Us Stocks Overvalued? How to Identify Strong Canadian Dividend Payers

2024 was again a strong year for U.S. stocks.

The S&P 500’s return over the last few years is nearly 50%. However, many are questioning how much further the US stock rally can go amid numerous growing uncertainties.

In contrast, the Canadian markets are looking a lot more attractive on a valuation basis. When you think about it, this makes sense. Our economy is weaker and Trump tariffs could certainly have an impact on the earnings potential of numerous Canadian companies.

However, with a brand new allotment of TFSA room for 2025, many are on the hunt for Canadian dividend stocks.

So the question to ask is which Canadian dividend stocks are set to stand out? And how can you track them?

Will US Stocks continue to shine next year?

Trump’s tariff threat

President-elect Donald Trump announced plans to implement significant changes to U.S. trade policy, including increasing tariffs on Canadian and Mexican exports to 15% on the low end. Additionally, he also proposed imposing higher tariffs on China.

This move set the stage for a shift in global trade dynamics, particularly with countries like China, Canada, and Mexico. The policy created uncertainties for both the U.S. and Canada.

In the U.S., concerns are rising that the tariffs could reignite inflation, while in Canada, the higher tariffs could negatively impact the country’s GDP. As self-directed investors, it is definitely a tricky situation to navigate.

Pivot on interest rate policies

With higher tariffs, inflation may resurge in the US next year, leading to worries about continued rate cuts. Recently, Fed Chairmain Jerome Powell affirmed that he still sees inflation as being “on a sustainable path to 2%,” which would allow the US central bank to adjust monetary policy “over time to a more neutral setting” without intending to slow the economy.

Following these remarks, traders now expect fewer rate cuts in 2025, and the markets are taking a bit of a step back.

With an uncertain economic outlook and reduced liquidity due to the fewer rate cuts, there are growing concerns about whether US stocks can continue to rise amidst higher valuations.

With this uncertainty, could Canada’s big stocks provide a safe haven?

Dividend-paying stocks with strong balance sheets and attractive yields can offer investors a steady source of income while providing a cushion against market downturns. Canadian dividend stocks, particularly bank stocks, are a favorite among Canadian investors.

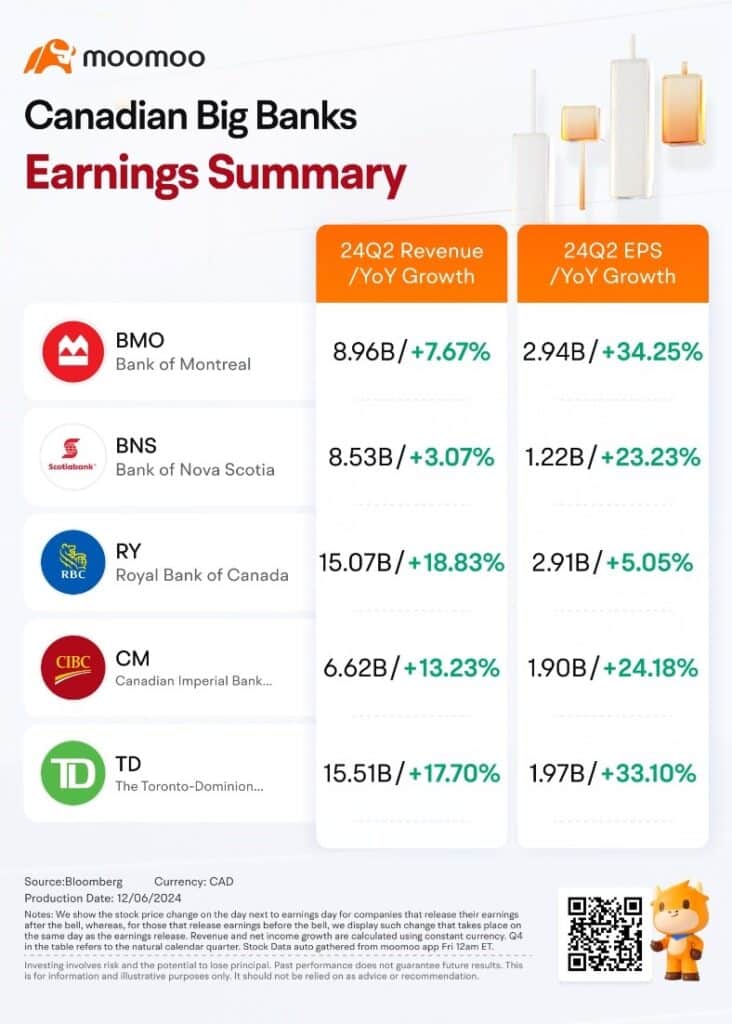

Canada’s banks recently wrapped up their earnings reports for Q4, with several of them seeing quarterly revenue and earnings reach new highs. Royal Bank of Canada and Canadian Imperial Bank of Commerce have had some outstanding quarters over the last year.

Robust credit activity has continued to boost corporate interest income. The quarterly reports show that five Canadian banks’ net interest margin increased year over year.

