Tax-Deferred and Highly Diversified. These ETFs are Worth a Look in Your RRSP

Key takeaways

RRSP Tax Benefits – U.S. dividends are tax-free inside an RRSP, making U.S. ETFs like VOO and SCHD attractive choices.

Diversification is Key – Holding a mix of Canadian, U.S., and bond ETFs helps balance risk and optimize returns.

Growth vs. Income – Investors should consider a blend of growth-focused ETFs (VOO, XEQT) and income-generating options (SCHD, ZAG) for a well-rounded portfolio.

One ETF I like way better than the ones on this list.In Canada, a popular retirement savings option is the Registered Retirement Savings Plan (RRSP), which offers tax benefits to encourage long-term savings.

Whether or not the RRSP is useful for you is highly dependent on your current financial situation. If you’re a high-income earner, you will generally benefit more from the RRSP than someone who is a low-income earner.

This is because you can contribute money at a higher nominal tax bracket in your working years and withdraw it at a lower one. It doesn’t provide much benefit if your nominal tax bracket is the same in retirement as when you’re working.

A lot of external factors can be at play here though when it comes to deciding whether the RRSP is even of value to you. For the purpose of this article, I’m going to assume you have come to the conclusion it is.

In this article, I’m going to dive into some of the top ETFs for your RRSP today.

Make sure to check the bottom of this article as we go over some very important considerations from a tax perspective when it comes to US exposure inside of an RRSP.

Let’s get started.

What are the best ETFs to hold inside an RRSP?

Low-cost access to U.S. market leaders

Vanguard S&P 500 ETF (VOO)

VOO tracks the S&P 500, giving investors exposure to the 500 largest U.S. companies. With a low expense ratio (0.03%), this ETF is a top choice for passive investors seeking long-term growth.

Broad Canadian market exposure

iShares S&P/TSX 60 Index ETF (TSE:XIU)

XIU tracks the S&P/TSX 60, providing exposure to Canada’s largest companies across finance, energy, and materials. It is one of the most liquid and established Canadian ETFs.

All-in-one global equity exposure

iShares Core Equity ETF Portfolio (TSE:XEQT)

XEQT is a one-ticket ETF that holds 100% equities across Canadian, U.S., international, and emerging markets. It is designed for long-term growth and simplicity.

High-quality U.S. dividend stocks

Schwab U.S. Dividend Equity ETF (SCHD)

SCHD tracks a selection of U.S. companies with strong dividend histories. It focuses on stability, quality, and cash flow growth, making it ideal for income investors.

Core fixed-income holding for stability

BMO Aggregate Bond Index ETF (TSE:ZAG)

ZAG provides exposure to a broad mix of Canadian government and corporate bonds. It is ideal for reducing portfolio risk and generating steady income.

Why ETFs in your RRSP?

Exchange-traded funds (ETFs) have become a favoured option within RRSPs due to their cost efficiency and diversity.

With an ETF, you can invest in a basket of assets, such as stocks or bonds, which can help spread out risk while providing the potential for steady growth.

The landscape of ETFs in Canada is vast, with options ranging across various sectors and asset classes. The investment vehicle has simply exploded in popularity over the years.

When considering ETFs for your RRSP, the management expense ratio (MER) is important, as it can impact your returns over time.

Canadian ETFs typically offer lower MERs compared to mutual funds, making them the preferred choice among DIY investors.

Because there are so many ETFs these days, you must consider funds that align with your investment goals, whether you’re looking for global equity exposure, Canadian stocks, or even U.S.-specific holdings.

Understanding the RRSP and its benefits

Registered Retirement Savings Plans (RRSPs) are an essential part of retirement planning in Canada.

This government-sanctioned program allows you to save for your retirement in a tax-efficient way, mitigating your taxable income during your highest-earning years.

Benefits of RRSP:

- Tax Deferral: Your contributions are tax-deductible, meaning they reduce your taxable income for the year in which they are made. This deferral can create significant tax savings. If it isn’t optimal from a tax perspective, you can always carry contribute room and even contributions forward to future tax years.

