VFV vs VSP – To Hedge or Not to Hedge?

One of the best ways for investors to immediately diversify their holdings is to invest in an exchange-traded fund (ETF). Currently, there are many different Canadian ETFs available for investors to choose from on the Toronto Stock Exchange.

An ETF is a relatively low-cost way for investors to hold many different assets at once. Whether it is stocks, bonds, or even commodities ETFs. Essentially, the primary goal of investing in an ETF is to minimize your exposure to asset-specific risk and benefit from the general growth of the economy as a whole.

In Canada (as well as the United States), many of the most popular ETF options are managed by Vanguard. Vanguard is one of the world’s largest investment management companies and is widely trusted by many investors. It is well known for its low fees, and many Vanguard clients have been happy with historical returns.

As we all know, fees eat away at overall investment returns and low-cost investing can save you tens, if not hundreds of thousands of dollars over a 20-30 year time period.

In addition to many of the company’s other current offerings, many investors will be drawn to the S&P 500 Index Fund (VFV) and the S&P 500 Index ETF CAD-Hedged (VSP).

While these funds are structurally similar — and typically move in the same direction — it is still important to keep track of the differences between them. The primary difference between these two funds is that while VSP is hedged for the Canadian Dollar (CAD), VFV is not, unlike something like VFV vs VOO, where currency is the difference.

Why buy Canadian-listed S&P 500 ETFs?

Many investors ask whether or not they’d be better off buying these ETFs in USD. And, this certainly depends on your overall investment strategy.

Buying these Canadian listed ETFs can save on conversion fees, as it will cost you money to convert your Canadian dollars to US dollars. It also becomes useful if your brokerage account is at something like Wealthsimple Trade, which charges in and out currency conversion fees unless you pay for their premium membership. These fees can make up years of management costs, so it’s important to weigh the pros/cons in that regard.

But, make note that holding a Canadian traded ETF that holds underlying US stocks or ETFs is subject to a withholding tax on the dividend, even in an RRSP. This is something that is not well known in the investment community. It is typically taken right out of the cash distributions before you receive them, and in a taxable account, you may be able to claim a foreign tax credit.

It’s not a make-or-break fee to be honest, as both of the distribution amounts are in the low 1% range. But, in large quantities, it can impact the distributions.

Keeping that in mind, you might be wondering which ETF will be best for you. Below, we will briefly compare VFV and VSP in order to help you make the right decision.

VFV vs VSP – Let’s start with the unhedged version VFV

According to Vanguard Group, the “Vanguard S&P 500 ETF seeks to track, to the extent reasonably possible and before fees and expenses, the performance of a broad U.S. equity index that measures the investment return of large-capitalization U.S. stocks.”

This ETF is mostly focused on investing in the S&P 500, a portfolio that (more or less) consists of the 500 largest publicly-traded companies in the United States. The S&P 500 is one of the most commonly tracked measures of the American economy and is often referenced to describe how the economy is performing.

As Vanguard helps further explain, the ETF “employs a passively managed, full-replicated index strategy to provide exposure of large U.S. companies.” The current structure of the fund makes it easy to keep management fees very low, which at the time of writing sit around 0.08%. This means you’ll pay a mere $0.80 per $1000 invested. This is typical among unhedged ETFs, as they have less internal management and are more passively managed.

Other than an initial dip following the COVID-19 outbreak, Vanguard’s VFV ETF has had a strong performance over the past three years. In the year leading up to January 31 (2022), the Vanguard ETF increased in value by 22.08% — just below the 22.30% percent benchmark. Had someone invested $100,000 in January 2021, it would be worth about $122,000 a year later.

Over the past five years, the ETF has enjoyed an average annual return of 15.82%, nearly on par with the annualized benchmark of 15.92%. This means there is little deviance on this ETF from the S&P 500. In fact, after we subtract the management expense ratio of 0.08%, it has only underperformed the S&P 500 by 0.02%.

Currently, Vanguard’s VFV consists of 507 stocks (the S&P 500 isn’t always exactly 500 stocks). These companies have a median market cap of $258B, a price/earnings ratio of 22.8x, a median return on equity of 22.6%, and an earnings growth rate of 18.4%. Historically, 22.8 times earnings is certainly expensive, and the bulk of this high valuation is from the current top weighted holdings, which we’ll go over below.

The stocks selected for the fund generally reflect the variety of companies operating in the United States, with a strong emphasis on the tech sector.