At the same time, active capital markets have led to continued growth in their wealth management arms. RBC’s wealth management business generated $969 million, a significant increase from $272 million last year. This makes perfect sense with the overall trajectory of the markets.

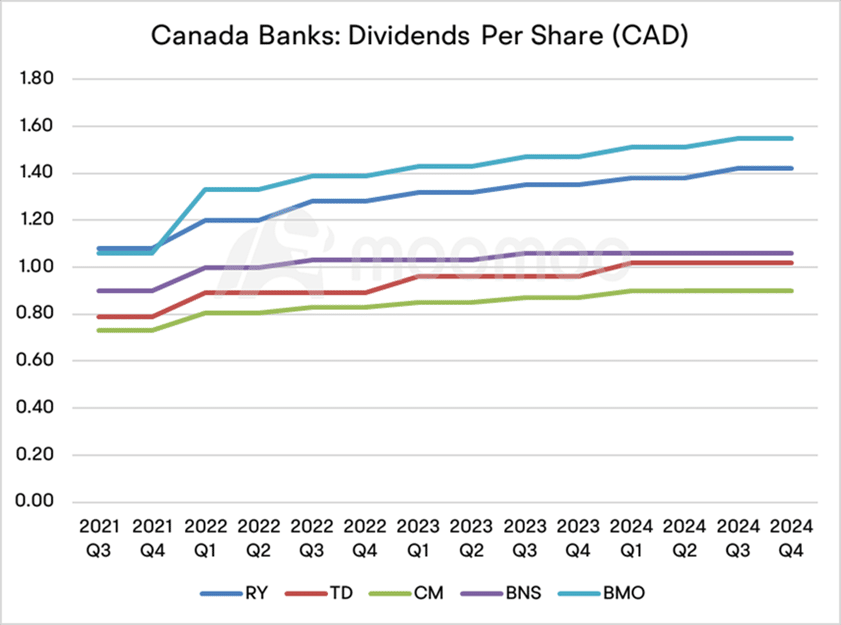

Canadian banks continue to raise dividends for shareholders, with only Scotiabank’s dividend remaining the same as last year. Scotia has struggled in recent times, but 2024 showed a year of recovery, and it’s possible we could see it return to dividend growth in 2025.

Canadian banks continue to increase dividends and provide strong shareholder returns

Compared to Q1 2022, RY and BMO have the fastest dividend growth rates at 18% and 17%, respectively. TD and CM saw their dividends increase by 15% and 12%, respectively, while BNS only grew by 6%.

Data: moomoo Canada

Easy ways to track dividend stocks using Moomoo

I’ve been playing around with some screeners and tools from a newer brokerage to the scene here in Canada, Moomoo. It seems like the brokerage is certainly targeting the functionality and user experience area of major brokerages here in Canada, which is something a lot of the major players lack.

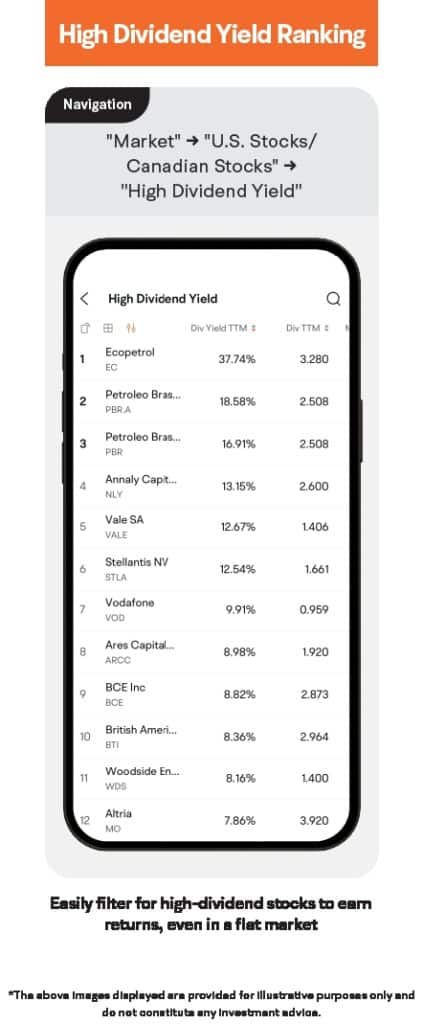

Looking at TD and BNS, their dividend yield (Trailing 12 months) exceeds 5%, while BCE offers the highest dividend yield, according to data from Moomoo Canada. The best part about this is I was able to filter for these selections with just a few clicks of a button, and on a mobile device.

If you want to know the latest dividend yields and payout ratios, the Moomoo Canada app can assist you. The app features a “High Dividend Rankings” function, which provides a list of the top 100 Canadian dividend stocks.

The rankings include dividend yield, payout ratio, 5-year average yield, stock price growth, and more. Through the ranking chart, you can easily identify stocks that offer both high yields but secure dividends.

