Turn $10k Into $220k With a Tfsa Growth Investing Strategy

**The article below is a transcription of the video above. View the original video on Youtube about a growth investing strategy and Canada’s best small cap stocks here

When it comes to buying stocks, the most popular method of investing and possibly the most stable is either an income or dividend growth strategy.

My favorite strategy? Using both a blend of dividend investing and pure-growth investing.

My names Dan from Stocktrades.ca, and in this video I’m going to show you how I took $10,000 and am well on my way to turning it into over $220,000 via growth investing. I’m also going to go over some small cap stocks here in Canada, all with market caps of less than $1 billion that you can look at today to try and achieve outsized gains moving forward in 2020.

So before we get started with the stocks, I’d like to answer the most burning question.

How did I, with a pure growth play strategy inside my TFSA, take $10,000 and am well on my way to turning it into $220,000?

Well, it all started in 2017. Prior to 2017 my portfolio was exclusively dividend and dividend growth companies. I was gaining a really strong interest in growth plays, and I decided to sell off around 40% of my holdings and invest them in Canadian growth stocks.

My first purchase was Canopy Growth (TSX:WEED) in late 2017. I bought the stock for around $11, and within a year it had increased to around $67. I sold for $62, and ended up with total cash of around $28,200.

From there, I took that $28,200 and invested it into strong, blue-chip dividend paying companies. And if I can get an 8% annual return over the next 20 years, which is completely feasible, I’ll have turned that $5000 into nearly $132,000.

Second stock would be my purchase of Shopify (TSX:SHOP) in 2018 for around $160. In just a little over a year, I decided to sell the stock for around $610 per share, and yes, I know that looks like a mistake right now as the stock nears $1300, but I still did end up taking that $5000 and turning it into $19,000 today.

Again, I’ve reinvested that money into dividend paying companies, and with an 8% annual return I can expect that to be around $88,800 in the next 20 years.

If both of these investments can achieve that type of return, which I fully expect with the companies I have it invested in, I’ll turn that $10,000 into $220,000 over the next 20 years.

A significant outperformance, all tax-free inside of a TFSA

If I were to have taken that $10,000 originally and invested it into my dividend portfolio, with the same 8% return, it would be around $46,000. This is an outperformance of $173,000 over that time frame. And it just shows you how picking the right growth stocks can put your overall portfolio years ahead.

So there’s a right way to deploy a growth strategy and a wrong way to deploy a growth strategy.

The wrong way?

Head to a Facebook group or Reddit thread and purchase the first stock that’s being pumped on there without doing any sort of fundamental research. More often than not, people on these groups have a vested interested in the stock they’re promoting. They are either being paid to promote that stock, or they own that stock and are benefiting significantly from others buying that stock.

The only way you will succeed with a growth investing strategy is to be able to fundamentally analyze these companies yourself. The amount of times I’ve seen people promoting stocks that don’t have a balance sheet to even survive the year is very concerning for new investors using these groups to learn.

The right way to go about a growth investing strategy inside of your TFSA

You need to learn how to fundamentally analyze these companies, both on an individual basis and on an industry level.

You want to find industries that are growing, and you want to find companies within those industries that can provide better than expected earnings and revenue growth. In the end, if they can do this on a consistent basis you, the investor, will be rewarded with higher than average share price appreciation.

Or, if you don’t feel like analyzing these companies, you want someone else to do it for you, there’s always Stocktrades Premium. Since the start of 2019 we have significantly outperformed the TSX, we’ve posted returns of around 21.5% while the TSX has posted returns of around 0.62%.

Anyways, with all that being said, lets get into our small cap stocks here in Canada

So the first small cap stock I’m going to speak on, and one that actually provides excellent dividend growth as well.

Keep in mind, this is prior to COVID, I’m not sure about moving forward, remains to be seen. But that is Goeasy Limited (TSX:GSY), one of the most popular alternative lenders here in Canada.

A $10,000 investment in Goeasy when it IPOed in 1996 would be worth around $118,000 today. This is a compound annual growth rate of 10.85% over that 24 year timeframe.

And this isn’t even including dividends, this is simply stock appreciation.

