Two Top Canadian High Yielding Dividend Options Today

If you’ve followed us here at Stocktrades for any amount of time, you’ll know that we tend to shy away from using dividend yield as an indication of a strong investment. Typically, Canadian dividend stocks that have high yields should set off alarm bells, not investment opportunities.

However, this is not always the case. There are plenty of high yielding Canadian dividend stocks that provide outstanding opportunities in the market today. In this article, we’re going to discuss a couple.

Enbridge (TSX:ENB)

If you’ve been buying stocks for any reasonable amount of time, you’ll likely know of Enbridge (TSE:ENB). In fact, if you’re a passionate income investor, you might even own it.

But, there are many misconceptions about Enbridge that cause beginner investors to avoid the company. In this piece I might turn some Enbridge bears into bulls. First lets look at what Enbridge does.

Enbridge is a midstream (pipeline) oil and gas company in North America. The company has a significant economic moat, being responsible for shipping over 20% of the natural gas consumed in the United States and shipping over 25% of North America’s crude oil.

The company’s cash flows are extremely reliable. A simple highlight of this is that the company has grown cash flow in numerous operating environments including the COVID-19 pandemic, the forest fires in Fort McMurray, and the 2014 commodity collapse.

Most companies find it difficult to increase the dividend by double digits on an annual basis. Enbridge has managed a double digit compound annual growth rate on the dividend for over two and a half decades. The company can do this because of its significant economic moat and its long term take-or-pay structured contracts, where the company gets paid regardless of product shipped.

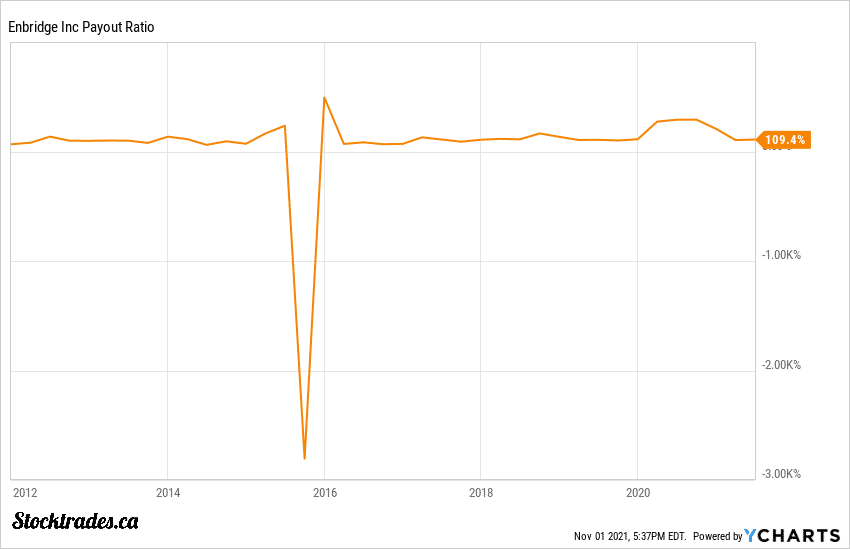

So, why do many avoid Enbridge and its high yield? Some people simply look at the company’s payout ratios and see the dividend is more than the company’s earnings, which can often be a red flag. However, this has been the case for decades with Enbridge, highlighted by the chart below.

So how can it afford to not only pay the dividend, but raise it for 26 years? It’s because the pipeline business can be complicated, so much so that earnings and free cash flow payout ratios are effectively useless due to excessive maintenance CAPEX, among other costly items.

Instead, we want to look at a company’s distributable cash flow, which is located in Enbridge’s quarterly filings. And if we look to this metric, Enbridge’s dividend is not only well covered, it’s well within the company’s comfortable range. It expects $5 in DCF on the high end, and pays a $3.30 yield, leading to a payout ratio of 66%.

With a yield of 6.44%, Enbridge is definitely a dividend investors can take advantage of for strong income.

Automotive Properties REIT (TSX:APR.UN)

I know real estate investment trusts (REITs) pay a distribution and not a dividend, but if our end goal here is income, especially in a tax sheltered account such as the best dividend stocks in a TFSA, it shouldn’t make much of a difference. And, Automotive Properties REIT (TSE:APR.UN) is a high yielding option that many Canadians should have an eye on today. The best part? This REIT comes with a little bit of growth built in as well.

Automotive Properties business model is relatively simple. They purchase car dealerships and lease them back to operators. The one benefit of this model is the fact they can lock customers in to long term contracts with ease. Why?

If you’ve ever had to move to a different home, you can understand the pain and annoyance of the process. Now imagine you have to move a car dealership from one location to the next. It’s not easy, and operators know this. So, they commit long term and are unlikely to pack up and move shop after a few poor months, primarily because of the hassle.