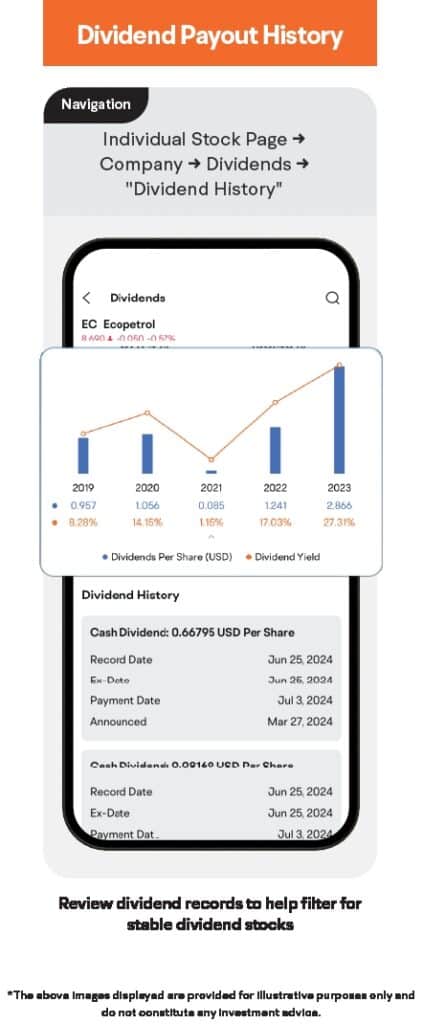

The Dividend Payout History

By clicking on each stock, the app also displays the dividend history, showing detailed information on dividends per share and yield. Additionally, it provides the next dividend date and the expected cash dividend payout.

I must admit, the interface impresses me. It is one of the best mobile apps I’ve utilized, and I’ve been with numerous brokerages over the years.

Investment Themes

Additionally, the moomoo app offers an Investment Themes feature, which highlights various investment topics and themes, such as dividend stocks and rate cut beneficiaries. It is a way to get a shortlist of stocks based on your criteria faster than you would with a normal screener.

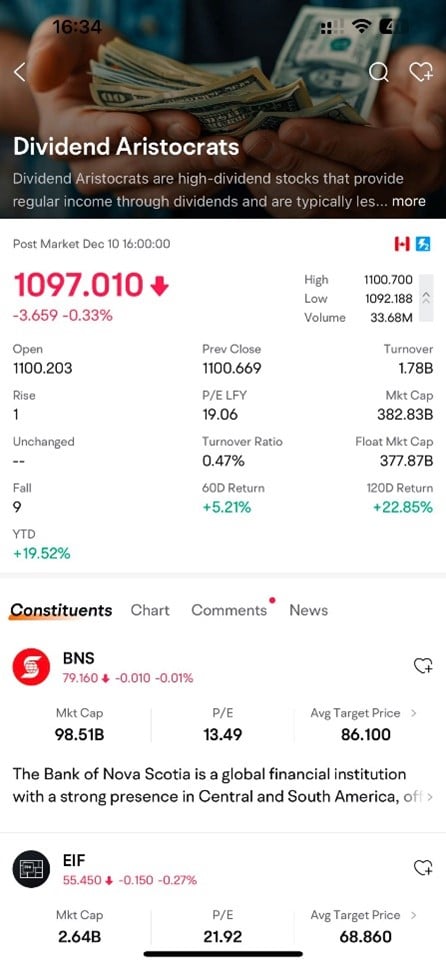

One notable theme is the Dividend Aristocrats, which refers to the S&P/TSX Canadian Dividend Aristocrats Index.

These are dividend stocks that have provided consistent dividend growth for 5+ years. In general, they have exhibited lower volatility, making them a defensive option during market uncertainty.

Typically, these are well-established companies with strong cash flows and earnings, and they may outperform more speculative stocks during market downturns.

Canadian dividend-paying stocks not only offer attractive yields but also provide investors with a cushion against market downturns because of their reliability. Major Canadian banks are often considered some of the best investment options in the country, and have weather numerous economic conditions.

If there is one thing for certain, it’s that I was finding opportunities to add to my watchlist way faster with Moomoo than I was with my current brokerage, Questrade. Moomoo Canada offers a range of features that allow you to track dividend stocks quickly and comprehensively.

And the best part? The brokerage is currently running some of the most attractive promotions in the business when it comes to maximizing the deposits in your TFSA or RRSP, upwards of $2300. I’ll drop an image below highlighting the current offer.

Signing up is easy, and you’ll unlock their full suite of features

Opening an account with moomoo is simple. I finished mine in just a few minutes.

Step 1

Sign up to join Moomoo Canada here.

Step 2

Fill in some information to complete your registration. Don’t worry, your information is secure. Moomoo Canada is fully regulated in Canada and is a member of CIRO and CIPF. Your information and your money are safe with them.

Step 3

Read the agreements and disclosures. Sign the document and hit submit.

Step 4

Wait for your account to be approved. This process can take as little as one day, but it may take up to three days.