strength, Genworth should be able to maintain that dividend and investors with a long term philosophy and have very good chance of earning money in terms of share price as well.

Lets move on to our next stock ,which is a big bank, which is the Royal Bank of Canada.

Royal Bank trades under the ticker RY on the TSX, and the company is essentially the most globally diversified bank here in Canada.

If you look towards TD Bank, they’ll have the most exposure south of the border in the United States, but if in terms of globally, Royal Bank takes the cake.

Now that isn’t to say that it has a low exposure to the Canadian economy, in fact over 60% of its revenue still comes from here in Canada.

It’s just if you want global diversification, they are the bank you want to head to.

Now over the last 5 years, and this is including the price crash due to COVID-19, Royal Bank has returned around 39% to shareholders. This is just under 7% annually including dividends. And in terms of a blue chip bank stock, this is pretty good. Especially when we consider that the stock has taken a steep hit due to COVID-19. These numbers would be a lot higher if that hadn’t of happened.

RBC has the highest market share in the country when it comes to things like personal banking, business loans, mutual funds and overall deposits. They have a very dedicated customer base, a loyal customer base and there is a very good chance that if you talk to a Canadian that they bank at RBC.

Royal Bank earnings

So in terms of earnings, it doesn’t look pretty for Canadian banks. But it didn’t in the 08 financial crisis either, and all 5 big 5 banks were able to maintain their dividend and this is absolutely critical in today’s crisis to keep their share price afloat.

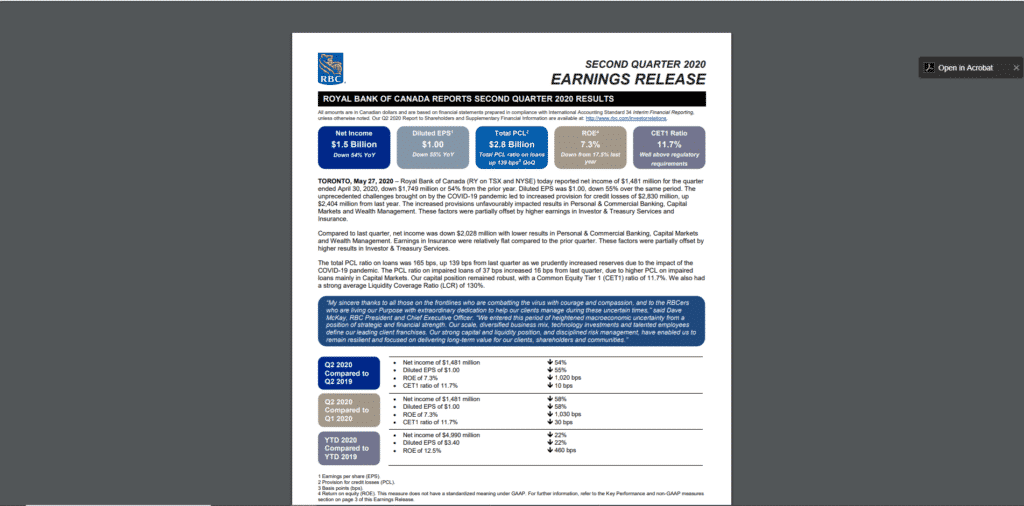

And the fact is, despite these numbers we’re going to look at, the banks remain well capitalized and should be able to maintain dividend payments. In terms of net income, the company saw a 54% year over year decrease, diluted earnings per share saw a 55% year over year decrease.

The total provisions for credit losses exceeded $2.8 billion dollars, and this is essentially money the company will put aside to cover bad loans that they think won’t get paid.

Return on equity saw a significant hit, down from 17.5% last year to sit at 7.3%. But its CET1 ratio of 11.7% remains well above regulatory requirements. And if you don’t know, the CET1 ratio essentially compares its capital against its current assets.

Now there is no questions that all financial stocks like insurance stocks, bank stocks, are going to struggle with interest rates this low. But generally if you’re looking for a company you want to look for an industry leader, and we believe RBC is best in class.

And a few of the reasons we think they’re going to outperform moving forward is simply the fact that it can drive volume more than any other Canadian bank, due to their sheer size. Like I stated before, they have a very loyal client base, they have the largest global exposure, and they are the biggest bank in the country here in Canada.

Another reason is the fact that the company has less capital allocated to, riskier sectors so to speak.

Royal Bank valuation

So with all that being said, if we look towards valuation ,you’ll see the points I just made are a prime reason why Royal Bank actually isn’t even trading that much off its pre-COVID valuations.

The company has a forward price to earnings of 10.92, which is essentially right in line with its 5 year averages. It has a price to sales of 3.16, which is a slight discount to its 5 year average and a price to book of 1.67 which hasn’t really budged that much.

The stock is actually only down around 9.41% year to date.

Now in terms of dividend, the company yields around 4.5% right now at the time of filming, and it has one of the higher payout ratios in the financial sector, primarily among the big 5 banks, that’s what we like to focus on in terms of payout ratios when comparing these banks of 54%. Now that is still a very safe payout ratio, and a healthy yield.

The company has raised dividends for 9 straight years, and the government has essentially stressed to Canadian banks to not raise their dividends, so we can expect that 9 year streak in which the company has raised dividends by around 7.5% on an annual basis to come to a stop.

But in current market conditions, when companies are slashing dividends at rates we’ve never seen before, most investors would be more than happy with a maintained dividend right now.