The company also has a “first dibs” advantage at new dealerships. This is because the Dilawri Group, which is one of Canada’s largest automotive dealership groups, gives Automotive Properties first dibs at any dealerships that it does sell.

In terms of the distribution, the REIT is paying only 69% of funds from operations (FFO) towards it. Typically I’m more than comfortable investing in a REIT with distribution payout ratios south of 80%. So, for it to be only 69% is exceptional.

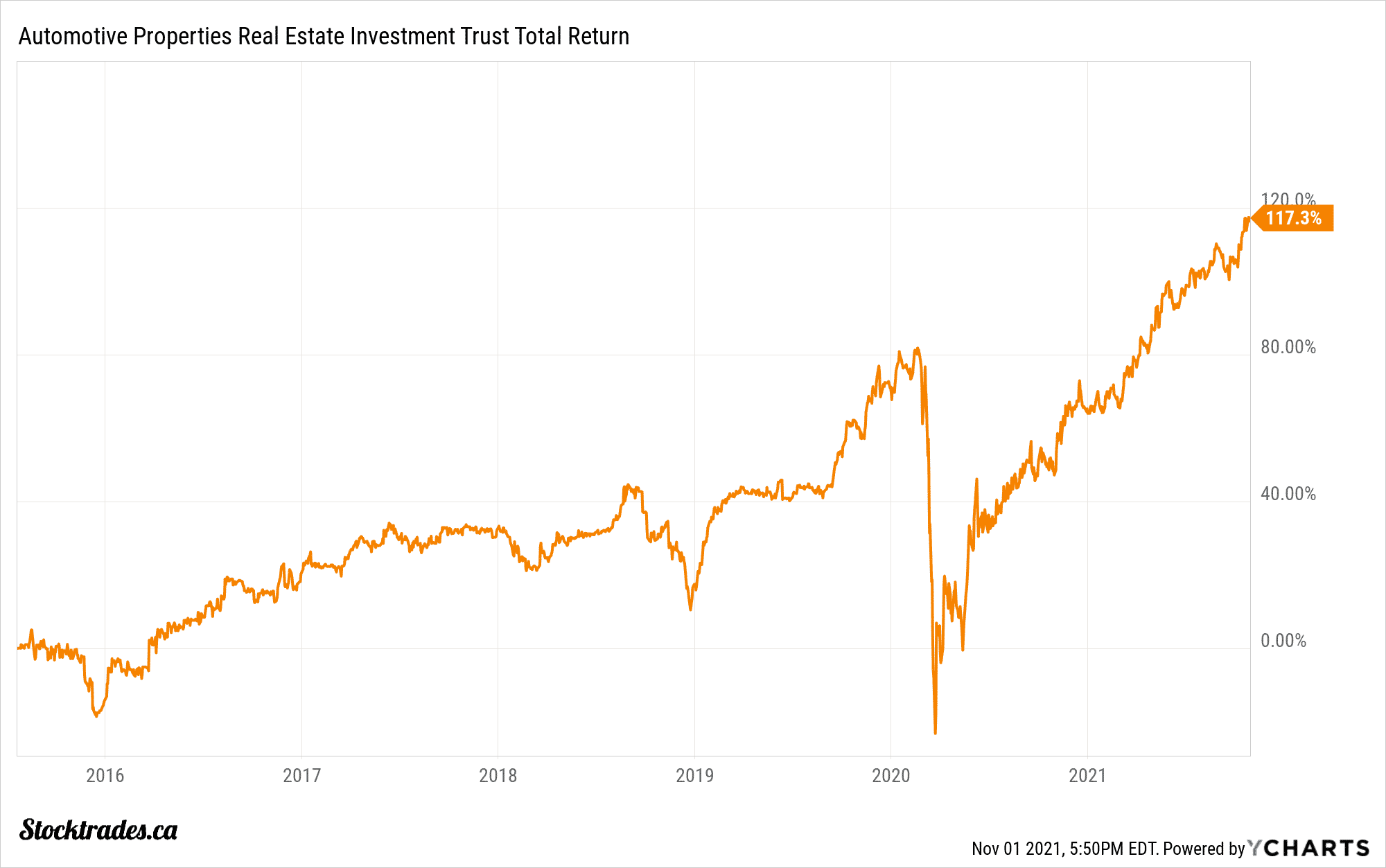

And to add to this, Automotive Properties at the time of writing pays a 6% yield, nearly as much as Enbridge.

The company has been consistently improving its balance sheet over the last year or two, and at the time of writing is also trading at a discount to its net asset value. Distribution growth is relatively sporadic with this one, but with a high starting yield it’s not necessarily a deal breaker.

In fact, with the current growth it has been achieving, I don’t even mind the company limiting distribution growth to drive capital growth. A 6% yield plus capital appreciation is certainly the right formula for long term outperformance, which this company has done.