VBAL vs VGRO – Comparing the Vanguard Balanced ETFs

For investors looking to set and forget their investments, picking individual stocks might not be a road you want to go down. Although you can beat the market and realize outsized gains with an individual stock strategy, many simply do not have the time to be successful in the endeavor.

This is because not only do you need to figure out how to identify strong companies, but you then need to apply the research and actually buy those companies. This can take a serious bite out of your free time.

So, what do we do about this? We can look to Canadian ETFs, or exchange-traded funds. And in this article we’re going to compare two popular Vanguard ETFs here in Canada, that being VBAL vs VGRO. Vanguard is one of the most popular ETF companies in North America, and these two are no exception, with billions of dollars in assets under management.

Also, if you’re looking for other great ETF comparisons, we have VGRO vs XGRO and VEQT vs VGRO.

VBAL vs VGRO quick comparison table

| VBAL | VGRO | |

|---|---|---|

| AUM: | $2.21B | $3.3B |

| Annual Fee: | $2.40 per $1000 | $2.40 per $1000 |

| Allocation | 60% Equities/40% Fixed Income | 80% Equities/20% Fixed Income |

| Total Holdings: | Over 30,000 | Over 30,000 |

| Top Holding: | Apple | Apple |

| Dividend Yield: | 1.98% | 1.85% |

| 1 Year Returns: | 6.86% | 10.79% |

| Returns Since Inception: | 33.91% | 41.84% |

| Max Drawdown: | 21.19% (2020) | 25.36% |

VBAL vs VGRO – let’s take a look at the Vanguard Balanced ETF Portfolio VBAL first

Vanguard’s Balanced ETF Portfolio (VBAL) started trading in January of 2018. So, this is a relatively new ETF for Canadians to purchase if they’re looking for one-click diversity. With over $2.2B in assets under management, it is certainly a large fund, with plenty of liquidity.

The fund’s main goal is to provide investors with a long-term diversified portfolio consisting of both equity and fixed income. The portfolio contains 60% equity and 40% fixed income. This allocation may differ depending on the returns of each moving forward, but the portfolio goes through routine rebalancing to maintain this allocation long term.

If we dig a little deeper into the fund’s holdings, it contains just over 13,400 stocks with a median market cap of $107B. Many more companies than smaller more industry targeted ETFs such as the iShares TSX Capped Information Technology Index ETF (TSE:XIT).

Some of the largest holdings within VBAL include the likes of Apple, Microsoft, and Amazon. However, this ETF does contain some excellent Canadian companies as well, including Shopify, Royal Bank, TD Bank, Enbridge, and Canadian National Railway. It is diverse, with the top holding Apple making up only 1.27% of the fund.

On the fixed-income front, the fund contains over 16,000 fixed-income investments. The top holdings are primarily Canadian government and provincial bonds, but it does contain some international fixed income as well. The vast majority are short-term bonds, being anywhere from 1-10 years in length and over 90% of the fixed income is rated A or better.

In terms of equity exposure, the fund has about 20% of its assets in the technology sector. However, financials are not far behind at 19.2% and the third largest allocation would be the consumer discretionary sector at 12.8%. The majority of the fund is situated in the United States and Canada, with 43.7% and 29.7% allocations respectively. However, it does have mid single-digit exposure to countries like Japan and the United Kingdom.

The fund yields around 1.74% at the time of writing and pays its distribution out quarterly. The management expense ratio (MER) comes in at 0.24%, which is not surprising considering the maintained 60/40 exposure it aims to achieve.