A lot of Canadians don’t like investing in these companies, they view them as predatory because they do offer higher than average loans to investors who can’t get loans from a bank. But if you can get past this, you’re buying into a company that has seen some insane levels of growth since the early 2000’s.

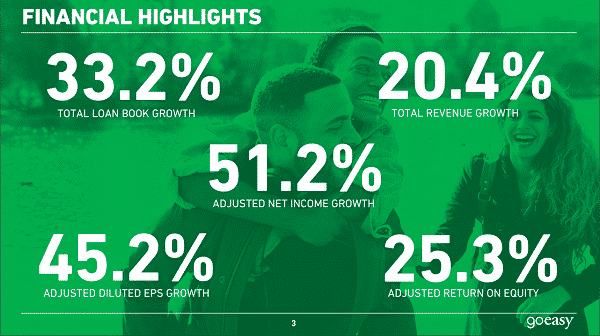

The company has a compound annual growth rate on diluted earnings since 2001 of over 30%, and they also have a CAGR on revenue of around 13.1% over that same time frame.

**Images courtesy of GSY’s investor relations**

To be able to growth earnings by that amount over a 20+ year time span is truly amazing, and that is why this company has been able to grow both its dividend and its share price at a rapid pace.

The company has reported positive net income for 75 straight quarters, and has same store sales growth in over 40 straight quarters. In its most recent quarterly report, Goeasy reported a loan portfolio of $1.17 billion.

The company also reported record revenue of $167 million, which is 20% higher year over year.

Now there are a ton of investors who are simply looking away from this stock. It’s a financial stock, an alternative lender, people are unemployed and they’re not going to be able to pay their loans.

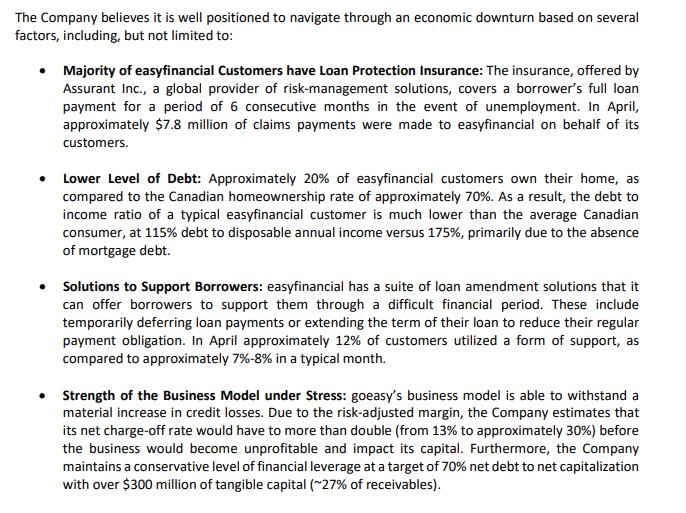

It essentially put all these things to rest. The company stated the vast majority of easyfinancial customers have loan insurance.

This means their loan will be protected by the insurance company by up to 6 months in the event of unemployment. So Goeasy is still receiving these funds from the insurance company.

As more and more people get back to work, it’s more likely that these loans will continue to be paid.

Another misconception is Goeasy’s customers actually have high debt levels. This just isn’t the case. In fact, only 20% of easyfinancial customers own their homes, which puts a Goeasy customer at a significantly lower debt to income level than someone who has a mortgage.

In terms of liquidity, the company has around $214 million and have stated this can help them fund growth to the end of 2021.

Overall, this is a pretty strong opportunity for Canadian investors to at least have a look at the alternative lending industry and take advantage of Goeasy’s excellent capital appreciation and dividend growth.

Heroux Devtek (TSX:HRX)

This is a stock that doesn’t pay a dividend at all, truly a pure-growth play, Heroux Devtek (TSX:HRX).

The company is an airline company, but not typically in the way you would think of an airline company.

They manufacture landing gear for aircrafts. Now, this pandemic has hit Heroux Devtek extremely hard. The stock is still trading around 47% off 2020 highs, and it is significantly under performing the overall markets due to the fact it is in the airline industry.

Valuation wise, the company is actually pretty cheap. It trades on a forward price to earnings basis of around 15.12, price to sales of 0.6 and has a 5 year PEG ratio of 0.94.

