VCE Vs VCN – Which Canadian ETF is a Better Buy in 2025?

When exploring exposure to domestic stocks, you may look to Canadian equity ETFs.

And in this situation, you may encounter two popular options: VCE and VCN.

Both are offered by Vanguard and provide exposure to the Canadian stock market, but they have some key differences, which is exactly what we’ll go over in this article.

VCE tracks the performance of the 50 largest stocks on the Toronto Stock Exchange. Meanwhile, VCN offers broader exposure with approximately 170 holdings across large, mid, and small-cap Canadian companies.

This distinction can significantly impact your portfolio’s performance and risk profile.

Choosing between VCE and VCN depends on your investment goals and risk tolerance. If you’re interested in focusing on blue-chip stocks, particularly in the energy and banking sectors, VCE might be more suitable.

On the other hand, if you prefer a more diversified approach that includes smaller companies, VCN could be the better choice.

But lets dig in even further.

VCE and VCN – Two of Vanguard’s premiere Canadian index funds

VCE and VCN are two popular Canadian equity ETFs offered by Vanguard. These funds provide exposure to the Canadian stock market but differ in their scope and holdings.

Overview of VCE

VCE, or the Vanguard FTSE Canada Index ETF, focuses on large-cap Canadian stocks. It tracks the FTSE Canada Index, which includes 50-60 of the largest companies listed on the Toronto Stock Exchange.

We can think of this as a very similar to the TSX 60 Index.

VCE has a management expense ratio (MER) of 0.05%, making it a cost-effective option for investors. The fund’s assets under management (AUM) total $1.8 billion, also making it one of the largest funds in the country.

VCE is heavily weighted towards the financial and energy sectors. This makes complete sense, as our large-cap stocks here in Canada are heavily concentrated on things like banks, insurance companies, and oil producers.

This concentration can provide strong returns when these sectors perform well but may also increase volatility.

Overview of VCN

VCN, the Vanguard FTSE Canada All Cap Index ETF, offers broader exposure to the Canadian equity market. It tracks the FTSE Canada All Cap Index, which includes large, mid, and small-cap stocks.

With 170~ holdings, VCN provides more diversification than VCE. Its MER is also 0.05%, offering excellent value for a bit broader market composition.

VCN has larger AUM of $7.4 billion, highlighting the fact that most investors do want broader exposure to the index and not necessarily the concentration that VCE provides.

The inclusion of mid- and small-cap stocks in VCN can potentially lead to higher growth, but it may also come with increased volatility compared to VCE’s large-cap focus.

Lets look at returns

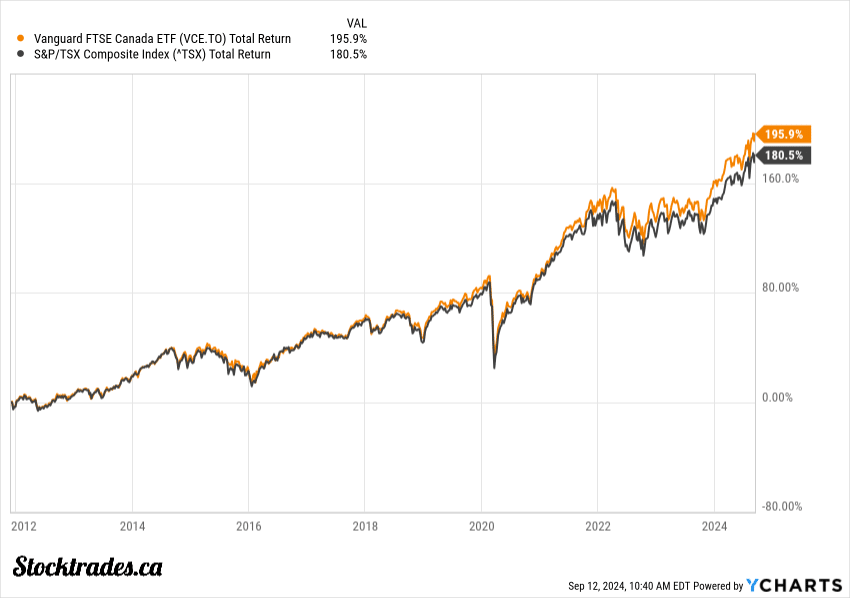

VCE performance

The Vanguard FTSE Canada Index ETF (VCE) tracks the performance of 50 large-cap stocks on the Toronto Stock Exchange. This focus on blue-chip companies can provide stability during market volatility.