- Tax-Sheltered Growth: Investments in your RRSP grow tax-free until withdrawal, allowing your portfolio to benefit from compound growth without the drag of taxation.

- Diverse Investment Options: You can include a variety of investment vehicles, such as ETFs, bonds, stocks, and GICs, within your RRSP.

- Flexibility for Withdrawal: While RRSPs are intended for long-term savings, you can access your funds through programs like the Home Buyers’ Plan (HBP) or the Lifelong Learning Plan (LLP), albeit under certain conditions.

Remember, the objective of an RRSP is to build a substantial nest egg for your retirement. Utilizing an RRSP helps to ensure that you have a reliable source of income when you do hang up the proverbial skates.

Why hold US stocks and ETFs in an RRSP

Investing in US stocks and ETFs within your Registered Retirement Savings Plan (RRSP) can be a tax-efficient strategy for long-term growth.

One of the primary advantages is the favourable treatment of dividends. Normally, US dividends are subject to a withholding tax for non-residents.

However, under the Canada-US tax treaty, holding these investments in your RRSP exempts you from this tax. By holding your US stocks and ETFs within an RRSP, you avoid the 15% foreign withholding tax that would apply to dividends outside of this retirement account.

When you invest in US-listed ETFs (more on this in a bit) through your RRSP, you’re investing in a diversified portfolio that may include hundreds or thousands of stocks.

You should consider a mix of investments, and US stocks and ETFs might be a strategic component of your diversified, long-term retirement portfolio.

A withholding tax catch you may not know about with an RRSP

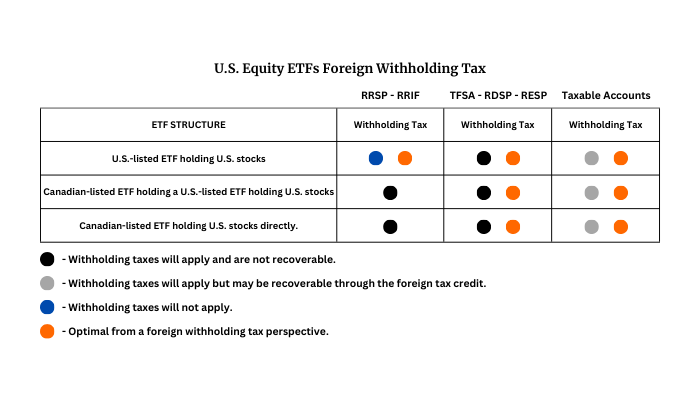

Many Canadian investors hear that if they hold US stocks or ETFs inside an RRSP, they can avoid a 15% withholding tax on the dividends. For the most part, this is true. However, you may be purchasing funds with the intention of avoiding the withholding tax, but in reality, you’re paying it anyway.

That is because if you own a Canadian-domiciled ETF that contains US-domiciled stocks or ETFs, you will still pay a withholding tax inside an RRSP. In addition, unlike a non-registered account, where you would be able to recover the tax via the foreign tax credit, with registered accounts like an RRSP or Tax-Free Savings Account, you lose the tax and cannot recover it.

The most obvious example I am bringing up is whether to hold the Vanguard S&P 500 Index ETF in Canadian or US dollars. Those holding VFV, the Canadian version, will pay a withholding tax on the distribution even if held in an RRSP. On the other hand, those who hold VOO, the US version, will not.

Considering VFV simply holds VOO, many investors are likely confused by this. But when you think about it, it makes sense. VFV is a Canadian-domiciled fund which holds a US-domiciled ETF, VOO. Technically, the fund owns the underlying ETF, and the fund won’t be eligible to have the tax waived.

For this reason, putting all other considerations aside and only focusing on the withholding tax situation, you are better off holding US-domiciled ETFS inside your RRSP than a Canadian version.

I’ll attach an image below that should help clear the air on this situation a bit more.