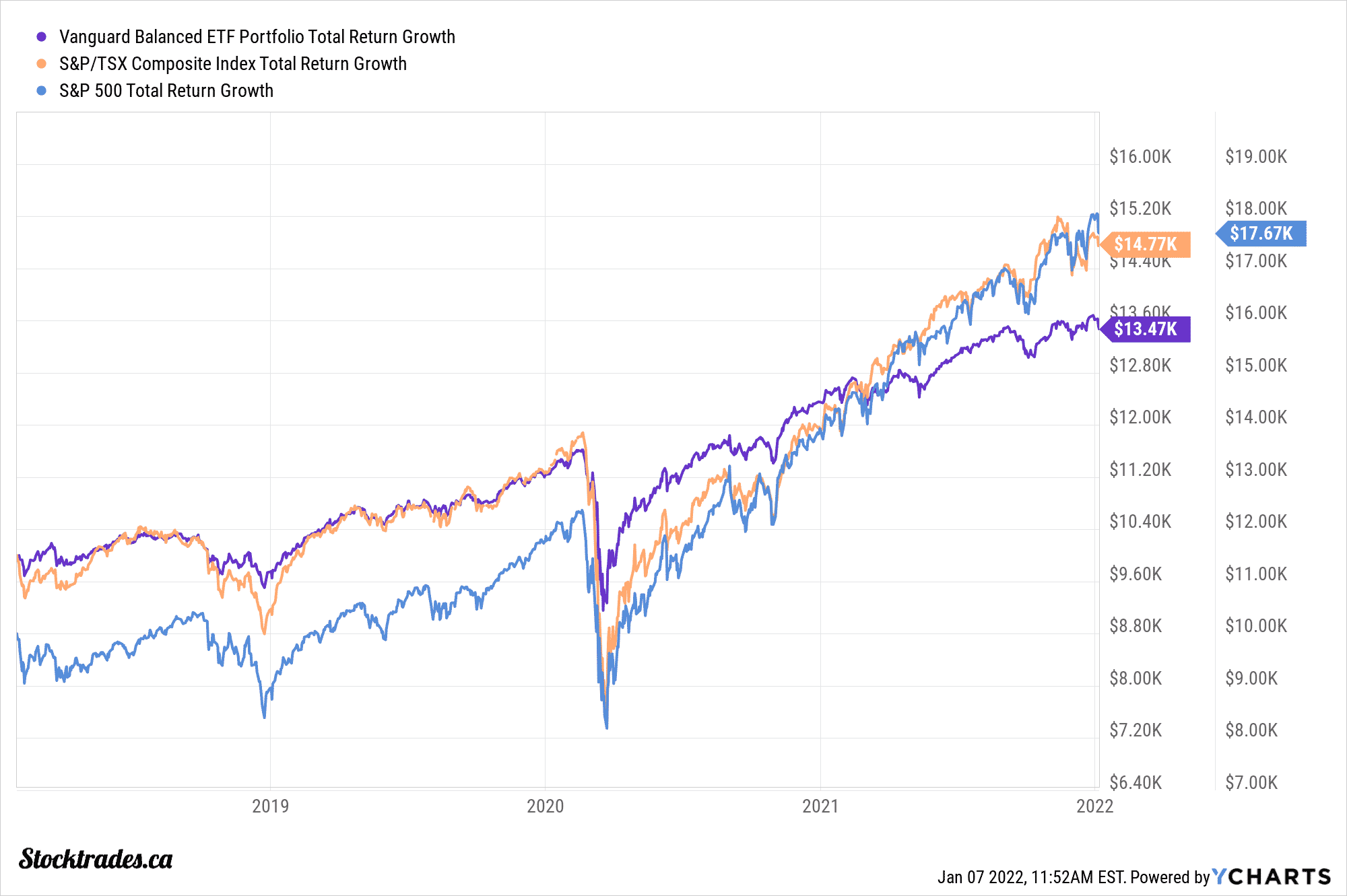

In terms of returns, if you had invested $10,000 into the fund during its inception in 2018, you’d be sitting on $13,470 at the time of writing. As you can tell by the chart, this is underperforming both the S&P 500 and TSX Index by wide margins. However, this is to be expected as the fund contains 40% fixed income.