VCE’s performance is closely tied to the energy and banking sectors, which dominate the Canadian large-cap space. You’ll find that VCE typically has lower volatility compared to broader market indices.

Since the funds inception, it has put up 8.8% annual returns, a small outperformance relative to the Toronto Stock Exchange.

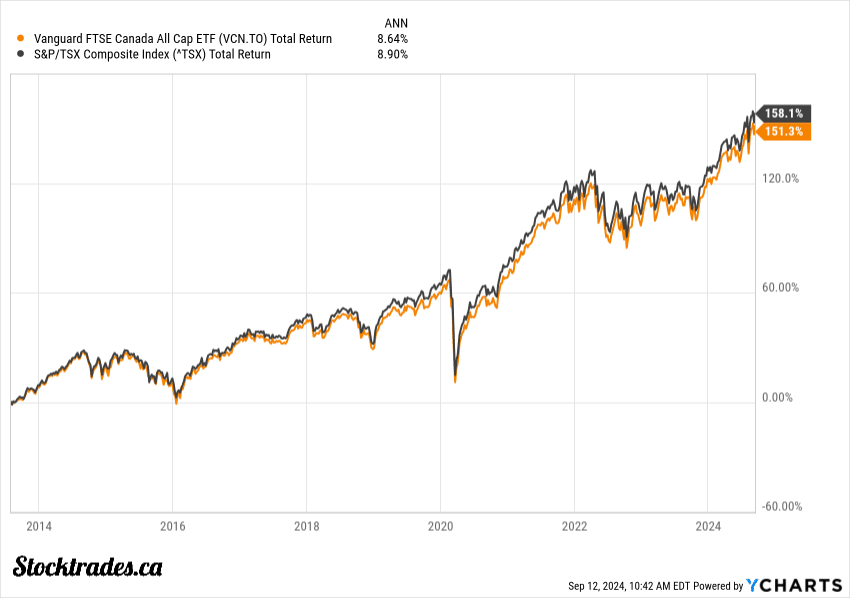

VCN performance

The Vanguard FTSE Canada All Cap Index ETF (VCN) offers a broader market exposure by including small and mid-cap stocks. This all-cap approach can potentially capture higher growth from smaller companies.

However, this just hasn’t been the case thus far. Because the Canadian small and mid cap market is full of volatile energy and material companies, the returns of VCN just haven’t really stacked up all that well to VCE or the TSX in general.

The fund has returned 8.6% annualized since its inception while the TSX Index has returned 8.9% over the same timeframe.

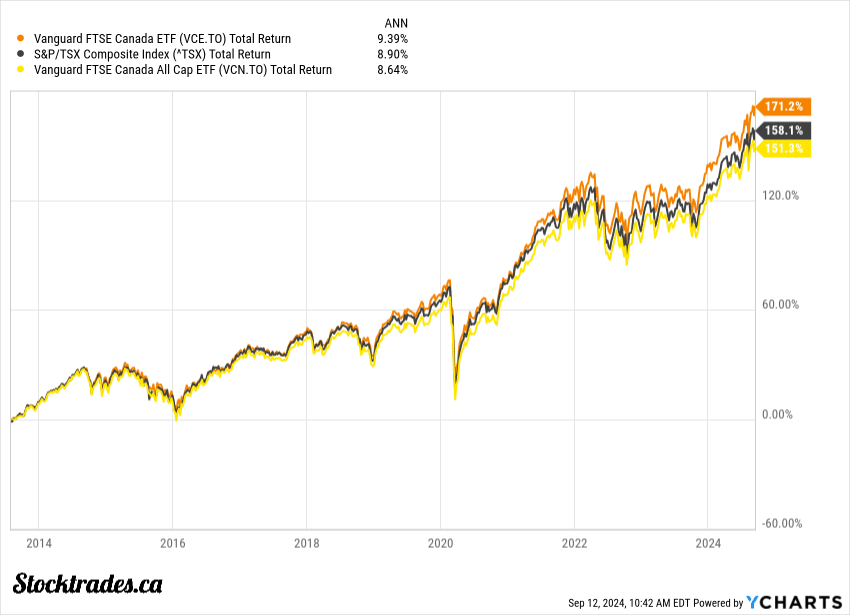

Overall, the better performing fund has been VCE

Due to the larger diversity of VCN, it has underperformed the more concentrated, blue-chip approach of VCE.

