If Well Health Can Expand Margins, Its Stock Could Explode

Well Health Technologies is a small cap company making waves in the digital health sector. A stock that was once a penny stock traded on the TSX Venture has now matured into a small-cap stock trading on the Toronto Stock Exchange.

Unfortunately, the market hasn’t been too friendly to Well Health in a post-pandemic environment. However, I believe investors may be making a mistake overlooking this one.

Well Health is positioning itself as a leader in the healthcare space. Their focus on digital solutions with traditional healthcare services is a blend I believe works perfectly in Canada. I believe the company will revolutionize how Canadians access and receive medical care in the coming years.

Lets dig into why.

Key Takeaways

- WELL Health is one of the more attractive small cap stocks in Canada from a valuation perspective

- The company’s recent financial results and acquisitions are driving its expansion

- WELL could be a promising small-cap stock for Canadian investors to watch

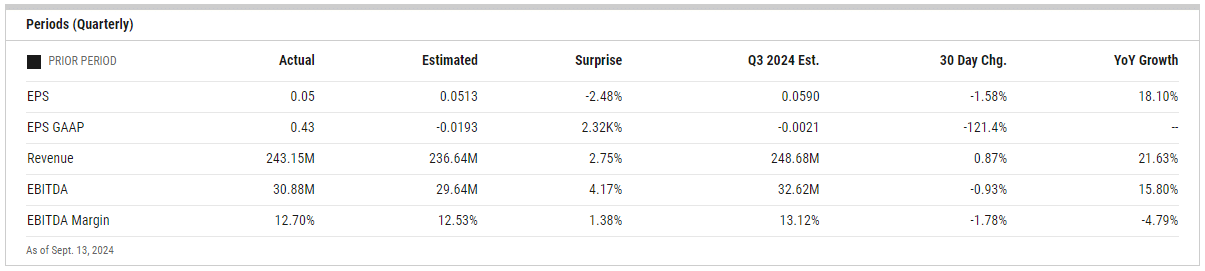

Q2 Earnings – Promising results leads to guidance bump

WELL Health Technologies knocked it out of the park with their Q2 2024 results.

Record-breaking revenue of $243.1 million came in a whopping 42% above last year. This growth isn’t just from acquisitions – they’ve achieved an impressive 21% organic growth rate as well.

Patient visits are through the roof. They’ve hit 1.4 million visits in Q2, up 38% year-over-year.

Here’s a quick breakdown of their key financials:

- Revenue: $243.1 million (+42%)

- Adjusted EBITDA: $30.9 million (+11%)

- Patient Visits: 1.4 million (+38%)

I’m particularly excited about their US digital revenues. Circle Medical and Wisp grew by 40% to $56.3 million.

Because of the results, the company increased its guidance. Sure, it was only by around $5-10M in terms of revenue, but any sort of raise at this point in time is a good sign.

Despite higher costs, they’re maintaining their Adjusted EBITDA guidance in the upper range of $125 million to $130 million.

The company has lofty plans for future growth

WELL Health Technologies is on a roll with its ambitious expansion strategy. Their subsidiary Wisp is leading the charge down in the United States, making waves in the women’s health sector.

Although Well Health is broad scope, their Wisp subsidiary aims to serve women’s needs on the reproductive health end of things.

They’ve hit the one million patient mark and are raking in over CAD$100 million in yearly revenue. That’s no small feat!

They’ve launched ten new products this year alone, covering everything from fertility to menopause care. And they’re not stopping there – more big launches are on the horizon.

But it’s not just about new products. Wisp is also expanding its reach. They’re making healthcare accessible across all 50 US states, even in areas where care is hard to come by.

Keep in mind, I’m speaking on just one of Well Health’s key acquisitions. The company acquired a majority stake in Wisp in 2021. Management has been finding a way to identify promising opportunities in the space, and because competition is relatively low, it’s been able to find them at attractive prices.

Looking at the bigger picture, WELL Health seems poised for growth. It’ll be exciting to see where they go from here.

Acquisitions are fueling a solid chunk of growth

The company’s recent purchases show it’s not slowing down.