The four largest companies include Apple, Microsoft, Amazon, and Alphabet (Google). Currently, about 29% of the selected stocks are in the information technology (IT) sector, about 13% are in healthcare, 12% are in the consumer discretionary sector, and 11% are in the financial sector—all remaining sectors account for about 35% of the ETF.

This heavy tech exposure is a first and the current top-heavy allocation is a bit higher than we’ve normally witnessed.

Now let’s go over the hedged version, VSP

Vanguard’s VSP ETF is similar to its counterpart VFV — the ETF is distributed across 500~ of the largest American public companies, spread out across many different sectors. The stock selection between the VSP and the VFV is identical. However, what makes VFV different from VSP is that VFV is hedged to the Canadian Dollar (CAD).

As Vanguard describes, it seeks to replicate “the performance of a broad U.S. equity index that measures the investment return of large-capitalization U.S. stocks, which Index is hedged to the Canadian Dollar.” What this means is that the portfolio is adjusted to account for any possible changes in the exchange value between the American Dollar (USD) and the Canadian Dollar.

If you are just learning how to buy stocks, I will just quickly note that the purpose of currency hedging is to eliminate (or at least minimize) the risk of sudden currency changes which will impact overall returns. As I mentioned above, typically the MER of hedged ETFs are a little higher. But, like the unhedged VFV, VSP has a low management fee of 0.08%. This means that despite this investment fund using hedging strategies, the fees stay the same.

In the year leading up to January 31 (2022), VSP increased in value by 22.39%, which was just ahead of the VFV alternative. In the five years leading up to that date (going back to 2017), 15.08%, which is just below VFV’s performance.

VFV vs VSP bottom line: Which is better?

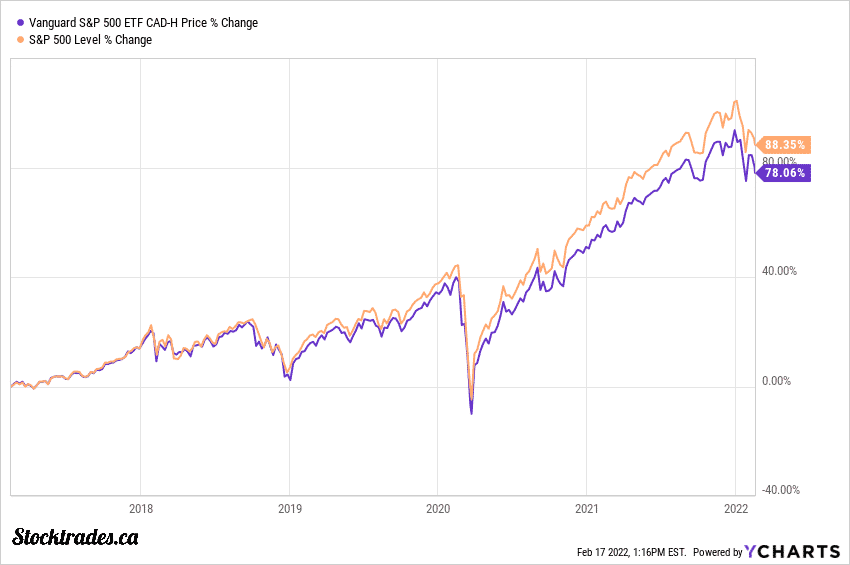

VFV and VSP are extremely similar exchange traded funds (ETF). Over the past year, VSP has slightly outperformed VFV, though VFV had previously had a slightly better performance.

This isn’t a surprise, as the sharp rise of the Canadian dollar due to a recovery in oil prices has caused hedging to outperform over the short term. However, the long term performance favors that of VFV extensively. If we look to the chart below, over the past decade VFV has outperformed VSP by more than 100%.

This means that investing $10,000 in each of these companies ten years ago would have you sitting on $40,380 with VFV, and $30,150 with VSP.

Over the long haul, currency fluctuations tend to even themselves out. So, if your time horizon is long and you’re looking for an S&P 500 ETF that trades in Canadian dollars, you may want to go the unhedged route. Although there may be some times you underperform due to currency volatility, over the long term unhedged ETFs have historically outperformed.

However, if you have a shorter time horizon and simply can’t risk a large fluctuation in currency offsetting your investment returns, hedging certainly makes sense. We go over this in our article on unhedged vs hedged ETFs and which one could be right for you.