Top Canadian Stocks To Buy

**The article below is simply a transcription from the video above. Check out our video on the Top Canadian Stocks To Buy In July on Youtube**

Hey everyone, welcome to another video by Stocktrades.

Today, we’re going to be looking at some top investment choices for Canadian investors to consider for the month of July.

Before we get into our top Canadian picks for the month of July, lets take a quick look at the state of the markets.

So far, so good. Ever since touching lows in mid-March, the TSX Index has rebounded quite nicely. In fact, it ended June up 1.83%.

This marks the third consecutive month that the TSX has posted positive gains. It’s off to another good start in July, and it seems that there is no stopping the markets. If you’ve just learned how to buy stocks and have gotten into the market, you’re loving life right now.

Unfortunately, we believe this is a little bit too optimistic. The reality is, the second quarter results are still yet to come, and we do believe that these will be much worse than last quarter. They will present the first brunt of the full effects of COVID-19 mitigation efforts.

We are also on the verge of recession, if we aren’t already there. The government of Canada expects that GDP will shrink by about 3.9% before rebounding by 3.4% in 2021. This means that we won’t yet return to 2019 levels until 2022.

That means a couple years of flat to negative growth. This isn’t anything to get excited about, and this isn’t anything that should be driving the markets to all time highs. With that ebing said, there are some clear winners. The gold sector being one of them.

Gold is nearing all time highs, and this is not surprising considering the amount of money the Fed is pumping into the market. This should help sustain the price of gold. As such, our first top Canadian stock is a gold miner.

Endeavour Mining (TSX:EDV)

Besides the price of gold, one of the reasons why we like Endeavor Mining (TSX:EDV) is because of its recent acquisition. On July 3rd the company closed on a deal to acquire Semafo (TSX:SMF).

Semafo is a leading African gold mining stock. The company was chronically undervalued. In fact, it often made an appearance on our top gold stock screener over at premium.

That is, before Endeavour swooped in and scooped up the company on the cheap. Now that it has integrated these assets, Endeavour is looking at forward productions of over 1 million ounces, with all in sustaining costs in the $850/oz range.

This is an excellent asset profile. The new mining entity is expected to be a top 15 gold producer worldwide.

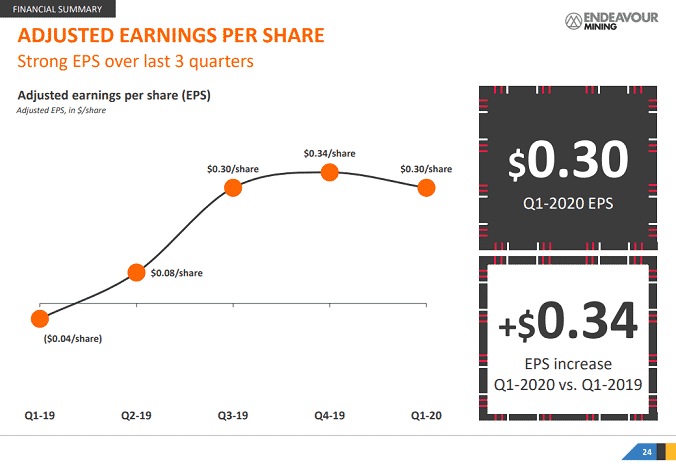

As of writing, the company is trading at 7 times forward earnings and it is trading at a 26% discount to 1 year analyst estimates. Likewise, it is trading at a PEG, price to earnings to growth ratio, of only 0.2. This makes it one of the cheapest stocks in the gold industry.

Endeavour is expected to grow earnings by approximately 50% annually and revenue by approximately 40% annually over the next couple of years. This makes for a very attractive growth stocks.

Likewise, analysts expect the company will introduce a dividend, it’s only a matter of time. The company is generating strong cash flows and is well positioned to be one of the top dividend stocks in the gold sector over the next year or so.

All things considered, the market is undervaluing Endeavour’s assets, much like it was Semafo’s assets. This is more than likely due to the fact it operates in Africa, so it has a higher risk profile.

However, it has a very strong asset base, and we believe that it is only a matter of time before the markets adjust and value the markets accordingly.

Capital Power Corp (TSX:CPX)

Capital Power Corp (TSX:CPX) is a mid-sized renewable energy utility company. The company has under performed the markets in 2020. It is down approximately 20% and is one of the few utilities that hasn’t outperformed the TSX Index.

So what gives?

Part of the problem is Capital Power has a high exposure to Alberta. Given the low price of oil and gas, there is negative sentiment towards utility companies in Alberta. See Canadian Utilities and Atco as perfect examples.

