VGRO vs XGRO – Which ETF will Canadians Choose?

We all aspire to be individual stock pickers and beat the market. However, there comes a time where an exchange traded fund, or “ETF” for short, just makes more sense.

When investors are looking for broad exposure to the TSX, S&P 500, NASDAQ, or even the global markets with a single click of a button, asset-allocation, or “all-in-one” ETFs make sense. If you’ve identified you want to purchase one, you now have a plethora of funds to choose from, Canadian ETFs, and also different companies such as Vanguard, iShares, BMO, or Horizon.

In this article I’m going to compare two popular growth ETFs in VGRO vs XGRO. These are the Vanguard and iShares growth ETFs that aim to give investors exposure to an 80/20 portfolio in terms of equities and fixed income.

These balanced ETFs are similar, but do have differences when it comes to distributions, fees (MERs), and overall holdings. If you’re looking at purchasing a strong ETF here in Canada, you’re on the right track. Lets dig into the similarities, differences, and overall landscapes of the two funds, starting with VGRO.

VGRO vs XGRO quick comparison table

| XGRO | VGRO | |

|---|---|---|

| AUM: | $1.4B | $3.57B |

| Annual Fee: | $2 per $1000 | $2.40 per $1000 |

| Allocation | 80% Equities/20% Fixed Income | 80% Equities/20% Fixed Income |

| Total Holdings: | 19,815 | Over 30,000 |

| Dividend Yield: | 1.5% | 1.55% |

| 1 Year Returns: | -11% | -9.98% |

| Returns Since Inception: | 70.62% (2007) | 28.2% (2019) |

| Max Drawdown: | 47.37% (2007) | 25.36% |

VGRO vs XGRO – Lets look at the Vanguard Growth ETF Portfolio VGRO first

The Vanguard Growth ETF Portfolio debuted on the Toronto Stock Exchange with an inception date of January 25, 2018. The asset allocation ETF has over $3.6B in assets under management at the time of writing and the purpose of the fund is to give Canadians exposure to an 80% equity, 20% fixed income portfolio to reduce overall volatility while still driving strong returns.

In order to see what the overall impact of fixed income is inside of the ETF, we can look to compare VGRO vs VEQT. VEQT is a similar fund, except that it is 100% equities, it does not include the fixed income portion.

