Why Altagas (TSE:ALA) is Running Up in Price Recently

The Canadian markets are chock-full of financial, material, and oil and gas plays. As such, many investors head to Canadian stocks in the search for reliable income plays.Why? Well, for the most part the financial and oil and gas sectors are mature industries, and most established companies within them pay consistent, reliable income.

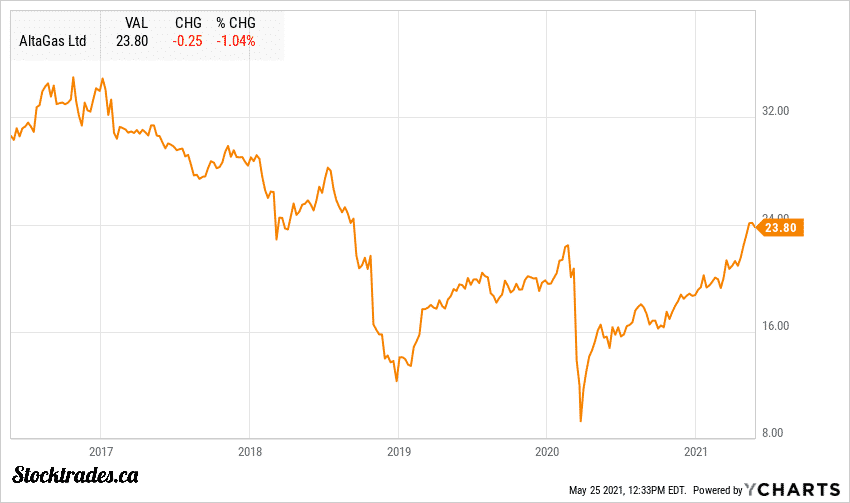

One stock that has garnered a lot of attention as of late is Altagas (TSE:ALA). The Canadian utility giant has struggled mightily throughout the last 5 years, but has been one of the best performers in the oil and gas sector over the past year.

The recovery of the energy industry was inevitable. The only question investors were asking themselves was when. And, it appears that 2021 is going to be a considerable turnaround for the industry…

So what gives? Is this stock worth looking at today, or has all the value already been accounted for? Lets cover some details.

What exactly does Altagas (TSE:ALA) do?

Altagas is a swiss army knife when it comes to utility and oil and gas operations. The company has four primary segments. Midstream, power, utilities, and corporate.

The company’s utility segment primarily consists of regulated natural gas, its power segment consists of natural gas fired, wind, biomass, and hydro power assets, and its midstream business, although it has been selling off non-core assets recently, consisted of the extraction, transportation, and storage of natural gas.

Although Altagas is a Canadian company, the bulk of its revenue comes from the United States.

Why has Altagas become more attractive recently?

Before I get into why the company is gaining some ground and getting the attention of investors as of late, we need to consider what the company has done over the last half decade that caused it to fall rapidly out of favor.

Altagas is going through what I would consider a pretty significant turnaround. If we go back to late 2018, the company slashed its dividend by 56% and sold off a significant stake in a hydroelectric power operation in British Columbia. The dividend had been considered rocky for quite some time, and the company had consistently relied on outside sources such as debt and share offerings to raise capital.

So, it set a goal to shore up its balance sheet and provide more of a self-sustaining business model. The change in direction of the company caused its share price to rise on the day it cut its dividend and announced its new strategy.

Fast forward to 2021, and it is starting to reap some of the benefits of the turnaround, along with rising natural gas prices.

Altagas earnings and boosted guidance has vaulted price

…one of the key questions investors are asking, is if the valuation gap has evaporated.

The recovery of the energy industry was inevitable. The only question investors were asking themselves was when. And, it appears that 2021 is going to be a considerable turnaround for the industry.

In fact, Altagas is bullish on 2021, raising its overall guidance in terms of earnings by 16%, now expecting 2021 earnings to come in on the high end at $1.80 per share. Investors have taken this guidance, along with an excellent quarter from the company, and are scooping up the stock right now.

But one of the key questions investors are asking, is if the valuation gap has evaporated.

Atlagas is still trading at a discount to its peers and historical averages

For those looking at Altagas from a valuation standpoint, you’re in luck. That is because the stock, despite a huge run up compared to its peers, is still trading at a discount. Valuing a company based on 2020 production, especially one in the oil and gas industry which was hit so hard, is ineffective. When looking at a company like Altagas, we want to be looking forward.

The company is definitely attractive in that regard. It is trading at only 13.25 times forward earnings, and is trading at a discount to its 3, 5, and 10 year historical price to book and price to sales ratios.

In addition, the price of natural gas has rebounded in a big way in 2021, and is currently up just shy of 20% in 2021, and almost 70% over the last year. As a company with high interest in the commodity, Altagas stands to benefit from bullish price movements in natural gas.

Yes, the company has run up 27% in 2021, but it still provides relatively solid value today. This is a stock that has been perennially undervalued for quite some time now due to its dividend cut and operational inefficiencies. But, the turnaround is still in motion and is paying off, as the company has strengthened its balance sheet and investors are becoming more confident in the company’s long term prospects.

This won’t be a company that will blow you away with share appreciation. However, it provides a modest dividend yield of just over 4%, and is likely to provide mid single digit share appreciation on an annual basis.

Trust is a pillar of success when it comes to Canadian companies within our stock market. See what happened with Xebec Adsorption (TSX:XBC) as we consider whether or not they will be able to recover.