So why exactly are we highlighting an airline company?

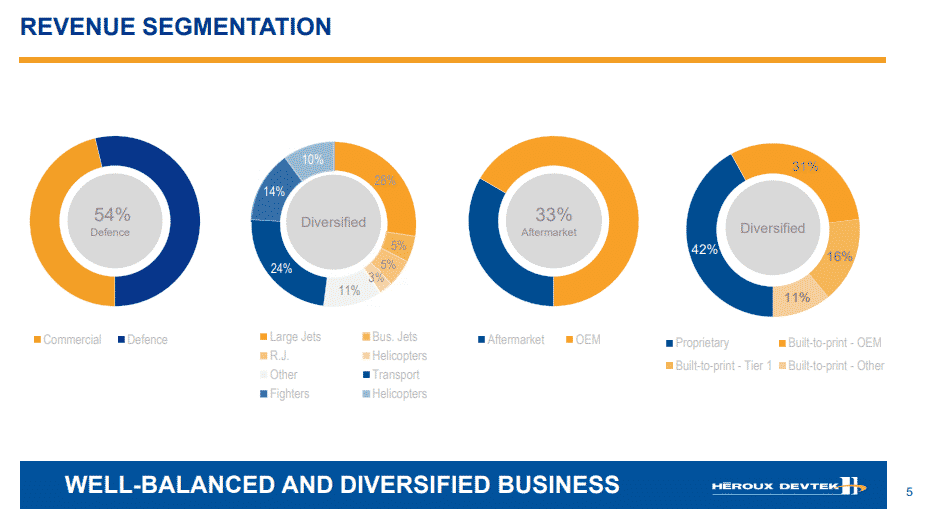

Especially one that makes landing gear for aircrafts. As aircrafts sit idle, production for new aircrafts has also dramatically lowered, and there is no doubt Heroux Devtek’s revenue will be effected by this pandemic, but the majority of its revenue don’t actually come from the commercial airline sector.

The company gets 54% of its revenue from military defense spending. In particular, a military that loves to spend money (expected to spend over $700 billion this year) the United States military.

**Images courtesy of Heroux Devteks investor relations page**

This is a very promising sector moving forward, and year over year the company actually increased its defense sales by 33%. It has a funded backlog of over $830 million moving forward, 2/3 of that being defense spending.

Typically defense spending doesn’t suffer based on economic conditions. Governments will want to spend money on military regardless.

As such, we can expect Heroux Devtek’s revenue to hold up better than say a pure-play commercial airline like Air Canada (TSX:AC).

Financial Position

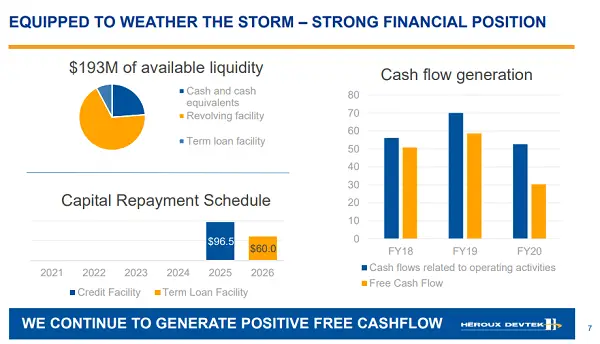

Heroux Devtek is in a much better financial position than say Air Canada. The company has stated they have around $193 million in available liquidity. The major difference being the company has not been forced to draw down an extensive amount of that.

All of the company’s facilities have continued to run with minimal disruptions, and none of their facilities have had a single virus transmission, and the company’s book orders have actually doubled over the last two years.

Overall, we can expect a rocky road for this company moving forward. But the fact remains its stock price has fallen nearly 50% when defense spending, which is expected to remain relatively untouched moving forward, makes up over half the company’s revenues, and is actually a more profitable area than commercial spending.

If you’re looking for a play in the airline industry, avoid the mainstream stocks that everyone is talking about, the Air Canadas, Delta, United Airlines etc and instead look at companies like Heroux Devtek who focus on military spending and are in a strong financial position to survive this crisis.

As always, head over to Youtube and like the video and subscribe to the channel!