Two Top Canadian Stocks to Watch After This Major Index Change

When major indices announces changes, the markets pay attention. Those just learning how to buy stocks should take note too, its important to keep up with these changes.

In Canada, one of the most well known is the S&P/TSX Composite Index and it is largely considered a bellwether for the Toronto Stock Exchange (TSX).

The Composite Index is comprised of 200+ companies which make up 70% of total market capitalization on the TSX. Rebalancing occurs quarterly and investors would do well to pay attention. Why? Because when changes are made to the index, funds that track the index are then required to rebalance accordingly.

This means that stocks added will likely benefit from increased buying which could lead to short-term upside. The opposite is also true, those removed could suffer from increased selling and short-term weakness.

There is also a certain legitimacy that comes with being included in the S&P/TSX Composite Index as these stocks are largely considered among the best in Canada.

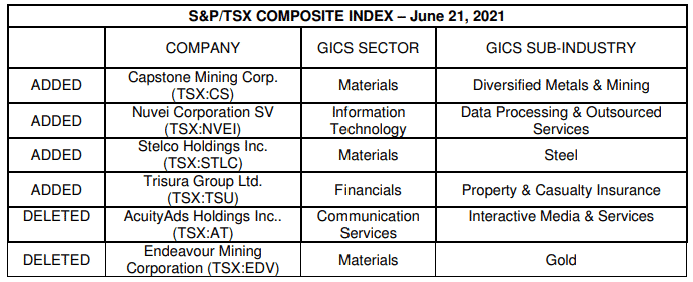

On June 11, the S&P Dow Jones announced changes to the Composite Index:

With respect to the above changes, there are two stocks in which I’d like to highlight – Nuvei (TSX:NVEI), and Acquity Ads Holdings (TSX:AT).

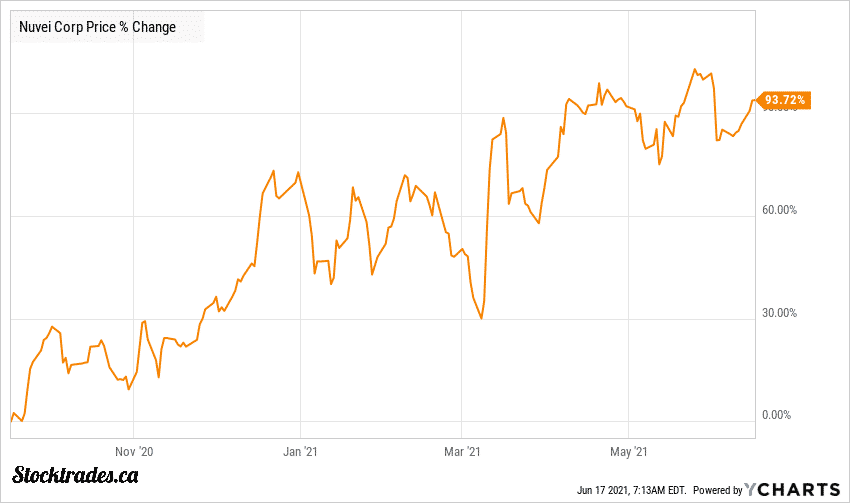

Let’s start with leading payment process Nuvei. This is a recent IPO that only began trading on the TSX Index in September 2020. At the time of the IPO, we noted to Premium members that the listed price looked attractive, especially when compared to peers such as Lightspeed POS (TSX:LSPD).

Not surprisingly, the company has performed quite well and continues to shine. Up by nearly 93% thus far, Nuvei is showing no signs of slowing down.

Nuvei (TSE:NVEI) is unique when it comes to other high-flying SaaS companies

Unlike most of its high-flying SaaS and payment processing peers, NVEI is profitable and is off to a strong start to Fiscal 2021. In the first quarter, NVEI posted adjusted earnings of $0.35 per share and revenue of $149.9M. This represented year-over-year growth of 218%, and 80% respectively.

Thanks to its strong start, the company raised guidance as it now expects to reach $630M in revenue at the mid-range, up from $585M previously. What sets Nuvei apart from many of its peers, is the fact that it is already a leading sports betting payment provider. It has licenses across many states, and is well positioned to benefit from this rapidly growing industry.

Now that it has been added to the S&P/TSX Composite Index, it adds another layer of credibility to the stock.