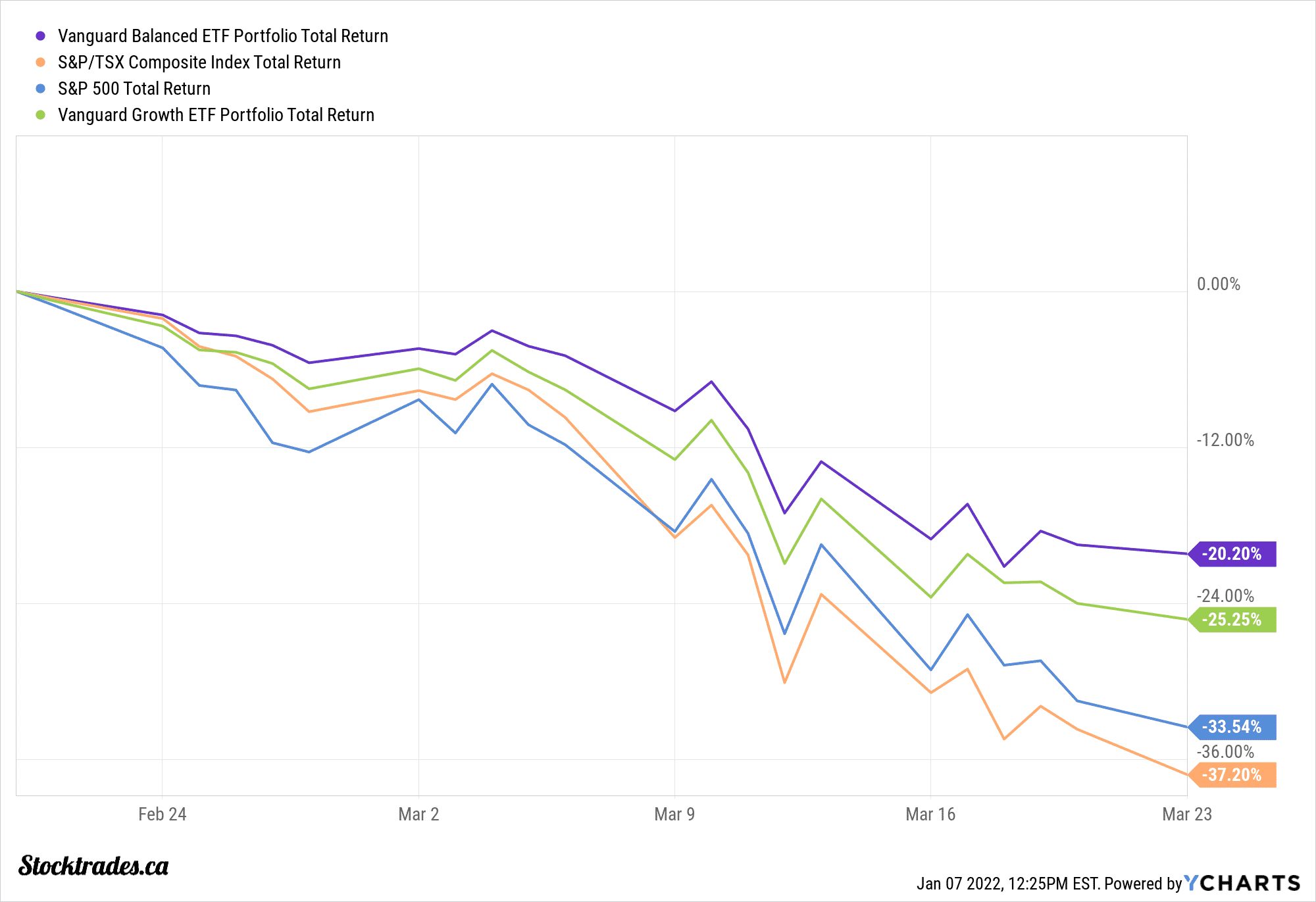

What is more important is how the fund performed during the COVID-19 crash in March of 2020, as the high allocation in terms of fixed income is supposed to reduce volatility. It did exactly that. If we look to the chart below, we can see the VBAL lost significantly less than the major indexes during the crash, even outperforming the TSX Index by over 17%.

