What Are Dividends? the Ultimate Guide to Dividend Investing

Are you looking to learn how to buy stocks in Canada, but don’t know where to start?

It’s likely you’ve heard of dividend stocks, but you may be wondering, what are dividends?

Dividend investing is also referred to as “income investing”. The two terms can mean the same thing. Income investing can mean investing in dividend paying securities, while also describing the goal of investing to generate income.

I decided to construct a brand new article, one that is going to cover not only what a dividend is, but how dividends are declared, what eligible dividends are, cash vs stock dividends, among other things.

At the end of this article I plan for you to have a complete knowledge on the subject of dividends by expanding on the question that many are asking today, and that is… what is a dividend?

Lets get started!

What is a dividend?

So what exactly is a dividend? How do they benefit you as a current, or prospective investor.

Dividends are often stated as a portion of the company’s profits that are paid back to investors. But, it’s important you understand that a company does not need to be profitable to issue a dividend.

In fact, if a company really wants to, they can take out a loan to fund the dividend (some companies do this in times of hardship).

Obviously borrowing from a bank to pay investors is not a healthy long term strategy to reach prosperity for a company, but it can be done nonetheless.

That said, don’t think of a dividend as the company paying investors out of its profits. Instead, think of a dividend as a dollar amount a company is willing to give an investor on an annual basis for owning shares of the company.

How can you find out exactly how much you’re going to get paid if you own a dividend company? That depends on the company’s current dividend yield, which we’ll go over next.

What is dividend yield?

Dividend yield varies from company to company. It is the percentage of your investment that you will receive back from the company on an annual basis.

Lets go over an example:

Say you currently have $100 to invest. You’re looking to buy a strong dividend stock.

Scrolling through stock charts, you see one that is trading at $100 and currently yields 4.62%. What exactly does this mean?

It means that every single year you own the company, you’ll receive $4.62 in dividends for your $100 investment in the company.

Why?

4.62% of $100, is $4.62. If we make the prices a little more complex, it becomes a little cloudier.

If you’re looking at a dividend stock that trades at $59.12 and has a 4.62% dividend yield, how much will you receive every year?

It would simply be 4.62% of $59.12.

59.12 X 0.0462 = $2.731

With this stock, you’d receive $2.731 on an annual basis.

Does your dividend yield change?

Absolutely. Your dividend yield will fluctuate on a daily basis, depending on the current price of the stock.

You’ll still get paid the same annual dividend, unless a company of course raises dividends which we’ll talk about later, but the underlying investment (the stock) is constantly fluctuating in price.

The easiest way to show you how your dividend yield can change is to use an example.

If we take a $100 stock that yields us $5 a year, its current dividend yield would be 5%.

$5 annual dividend divided by $100 stock price = 0.05, or 5%.

However, what is your dividend yield if the stock you own is cut in half, or doubles in terms of price?

This is a critical thing you need to understand moving forward. Lets look at both of those scenarios:

$5 annual dividend divided by $50 stock price = 0.10, or 10% yield

$5 annual dividend divided by $200 stock price = 0.025, or 2.5% yield

Now it’s easy to sit here and think “wow, I’m yielding 10%!” But, it’s also important to note that your original investment has been cut in half.

And it’s also easy to think “ah man, I’m only yielding 2.5%.” But, your original investment has doubled.

How does a company determine how much dividends it will pay?

The process a company goes through to determine how much it can safely pay out when it comes to dividends is a complex one.

For one, they want to be raising the dividend on a consistent basis, as this not only draws in new investors due to strong dividend growth, but rewards prior investors with more money in their pockets.

If a dividend grows too fast, primarily faster than profits, it can become a problem for the company. If a dividend grows too slow, the company can sit on excess profits, which can be looked at in a negative light with current and prospective shareholders.

So, companies often have targeted payout ratios they hope to achieve (which we’ll talk about next), and as such pay dividends according to those guidelines.

However, this can be particularly complex in certain sectors, especially those that rely on commodities to drive profits.

A gold or oil company for example may generate significant profits during an increase in commodity prices. However, when those commodities fall, if it was overzealous in dividend growth, even though it was able to easily pay the dividend during the good times, it may be unaffordable during the worst times, and a dividend cut (which we’ll also talk about later) could happen.

What is the dividend payout ratio?

When looking for dividend stocks, many new investors simply look at the yield, and skip this portion of analysis.

I cannot state the importance of analyzing payout ratios and overall company health enough.

Before we get into what exactly a payout ratio is, I want to show you a quick example of how so many Canadian investors lost a fortune doing what I call “chasing yield”, or the act of investing in companies just for their super high dividend yields.