However, investors are discounting the fact that Capital Power has been aggressively diversifying outside of Alberta, and it has 80% of its earnings contracted. This is a company that is generating considerable cash flow and is one of the fastest growing utilities on the TSX Index.

One of the reasons we’re adding it today, as a top pick in July, is because the company is scheduled to release quarterly results at the end of July. It’s important because at this time is typically when the company announces its annual dividend increase.

As a Canadian Dividend Aristocrat, the company has a 6 year dividend growth streak. All things considered, over the past couple months there have been very few companies that have raised the dividend. In fact, cuts have outsized the amount of dividend raises. So all eyes will be on Capital Power when they release earnings on July 30th.

Will it raise the dividend? Well, it hasn’t indicated otherwise just yet. In fact, it is well positioned to maintain cash flow targets. This means that the company is likely to execute on its targeted 7% annual dividend growth, which is expected to extend to 2021.

If the company raises dividends, this may be a good catalyst to send its share price higher, and it has room to run. It is one of the most undervalued utility companies, trading at a 30% discount to analyst estimates.

It is only trading at 15 times earnings and 0.8 times book value, significantly under industry averages. Finally, it has a PEG ratio of only 0.8 and is expected to grow earnings by approximately 20% annually over the next coupe of years.

In our opinion, Capital Power is the perfect blend of value, income and growth.

BRP Inc (TSX:DOO)

Our last stock is BRP Inc (TSX:DOO). BRP is a leading manufacture and distributor of all terrain vehicles, watercraft and snowmobiles. You’ll know them under the brand name Sea-Doo, Ski-Doo and Can-Am. Pretty high profile names.

Unfortunately, COVID-19 economic mitigation efforts have essentially sapped up demand. At least that was the initial fear. And those fears did come true.

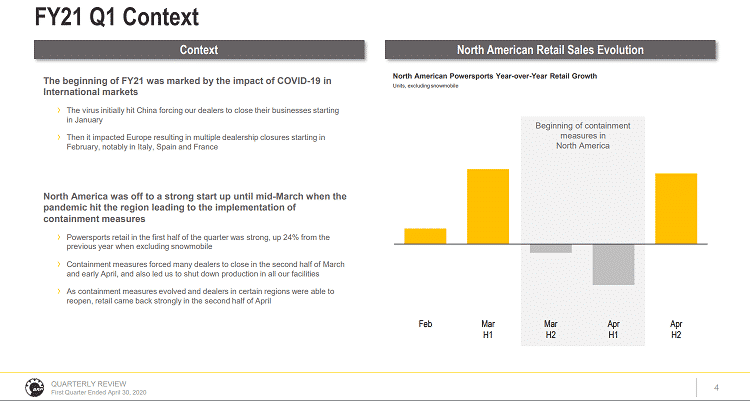

As per the companies presentation, you’ll see the demand dropped considerably in the second half of March and the first half of April. However, a funny thing happened.

In the second half of April, demand actually shot upwards. Year over year, it was up 20%.

Other information coming out of the U.S. indicates that personal and power sport vehicles are actually doing quite well during this pandemic. So why is that?

Likely, because families aren’t traveling, they’re staying home. And by staying home, they are spending money on things that they can do nearby, such as ATV’s, four wheeling, boating, those types of things.

In fact, personal anecdote here, my father went and bought a new fishing boat and in talking with the dealer they had mentioned they hadn’t been this busy in years. In fact, they had a hard time keeping up with demand. So, I think that people are under estimating just how much individuals are spending on personal power sport vehicles.

BRP is well positioned to rebound in a big way, so long as the economy continues to rebound and continues to track the way we’re currently tracking.

Likewise, the company suspended its dividend back in March. Once things were really bad, it suspended it completely. One catalyst that has the potential to send BRP’s share price higher is the reinstatement of the dividend.

Back in late March, BRP was one of the first Canadian stocks to suspend the dividend. They did so amidst all the uncertainty. It wasn’t clear what type of economic impact COVID-19 would have on sales and demand.

Now that we’re starting to get a good idea, lets see what happens over the next couple of months. I’m not suggesting that BRP will jump and reinstate tje dividend immediately, there still exists a considerable amount of uncertainty.

However, the way we’re trending, and the way the economic rebound is happening, so far it’s looking pretty good. If the economy continues to do well, there is a chance that BRP can reinstate its dividend by the end of the year.

Now, this may be a little optimistic, however all signs are pointing to a strong economic rebound.

Looking for some earlier picks by us during the pandemic? Check out this video for top picks in May of 2020!