Whether or not this continues moving forward is anyone’s guess, as past returns are never a guarantee of future results.

However, if I were to make an educated guess, it would be that the more concentrated approach of VCE is going to outperform a broader market index of VCN.

Our small and mid cap companies, for the most part, just aren’t all that strong, and I’d personally rather allocate my capital to the larger players.

Diversification

VCE and VCN offer different approaches to diversifying your Canadian equity portfolio. These ETFs vary in their sector allocations and market-cap coverage, providing distinct options for balancing risk and potential returns.

VCE focuses on large-cap stocks, heavily weighting financials and energy sectors. This concentration can lead to higher volatility but potentially greater returns in certain market conditions.

VCN, on the other hand, offers a more balanced sector allocation. While still emphasizing financials and energy, it includes broader exposure to:

- Materials

- Industrials

- Technology

- Utilities

- Telecoms

This wider range of sectors in VCN can help reduce overall portfolio risk by spreading investments across various industries. However, it has also caused a lack of performance over the last while

Fees of both funds

When comparing VCE and VCN, you’ll find their fees are remarkably similar. Both of these are passive index funds, which means they are unlikely to have high trading costs and transaction fees from rebalancing efforts. As a result, fees are rock-bottom for both these ETFs.

Both funds boast a management expense ratio (MER) of 0.05%. This means for every $10,000 you invest, you’ll pay just $5 annually in fees.

The low MER of these funds makes them highly attractive for cost-conscious investors. You’ll be able to keep more of your returns, as less money is eaten up by fees.

In terms of liquidity and trading volume, both ETFs are quite popular. This means you can buy or sell shares easily without significantly impacting the price. However, VCN typically has a slightly higher trading volume, which may result in marginally tighter bid-ask spreads

Top holdings

VCE and VCN have similar top holdings but differ in their overall number of holdings and sector allocations.

VCE top holdings

VCE tracks the FTSE Canada All Cap Index, focusing on large-cap Canadian stocks. Its top 10 holdings include major financial institutions and energy companies.

The top 5 holdings are:

- Royal Bank of Canada

- Toronto-Dominion Bank

- Enbridge Inc.

- Canadian National Railway

- Bank of Nova Scotia

VCE is heavily weighted towards the financial and energy sectors, reflecting the composition of the Canadian stock market.

This concentration offers you exposure to Canada’s economic backbone but may limit diversification.

VCN top holdings

VCN also tracks the FTSE Canada All Cap Index but includes more small and mid-cap stocks, holding 170~ stocks in total. Its top 10 holdings are identical to VCE’s.

Key features of VCN include:

- Broader market coverage

- More balanced sector allocation

- Inclusion of materials, industrials, technology, utilities, and telecom sectors

Overall, I’m a bigger fan of VCE than VCN

Diversification is a solid investing strategy, to a certain degree. In this instance, I think the diversification of a fund like VCN actually does more harm than good.

I’m a big fan of small and mid cap stocks. I believe they provide the opportunity for outperformance in the case of economic booms, typically where these types of stocks thrive.

However, the Canadian small and mid cap landscape is littered with companies in the material and energy sectors. Not only do these companies need a strong economy, but they also need a strong commodity market, as they primarily rely on the price of gold, silver, oil, and natural gas.

As a result, our small and mid cap markets tend to be much more cyclical and don’t really put up all that strong of returns.

This is the exact reason I tend to lean towards VCE. I like the concentration in Canada’s large cap names. I believe they’re going to be some of the strongest performers moving forward.

Do the small caps have a chance to outperform? Absolutely. And in this case, VCN may turn things around and outperform VCE. However, if I’m buying and holding for 10+ years, it’s a no-brainer to me.