In just the last 10 days, WELL snapped up 3 primary care clinics in BC and inked deals for 4 more diagnostic imaging clinics in Alberta. That’s $17 million in new revenue right there.

But it doesn’t stop there. WELL has been on a buying spree:

- 21 clinics in Q4 2023 (including MCI OneHealth and MB Clinic networks)

- 10 clinics from Shoppers Drug Mart in June 2024

The best part? These clinics are now all turning a profit on an adjusted EBITDA basis.

The company is taking underperforming assets and making them profitable. That’s a skill that’ll serve them well as they continue to grow.And grow they will. WELL’s pipeline is bursting with potential deals.

As one of the few major players in this space, especially in Canada, WELL has its pick of acquisition targets. I think this gives them a huge advantage in driving future growth.

Are valuations reasonable at this point?

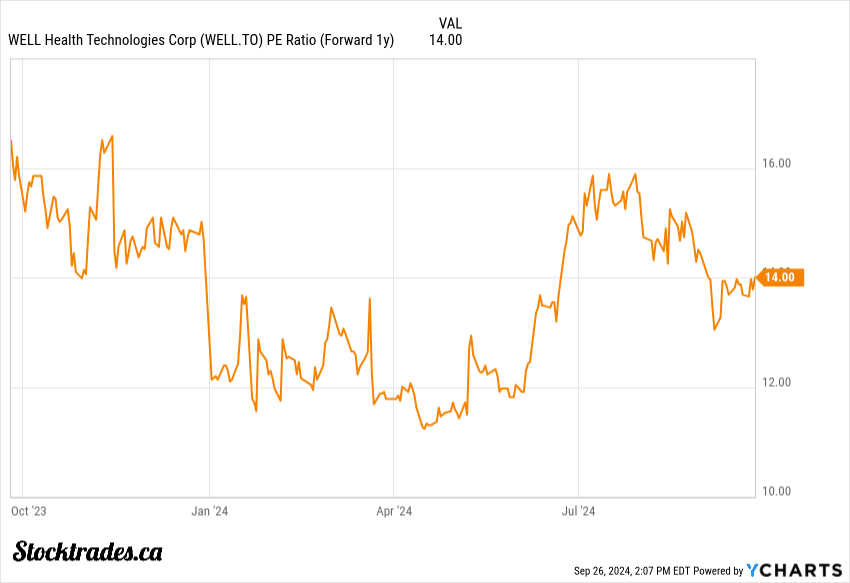

Well Health’s valuation is a bit of a mixed bag right now. On one hand, the company’s growth metrics look quite appealing relative to its price to earnings ratio.

But on the other hand, profitability has been a sore spot. The market’s been a bit skittish about that, and it’s keeping a lid on valuations as a result.

A forward P/E of 14.41 suggests that although the company is growing fast, the market just isn’t willing to reward it with all that high of a multiple. And I do believe this is from the uncertainty that the company can carve a path to consistent profitability. Its operating margins at this point are razor thin at 3.8%.

If Well Health can sort out its profitability issues, I do believe we’ll see multiple expansion in terms of valuation.

Should you buy Well Health right now?

Well Health is shaping up to be an interesting buy. The company has made some impressive strides in the healthcare sector. It is also much more than a digital health provider, but many investors do not realize this.

WELL Health’s stock is currently trading around $4.30 and only 14X its expected earnings.

This seems like a bargain given its growth potential. Analysts project a 20% increase in normalized earnings per share next year. I’ve seen some stocks trading at double this price to earnings ratio with the same growth.

Why? Well, the company needs to focus on carving out a more efficient path to profitability. It’s crucial for long-term success. Lots have been critical that it is very difficult to make a ton of money in the Canadian healthcare sector. With Well Health’s current margins, it certainly seems so.

Here are a few points to consider:

- Strong revenue growth

- Expanding market presence

- Need for improved profitability

Despite these challenges, I believe Well Health is positioning itself as a leader in the digital health space. Its innovative approach to healthcare delivery could drive significant returns for investors who are willing to be patient.

I think it is a stock with a reasonable risk/reward potential.