Our third stock, National Bank

So the third and final stock we’re going to talk about is one that often gets overlooked because it’s not technically a big 5 bank, National Bank. They trade under the ticker NA.TO.

So no, National Bank is not a big 5 bank, but if we look at this chart based on price growth over the last 10 years, it definitely posted big returns.

Over the past 10 years, a $10,000 investment in National Bank would have you sitting on around $21,190. Most all of the big 5 banks have somewhat of an established international presence. But with National Bank, that just isn’t the case.

In fact, less than 10% of National Bank’s overall revenue comes from its international streams.

For investors looking for a bank stock that they can invest in now and watch it grow over the next 10 years, National Bank is definitely one you want to keep an eye on. It’s already outperformed the big 5 banks in terms of capital appreciation in stock price over the last decade, and because of the fact it has more untapped potential, it might continue to grow faster than these banks moving forward.

And to add to that, it also does pay a dividend, and it actually yields around the same amount as most of the big 5 banks.

National Bank’s earnings

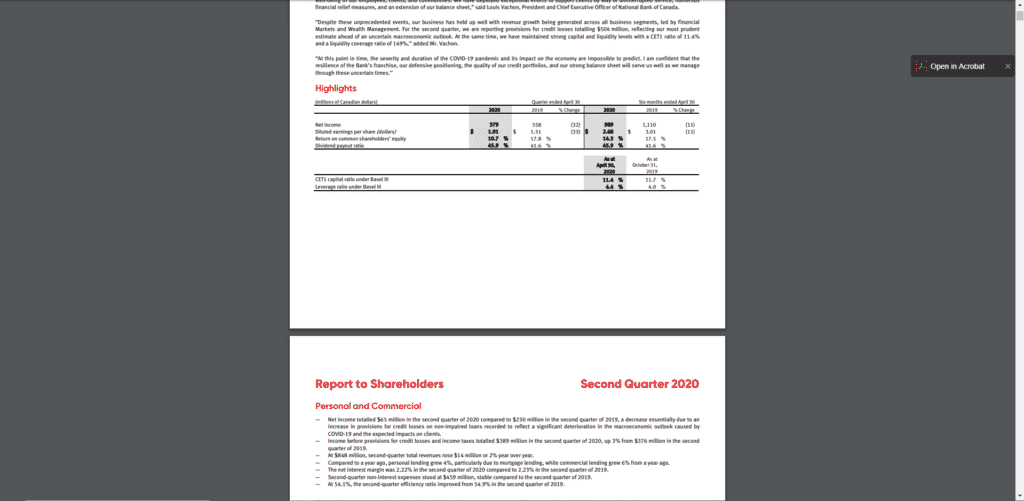

So much like Royal Bank, if we look at National Bank’s quarterly earnings, things do not look pretty right now. If we compare the second quarter in 2020 to the second quarter in 2019, net income is down around 32% and diluted earnings per share are down around 33%.

Now much like RBC again, the company attributes most of this fall in net income to provisions in credit losses, which like I said again, is money the company has to put away in case particular loans go unpaid. These loans can still be paid, and those provisions can eventually be added back into net income, but for right now banks are being extremely cautious with the amount of money that they’re setting aside for these provisions.

Right now a lot of these banks are desperately trying to help the government of Canada maintain the economy by deferring mortgages, deferring credit card interest, line of credit interest, deferring even stuff like standard bank fees.

And the fact that our banks are so well capitalized and are able to do this without say, suspending a dividend, should bode well for our economic recovery.

National Bank’s dividend

So out of the 6 major banks here in Canada over the last 10 years, National Bank has been the fastest growing bank, and we can probably expect them to be the fastest growing banks out of these 6 moving forward. But to add to that, the company actually has one of the fastest growing dividends as well out of these 6 banks.

With a yield of around 4.5% at the time of filming, and a payout ratio in the 46% range, National Bank has an excellent dividend. They’ve raised dividends by around 7.2% annually over the last 5 years, and their most recent increase of 9.2% was second in terms of dividend increases only to TD Bank.

Now although we won’t see dividend raises, or at least its very unlikely we see dividend raises from the big 6 banks here in Canada, it is very unlikely, although it’s never impossible, that the dividends will get cut.

National Bank overall is an excellent option

Overall, I really like National Bank. Excellent dividend, excellent capital growth. In fact, it’s outperformed the big 5 banks. But it does pose more risk than the big 5 banks, just due to the fact it is a smaller, centralized in eastern Canada.

Although it does have exposure to most all provinces, its primary generation of revenue will be from these two major provinces, and as such if they struggle the bank will struggle more than say a company like RBC which has global exposure.

But if you’re looking for strong growth and a strong growing dividend and you’re willing to take on a little bit more risk, National Bank is definitely the best bet in the country.

So everyone, that’s pretty much it for the video. We’ve never done a video on the top financial stocks. We’ve spoken on a lot of Canadian dividend videos about financial stocks, but we’ve never pinpointed our 3 favorites in the financial sector right now.

So again, make sure you click here to head to the video and comment!

Graham won the ability to get a custom report from us with hours of research inside and it took him 30 seconds to comment. So all you need to do, drop a comment, let us know what your favorite financial stocks are.

We’re talking alternative lenders, insurance stocks, bank stocks, whatever it may be. We want to hear from you and next week we’re going to highlight what company Graham wanted us to look at and announce a brand new winner.

Until next time.