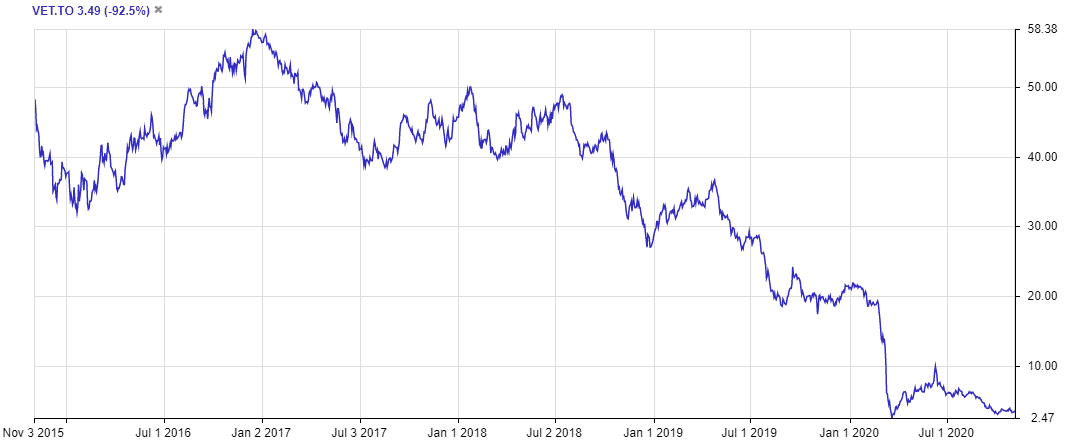

Vermillion Energy, which traded under the ticker TSE:VET on the Toronto Stock Exchange, was an oil and gas stock that provided investors with a crazy high dividend yield, often north of 10%.

However, as you can see over the last 5 years, a $10,000 investment in the company has dwindled down to around $750, and that’s with the dividends the company has paid over those years.

For a long time investors ignored the fact that both Vermillion’s dividend and stock overall were speculative at best.

So, what should investors have been looking for? Well, there are 2 different types of payout ratios you absolutely must learn before investing in dividend stocks.

The payout ratio in terms of earningsThe payout ratio in terms of free cash flows

The payout ratio in terms of earnings is a fairly simple calculation. It’s the company’s annual dividend, divided by it’s earnings per share. So if we have a company that has earnings per share of $7.50 and pays a $5 annual dividend:

$5/$7.50 = 0.66 or 66%

We can see that this company is paying out 66% of earnings towards its dividend, a seemingly healthy ratio.

However, what if the company currently has earnings per share of $5, and pays a $7.50 dividend?

$7.50/$5 = 1.5 or 150%

As with many things, if you’re paying out more than you’re earning you’ll eventually have to either cut back on your expenses, or go broke.

What is the free cash flow payout ratio?

However, earnings per share can be a complex number. The complexities of it are not something I’m going to go over in this piece, but just know that you must learn how to calculate the payout ratio in terms of free cash flows as well.

Why? Well, free cash flows excludes non cash expenses like depreciation of equipment. So it is a much more accurate payout ratio to work off of, as it is a more accurate figure of the amount of cash the company has to pay the dividend.

A prime example? At the time of writing, a popular Canadian Pipeline stock Pembina Pipe has a payout ratio of 160% when we look at earnings.

However, when we look at free cash flows, its dividend payout ratio shrinks to only 28.8%. This is significant, and I strongly encourage you to have a look at both payout ratios before making a decision.

One thing of note however, the dividend payout ratio in terms of free cash flows is not easy to find, and you may need to calculate it yourself by looking at a company’s quarterly report.

Can a dividend go down?

The answer to this is absolutely. And often in situations like this, when the dividend gets cut, the company’s share price plummets.

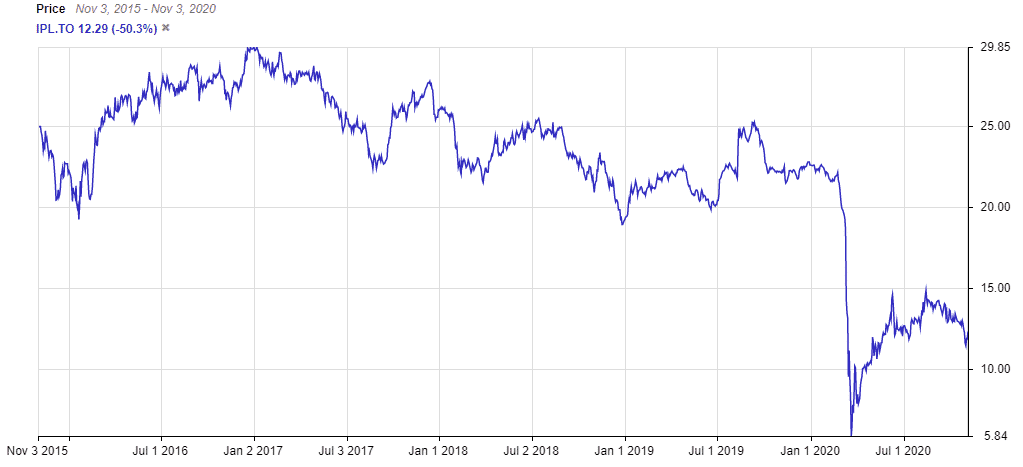

Above is a chart on Interpipeline, another popular Canadian stock that trades on the TSX under the ticker IPL. We can see that both the pandemic in 2020 and a dividend cut around the same time caused its stock price to crater.