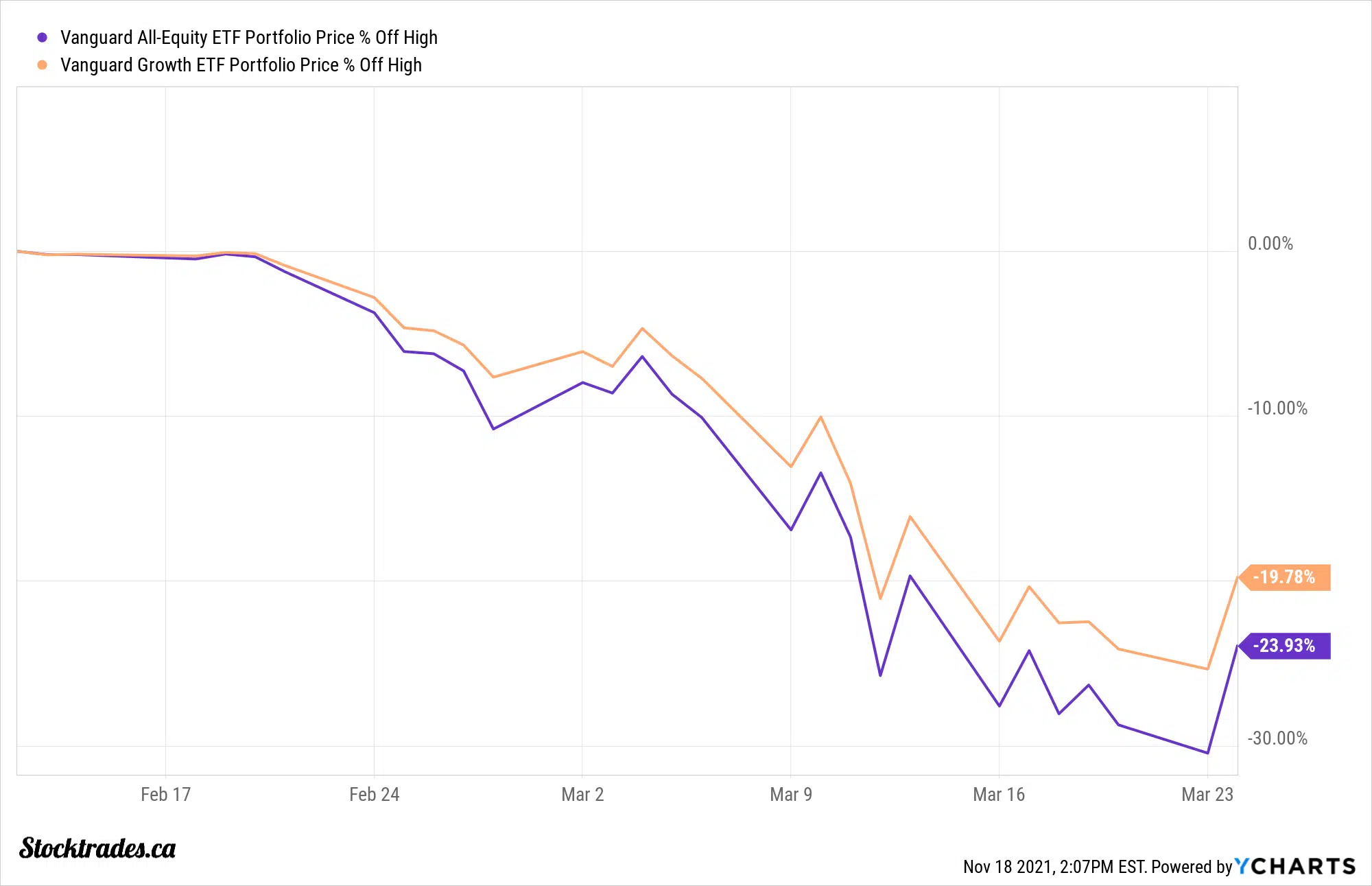

And if we look to the max drawdowns of the two funds during the COVID-19 pandemic, you’ll see that VGRO, because of its fixed income, outperformed VEQT by a pretty solid margin.

VGRO contains just shy of 13,500 stocks. At first, this seems like a massive amount of holdings. Which, it certainly is. But the ETF doesn’t actually hold that many. It uses underlying ETFs to gain exposure to those companies.

First, lets take a look at the “boring” bond portion of the ETF. Over 55% of the fixed income inside of VGRO is government bonds and treasuries. In fact, only 15% of the fixed income portion has a rating of BBB or less. This means that 85% of the portfolio is rated A, AA, or AAA. This means that the bonds the ETF holds are extremely likely to make timely payments to holders.

In terms of the equity portion, the top holding inside of the portfolio is Apple Inc, in the high 1% range. After this comes Microsoft Corp, and third is Canada’s largest bank in Royal Bank of Canada.

From a sector basis, financial and technology stocks make up nearly 20% each, while healthcare, energy, and basic material plays are all in the mid to high single digits. Geographically, the bulk of holdings are going to be located in Canada and the United States (nearly 75%), but the ETF does have some strong exposure to countries like Japan, China, and the United Kingdom.

In terms of management fee, it’s hard to beat a Vanguard product. The fund’s MER will cost you $2.00 per $1000 invested on an annual basis. If you combine the fact you could buy a fund like this commission free at Questrade or Wealthsimple Trade, I’d consider it pretty much free.

