Two Inflation-Proof Top Canadian Stocks to Watch Today

The consumer price index in Canada reached a record high in August, and those looking to buy Canadian stocks are now looking for options that will be able to survive a high, and potentially even rapid inflation environment.

In general, during an inflationary environment you want companies that generate cash, not burn through it. High growth companies, ones that are in their infancy and often have negative cash flow and sinking profits will struggle through an inflationary environment while those that generate significant amounts of cash and return some to shareholders via a dividend tend to thrive.

In this article, we’re going to have a look at two top Canadian stocks that could be utilized as potential inflation plays.

Canadian Natural Resources (TSE:CNQ)

Canadian Natural Resources (TSE:CNQ) is the largest oil and gas producer in the country, with a market capitalization in excess of $53B. Suncor (TSE:SU) previously had this title, but as operational efficiencies and a dividend cut took its toll, Canadian Natural has emerged as the largest in the country.

Canadian Natural Resources produces light, medium, heavy, and synthetic oil along with bitumen, NGLs, and natural gas. In 2020 production numbers topped 1.1 million barrels of oil per day and it holds nearly 12 billion barrels of proven and probable crude oil and natural gas reserves.

The company is one of the lowest cost producers in the country, and did the unthinkable by raising the dividend in the midst of the COVID-19 pandemic while many junior producers, and Suncor Energy, were cutting dividends.

The company is often referred to as a “cash flow hog” and the title does suit it well. Free cash flows in 2018 nearly eclipsed $4B and despite the Covid-19 pandemic, the company generated over $2.2B in free cash flow in 2020.

An added bonus of this oil and gas giant during an inflationary environment? Canadian Natural depends heavily on the price of oil. During periods of high inflation, commodities tend to do quite well.

From a valuation standpoint, Canadian Natural is trading significantly below its historical averages. And with it trading at only 9.9 times trailing cash flows and 13 times earnings, the stock is cheap. Not to mention, although cash flows were still positive last year they were severely impacted. So, on a forward P/FCF basis Canadian Natural gets even cheaper.

The difficulty with oil and gas stocks is often having to time the tops and bottoms of the commodities cycle to exit with profits. It’s been documented over the last 15-20 years that a buy and hold mentality among oil producers, especially the major ones in Canadian, has not done well.

But if there was a single company that you could arguably buy and hold, Canadian Natural would probably be it.

Fortis (TSE:FTS)

Somewhat of a controversial pick, Fortis (TSE:FTS) would seem like a stock that could struggle in periods of high inflation.

Why?

For those of you learning how to buy stocks, utilities are often CAPEX heavy companies and they need to take on debt to fund expansion. As a result, they will thrive in low interest rate environments but struggle in rising ones as the cost to borrow increases and eats away at their bottom lines.

What does the government tend to do in a rising inflation environment? They raise interest rates. Which in theory should hurt Fortis. However, historically it hasn’t impacted the company at all. Utility stocks tend to drop during periods of high inflation. But, Fortis continues to provide long standing reliable returns for Canadians.

Fortis is a regulated utility. Meaning it owns all of the assets utilized to bring electricity to your house, from the poles to the meter box to the means of generation. What this means is that the company is not as susceptible to competition, and its economic moat is about as wide as it gets.

The company will discuss an appropriate rate with municipalities that is not only fair for customers, but guarantees a profit for Fortis.

As a result, cash flow is consistent, and will likely be in the future. This makes earnings predictable, and volatility low. In fact, Fortis has a beta of 0.05, suggesting it is significantly less volatile than the overall markets.

In fact, many state that Fortis acts more like a bond than a stock. I tend to agree. From a valuation standpoint, it’s trading at 19.46 times forward earnings, which is right in line with historical averages. This is a company that is never really expensive, nor cheap. It tends to trade at a particular range and stick within that range.

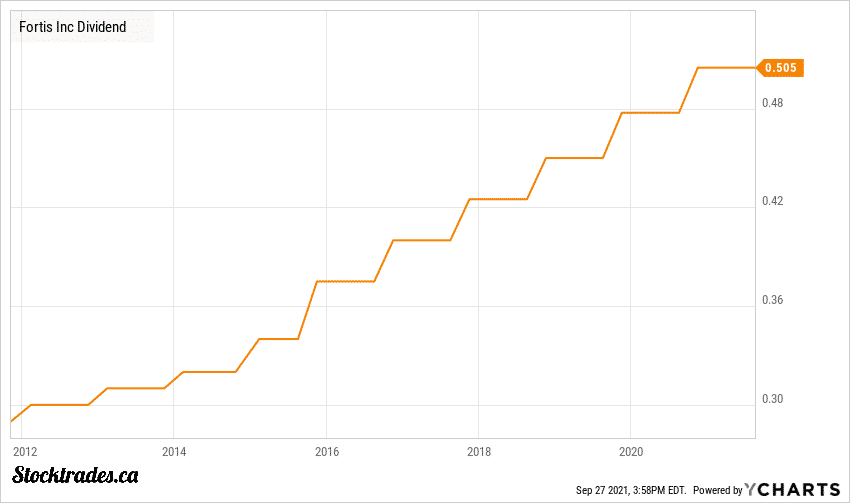

With a dividend growth streak that spans 47 years and a yield north of 4%, it provides some significant passive income for those who are patient enough to buy and hold.

Next lets look at some waves made by a short seller against Lightspeed Commerce (TSE:LSPD).