Now, let’s turn our attention to Acuity Ads (TSE:AT)

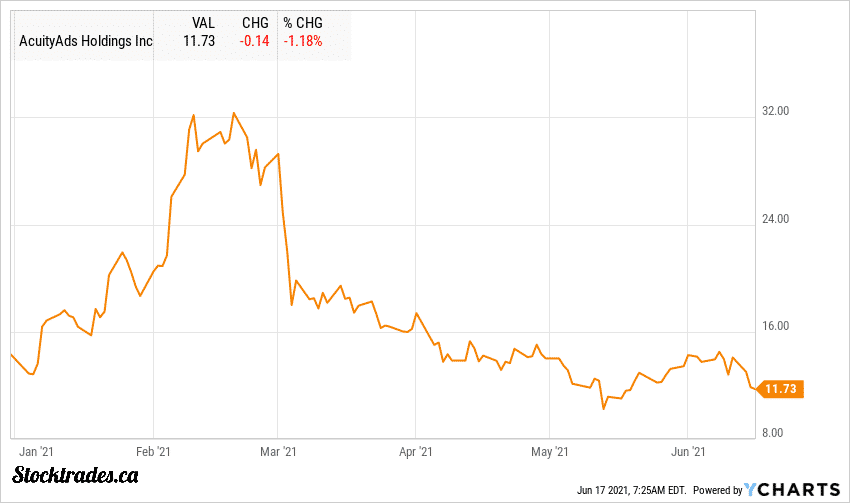

Since the removal announcement, Acuity has lost around 16% of its value. It is the continuation of a downward trend that started in late February 2021 when high growth stocks began taking a significant hit.

Since hitting all-time highs, the company has lost ~64% of its value and investors are left wondering if its best days are behind it.

Acuity Ads is one we brought to investors attention when it was trading in the $4 range and we like it quite a bit. The company has an excellent platform and the comparisons to the Trade Desk (NASDAQ:TTD) are warranted. Of note the Trade Desk has also taken a hit in recent months.

However, we also warned investors that the stock got way ahead of itself over that short period of time. Momentum investors drove up the price significantly and once the market soured on growth, the stock tanked.

The removal from the S&P/TSX Composite Index is yet another headwind for the company’s stock price

While this all may seem like bad news, there is a silver lining. The price action on the company’s stock had nothing to do with the company’s execution.

Acuity is performing quite well, and the recent launch of its Iridium platform is expected to lead to higher growth rates. After growing revenue by 13% and turning a profit in Q1, the company guided to 50% revenue growth in Q2 thanks to the strong performance of its new flagship platform.

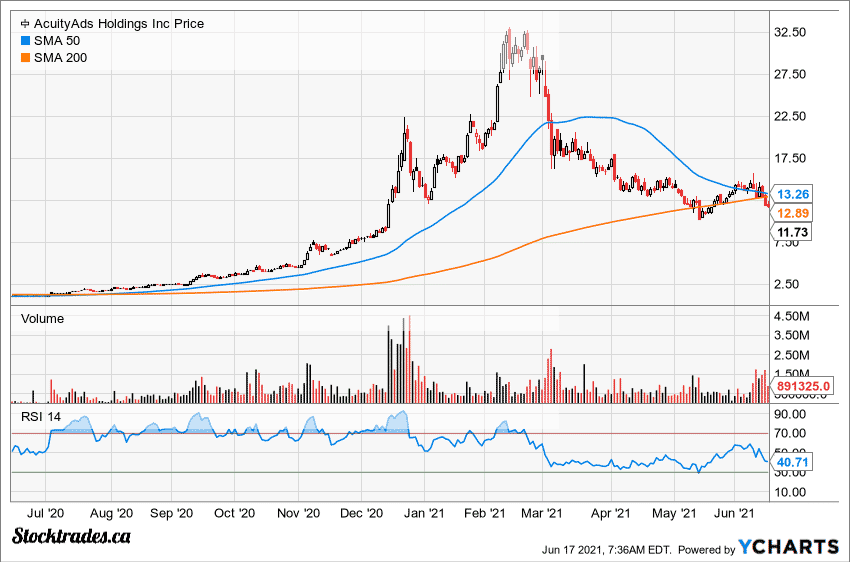

While the company is trading at more respectable valuations, there is the potential for a negative technical event – the “death cross”. The 50 day SMA is close to crossing below the 200 day SMA, which can be a bearish indicator.

If that happens and the price drops further, it’s likely that the company will be close to entering oversold territory, at which point it might make for a pretty attractive entry point. Worth keeping an eye on over the next week or so.

Curious about how the Canadian casino stocks are handling the pandemic and re-opening? Should you consider these 2 casino stocks today?