Stocks will typically only cut the dividend if the situation gets especially dire, because of the impact it has on its share price. Although a company can cut the dividend much earlier than this, a company borrowing money to pay out dividends is often on its last legs prior to a dividend cut.

How are dividends paid?

There are typically 2 ways a dividend can be paid, and 2 payment intervals a dividend can be paid at. I’ll go over both of them, starting with the ways a dividend can be paid.

Dividends are typically paid on a cash basis, or stock basis.

A cash dividend is simply that, a dividend that is paid into the investors brokerage account in the form of cash.

A stock dividend however, is a dividend made in the form of additional shares of a company. This is a rarity these days, as most dividends are paid out via cash.

The second way to be paid a dividend is typically the timeline in which you are paid. Although some dividend companies pay semi annually, the two primary methods of payment are either on a monthly basis, or a quarterly basis.

Keep in mind that dividends on most sites are based on an annual basis. So, a stock that pays a $1.44 dividend pays either $0.12 monthly, or $0.36 quarterly.

When are dividends declared?

The act of collecting a dividend isn’t as simple as just buying the stock. You do have to be a shareholder at specific points in time in order to qualify for a dividend.

So how exactly does this process work? It’s a little more complicated than you think.

While you’re seeing stocks trade instantly inside of your brokerage, in the back end it’s actually taking 2 days for a trade to officially settle. So, to help investors understand whether they’ll qualify for a dividend or not, there is 2 critical dates you need to know:

The Dividend Record Date

Shares trade hands all the time on the stock market. So, to make it easier on companies to issue dividend payments, typically during the announcement of its dividend it will announce a dividend record date. On the day of the dividend record date, the ones who hold shares at that time will be the ones to receive the dividend.

And yes, this means if you sell your shares once the dividend record date has passed, but before the dividend is issued, you will receive the dividend, not the investor who bought them off you.

The Ex-Dividend Date

Because trades take two days to settle, they wanted to make it even clearer to investors the last possible day you can buy a stock and receive the dividend. But, it still does become quite confusing, because most think that they can buy the stock on the ex-dividend date and receive the dividend, which is wrong.

In order to be eligible for a dividend payment, you need to buy the stock before the ex-dividend date, not on or after.

If you buy a stock on the ex-dividend date thinking you’ll receive a dividend, you’ll be disappointed when the seller of the stock gets it, not you.

The ex-dividend date is set to one day before the dividend record date.

This makes sense if you consider the fact that trades take 2 days to settle.

What are preferred dividends?

Without going too in depth on what a common or preferred share is, dividends paid by either of these shares are very different.

As a common shareholder, you’re essentially at the bottom of the totem pole when it comes to any sort of dividend and/or interest you’re owed on an investment. Both debt holders (bonds for example) and preferred shares have priority over you.

So, if the situation arises that a company cannot pay all of its dividends, preferred dividends take priority over dividends paid on common shares.

There are also instances where an investor may be entitled to cumulative preferred dividends, which means if a company cancels even the preferred dividend, they would be entitled to past dividends once it is re-instated.

Now, before you run out an buy a bunch of preferred stocks to collect preferred dividends, just know that they are significantly different investments than common shares, and are well beyond the scope of this article. Please, prior to considering a purchase of them, read up on preferred stocks and understand how they work.

So how do you buy a dividend stock?

The method of buying dividend stocks is much the same as buying any other stock. All you really need is a brokerage account and some money inside of it.

There are few instances where stocks are available through direct purchase by the company, but to be honest especially as a beginner it’s much easier for you to just set up a brokerage account and pay the $5 in commission.

What is DRIP (Dividend Reinvestment Plan)

DRIP, or the Dividend Reinvestment Plan, is a plan set up by brokerages and companies that allow investors to take the dividends earned by the issuing company and turn it in to more shares.

The fundamental advantage of the DRIP program is it allowed you to purchase shares without incurring trading or commission fees. There was also particular instances where companies gave individual investors discounts on new shares if they did enroll in a DRIP program.

Commission free trading has caused the popularity of DRIPs to fall, considering investors can purchase single and even partial shares at $0, but the DRIP does still provide value to investors as it allows them to develop a “snowball” like effect on their portfolio, and allow their income to continue compounding moving forward.

Overall, I hope you liked this explanation on dividends and the concepts behind them

There are many things you’ll need to know outside of this guide like taxation prior to choosing the best dividend stocks to buy.

However, I hope the guide helps you and you know a lot more about dividend stocks than you did 15 minutes ago! If you have any other questions, feel free to contact us and we’ll add them to the guide.