Two Deeply Discounted Canadian Stocks to Look at Today

Generally, chasing Canadian stocks that are trading near lows is not a strategy I would deploy.

There are a lot of people learning how to buy stocks who get caught up in the “buy low, sell high” mentality and end up buying poor companies trading at lows not because the market is ignoring them, but because the new valuation is certainly justified.

But, even in this all time high environment, there could be short term opportunities to pounce on struggling companies. In this article I’m going to do my best to highlight two of them for you.

Bank of Nova Scotia (TSX:BNS)

Let me start off by saying that the Bank of Nova Scotia (TSE:BNS) is the cheapest Big 5 bank here in Canada for a reason, and that is underperformance – more on this in a second.

The Bank of Nova Scotia is the third largest bank here in Canada with a market cap just shy of $100B. The company has five key operating segments including Canadian banking, international banking, wealth management, global banking, and capital markets.

The company has heavy exposure to Central and South America, which have unfortunately been the driving factor to the banks underperformance over the last half decade. It’s international expansion was once thought of as a wise growth decision, but it has proven to be extremely difficult. The pandemic certainly hasn’t helped this.

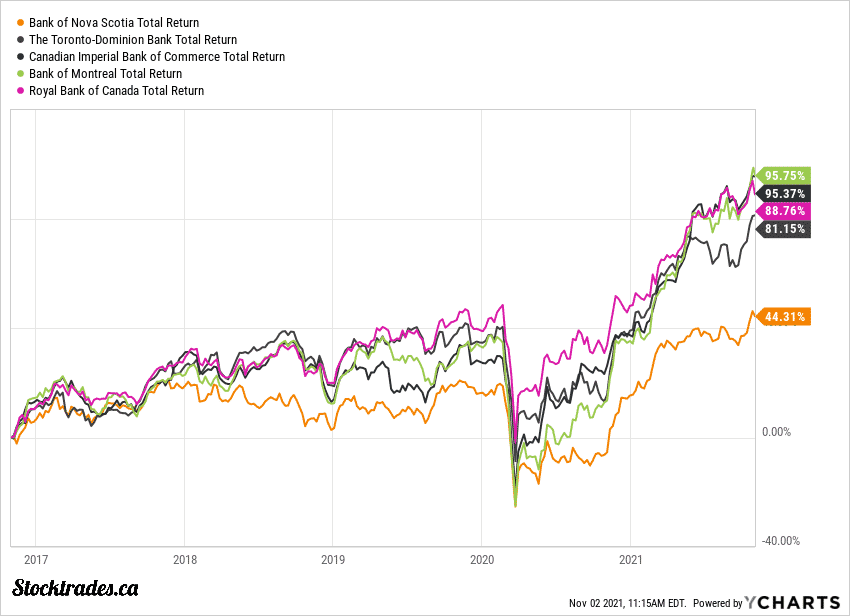

Over the last half decade, the bank has been a laggard in terms of returns, and by a significant margin. In fact, it’s underperformed its closest peer, Toronto Dominion Bank, by nearly 40% over those 5 years. You can see this in the chart above.

However, if we approach this from a glass half full perspective, there’s some positives here.

Yes, the bank’s international struggles have made it the worst performer among Big 5 banks, but these challenges have also made it the cheapest.

Trading at only 9.6 times forward earnings, the Bank of Nova Scotia is the cheapest Canadian bank you can buy today. The title of highest yielding Canadian bank was often held by Canadian Imperial Bank of Commerce, but that is no longer the case. Scotiabank now offers the most attractive yield for investors, sitting in the mid 4% range.

The company also has a PEG ratio of only 0.41, suggesting that the market is not pricing in much of Bank of Nova Scotia’s forward growth. Considering it has failed to meet expectations for some time now, this is not surprising.

As a contrarian play, if this company turns things around we can expect it to likely be the best performing Canadian bank moving forward and provide the best bang for your buck. The alternative is that the bank continues to underperform and drives lower returns for investors compared to other options.

Nutrien (TSX:NTR)