When we look to performance history, the fund has put up some pretty strong numbers. At the time of writing, it has grown nearly 28% since its inception. This does trail the S&P 500, but it’s important to understand that major tech companies pushed that index much higher, and a 500 stock index is going to be much more volatile in either direction than an ETF like VGRO which contains over 13,400 holdings.

The fund pays a 1.55% distribution. If you’re looking for income from this ETF, you’d be best to look elsewhere.

Now that we have some clarity on VGRO, its fees, holdings, and overall strategies, lets take a look at how an iShares product XGRO compares.

VGRO vs XGRO – iShares Core Growth ETF Portfolio (XGRO)

Much like VGRO, XGRO is an 80% equity 20% fixed income ETF that aims to give investors a balanced portfolio of equity and income securities. Blackrock Canada, with Blackrock being one of the largest asset manages in the world, manages iShares ETFs.

The fund is older than VGRO, being around since 2007. But, don’t mistake this funds age with popularity. With assets under management of $1.23B, it is much smaller than Vanguard’s VGRO.

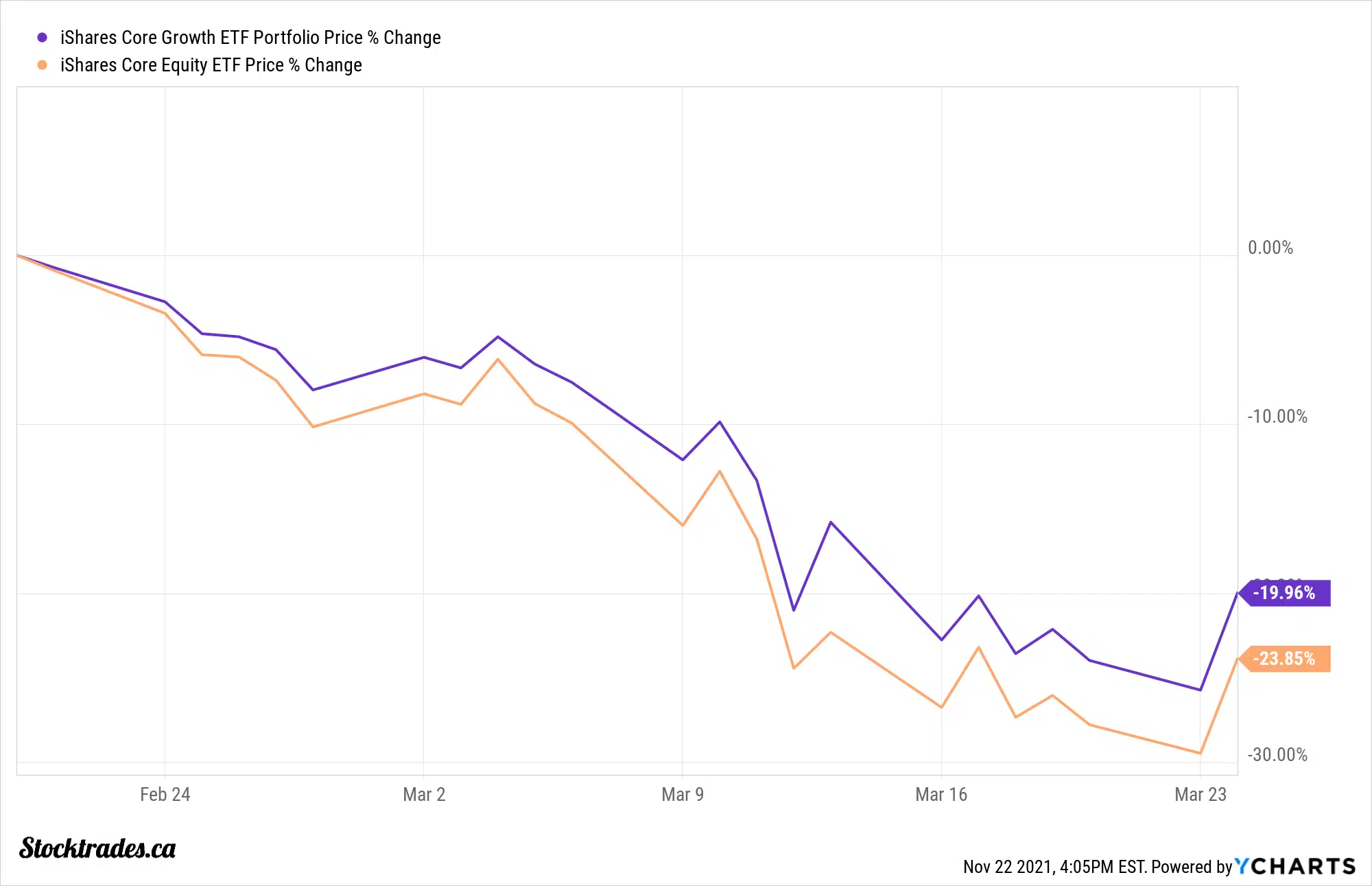

Much like VGRO, lets compare XGRO’s performance vs iShare’s all equity ETF XEQT. This will give us an idea of how well the fixed income portion of the portfolio has done its job. And, as you can see by the chart below, it is similar to the outperformance during the crash of VGRO.

The ETF has similar holdings to VGRO, and much like VGRO it uses underlying iShares ETFs to gain exposure to the large amount of holdings. For example, the number one holding inside of this ETF is ITOT, which is the iShares Core S&P Total U.S. Stock fund.

If we look to the fixed income portion, the fund has a relatively equal split of corporate and government bonds. There are a bit more lower quality bonds inside of this portfolio, with 20% of them being rated BBB or less. However, there are still some outstanding companies with BBB debt ratings.

When we look to the equity portion, it is also much the same. Apple makes up the top holding followed by Microsoft and Royal Bank.

The management expense ratio comes in at $2.10 per $1000 invested, so much like VGRO for a DIY investor to get one click access to tens of thousands of holdings, it’s a price you should be more than willing to pay.