Now let’s look at the Vanguard Growth ETF Portfolio VGRO

The Vanguard Growth ETF Portfolio debuted on the Toronto Stock Exchange around the same time as VBAL, January of 2018. with over $3B in assets under management, it is much larger than VBAL. This shouldn’t come as a surprise to most, as the 60/40 equity/fixed-income portfolio has been pushed to the side in the extravagant bull market we’ve been in for stocks over the last decade.

The aim of the fund is to give investors exposure to a 80/20 portfolio, meaning 80% equities and 20% fixed income. So immediately you can tell the main difference between these two is the fact one contains more fixed income than the other. And as we continue, you’ll also learn how this has impacted the returns and drawdowns of both these popular ETFs moving forward.

In terms of total holdings, they are relatively the same. VGRO contains 13,400 stocks and top holdings include Apple, Microsoft, Shopify, Royal Bank, TD Bank, and Amazon. The only slight difference between these two, which would come from the lower fixed-income allocations, is the total allocations per company. For example, VBAL’s allocation towards Apple was around 1.27%. VGRO’s is about 1.82%.

On the fixed income front, more than 60% of the fixed-income securities are government bonds and treasuries. Much like VBAL, the vast majority of fixed income is rated A or better. The yield of the fixed income portion is less than 2%, which considering the current inflationary environment would give an investor negative real returns. But, we must think of fixed income as more of a security blanket in this day and age rather than a positive returning asset.

When we look to management fees, the fund has the same MER as VBAL, coming in at $0.24. This means you’ll pay $2.40 CAD per $1000 invested. And when we look to distribution yield, it yields marginally less than VBAL with a trailing 12-month yield of 1.7%.