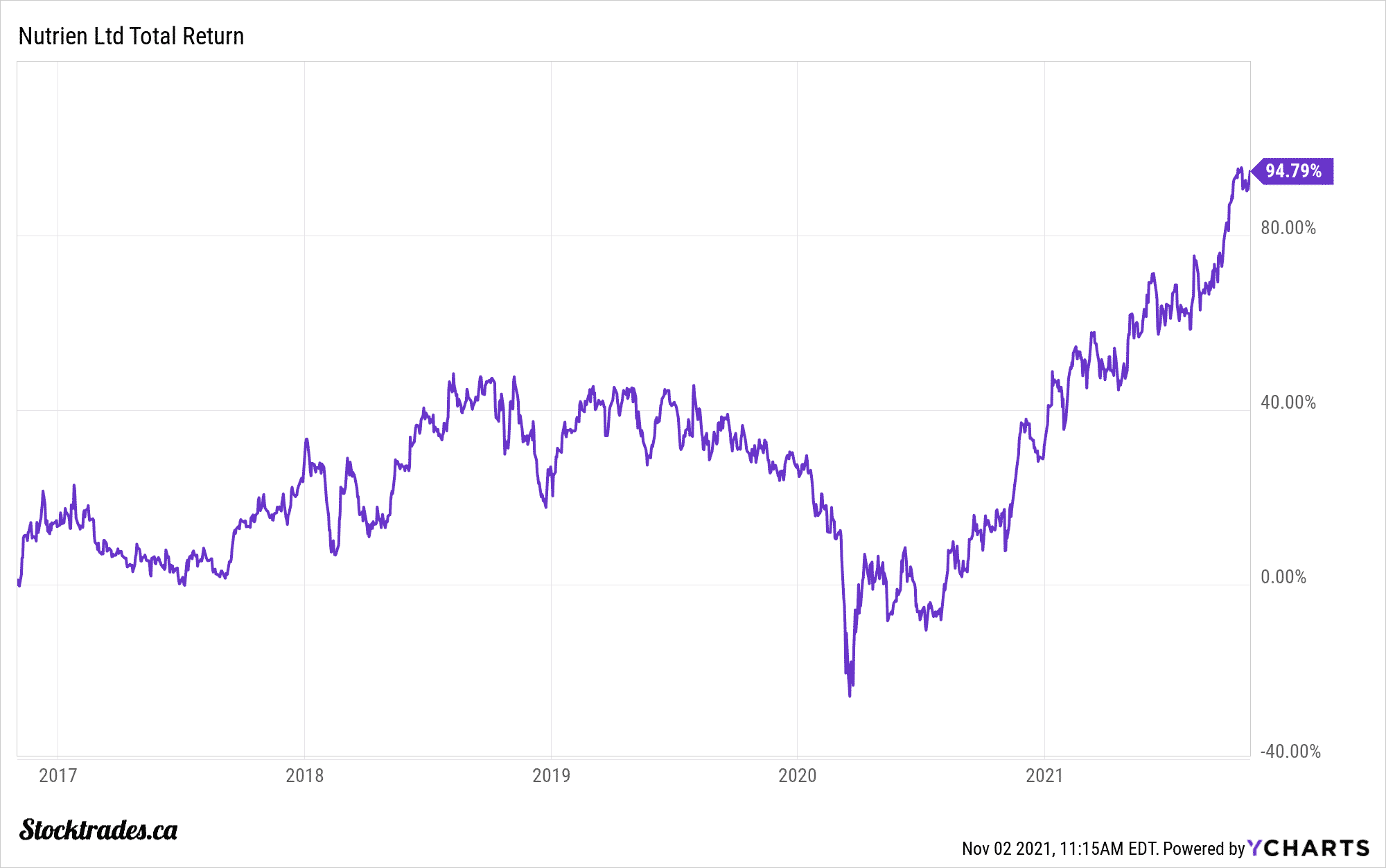

For those who think I’m crazy by mentioning Nutrien (TSE:NTR) as a value play, you’ve likely got your screener set up in the wrong fashion. That’s because although Nutrien is trading at 43 times trailing earnings (significantly above historical averages), when we look on a forward basis this price to earnings ratio shrinks to 11.5.

Why is this?

COVID-19 wreaked havoc across the entire globe. It impacted a significant amount of companies, Nutrien included. In fact, the company saw net income dip by over 50%, and EBITDA drop by nearly $1B.

However, the company is exiting the pandemic in an environment that it should thrive in. Nutrien is a producer of three key crop nutrients, those being potash, nitrogen, and phosphate. The company has a dominating presence in the global potash market, with a roughly 20% market share.

And if you’ve been paying any sort of attention to the commodity markets as of late, you’ll know they’ve been on a torrent rise, potash included. In July of 2021, potash hit its highest price in the last 8 years at $501 per ton. Prices have settled a bit, but they still remain at levels that should cause Nutrien to generate a significant amount of cash flow.

This is exactly what is leading to a significantly reduced valuation on a forward basis. Nutrien recently raised guidance in which it expects to generate anywhere from $5.85-6.10 per share. In 2022, earnings are expected to eclipse $7.53 before dropping down to $5.46 in 2023.

Through the first 9 months of 2021, the company has generated record adjusted EBITDA and free cash flow, and expects commodity tailwinds to spill into next year.

Being a cyclical play, Nutrien is a stock that needs to be purchased, held, and sold at timely intervals. It’s extremely hard to time the commodity cycles, but it is needed to make considerable money from cyclical options. We’ve witnessed this in the Canadian oil and gas market for some time, as companies have gone on decade long droughts with little shareholder returns.

But, if you’re interested in a short term hold to reap the benefits of rising prices in the agriculture sector, Nutrien is certainly one that looks cheap today.

Next, learn more about Telus (TSX:T) and the move into multiple verticals.