When we look to performance, the fund has performed fairly well. Since its inception in 2007, it has returned just under 71% to investors. Now, this may seem like peanuts considering the markets overall have launched post financial crisis. But, it’s important to note we are investing in a fund where 20% of it is fixed income securities. Over the long run, this will have a big impact on overall returns.

However, it will also have a large impact on max drawdowns, which is the largest amount the fund fell during a correction or crash type situation. With a max drawdown of 25.36%, this is significantly less than the 36% the S&P 500 fell during the COVID-19 crash.

The fund pays a little lower distribution than VGRO, yielding 1.50%, but again if you’re looking for income these likely are not the ETFs for you. They’re more suited for long-term capital growth.

The bottom line: VGRO or XGRO, which is better?

In its short existence, VGRO has proven to be the much better performer, outperforming XGRO by about 5% since its inception. This is likely due to its larger US exposure, as we all know how the US stock market has performed over the last few years.

Being nearly triple the size in terms of assets under management, many investors will choose VGRO over XGRO as well.

In order to truly determine which one of these balanced ETFs is better, we really need to see more performance. Right now, it is difficult to determine which ETF I’d choose, simply because I don’t have enough history to go off of. For right now, I do like VGRO’s increased exposure here in North America, as I believe exposure to one of the largest economies in the world (the United States) is generally a positive. So at this point in time, I’d likely lean towards VGRO.

However, there are cases to be made for either fund, and both provide excellent diversification for investors to gain exposure to the US and emerging markets in CAD.

TFSA, RRSP or cash account, where should I hold these all-in-one ETFs?

If you are able to tax shelter investments, that is generally what I would view as best. If you are just learning how to buy stocks, it is also important to note that these ETFs do contain underlying US ETFs. In that situation, your brokerage platform might end up subtracting withholding taxes, even if they are held inside of an RRSP.