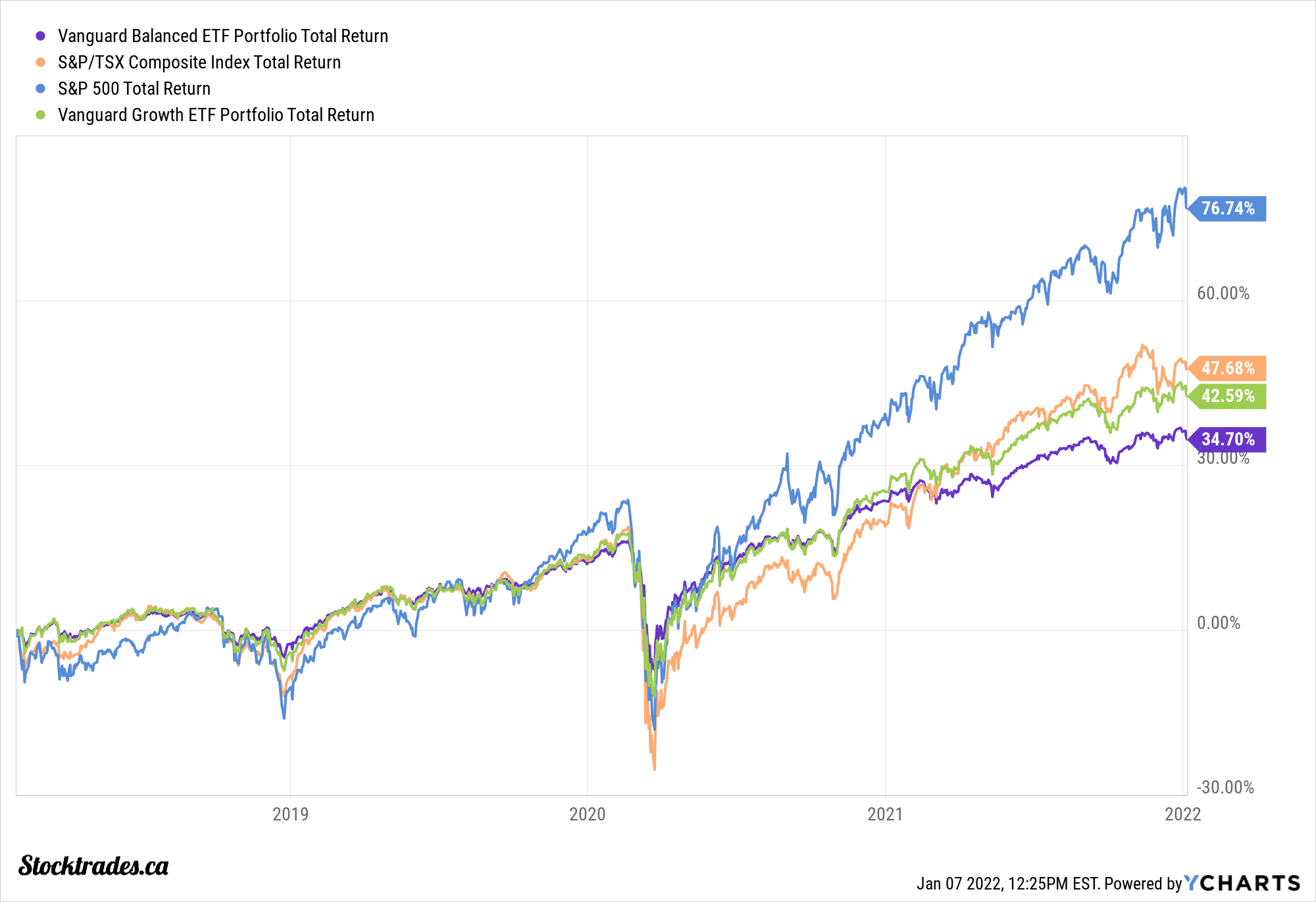

When we compare the two in terms of returns, it is not a surprise that VGRO has outperformed VBAL in terms of total returns, but has also underperformed during the COVID crash. This is again due to the fixed income nature of the fund.

Overall, there is one key difference between these investment funds, and that is fixed income exposure

When comparing VBAL and VGRO, there is one difference. Do you want more, or less fixed income exposure? Because the reality of it is, that is the only difference between these two index ETFs.

Due to the structures of the funds, we can assume that during market drawdowns VBAL will outperform VGRO and during bull markets, VGRO will outperform VBAL.

Should I buy these funds in a TFSA or RRSP?

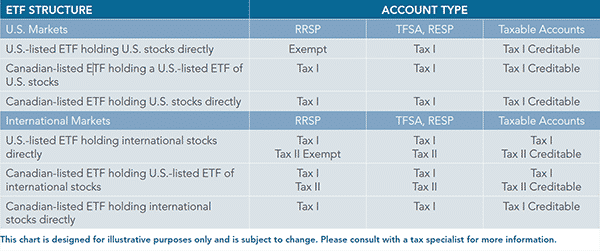

Regardless of which fund you choose, it is important to understand that they do contain underlying US stocks and ETFs. In this situation, they could potentially be subject to withholding taxes even inside of an RRSP. This chart below, courtesy of CI Global Asset Management (read their excellent guide on withholding tax and the source of the chart here) should give you a good indication of the taxation, as it can be convoluted when it comes to ETFs.

Keep in mind, this is simply withholding taxes on the dividend, and if you hold these ETFs in a tax-sheltered account you will not pay capital gains.

What are the commissions to buy these ETFs?

There are a multitude of different brokerage platforms here in Canada, and the amount you pay to buy these ETFs can vary. You might be exploring the different options if you are just learning how to buy stocks. For example, with Wealthsimple Trade, much like any other stock or ETF purchase, it is commission-free, meaning it will cost you $0 to buy and sell these ETFs.

With Questrade, ETFs are free to buy but you pay when you sell. And for many other brokerages, it just depends if the ETFs are on their list of commission-free eligibility.

Overall, if you’re buying these for long-term capital growth, you shouldn’t really be worried about small trading fees if you do need to pay it.