Let’s Take a Look at This Popular Tech ETF in Canada: XIT.

If you’ve been investing in the stock market for the last few years, you likely know that tech stocks have reined supreme. In ultra-low interest rate environments, these companies have been able to borrow and expand their businesses at record low costs. Returns on capital have ballooned for major tech companies like Apple, Microsoft, and Alphabet.

You’re looking to get exposure to the Canadian tech sector, but don’t exactly want to pick an individual company or a handful of companies out of the fear of picking the wrong ones. You’d rather just own the entire industry. Well, let’s introduce one of the best Canadian ETFs in the country for long-term capital growth and exposure to Canada’s growing tech industry.

The iShares TSX Capped Information Technology Index ETF (TSE:XIT)

For those looking for a tech ETF that has exposure to Canadian technology stocks, unfortunately this is the only option. However, considering how small the options are here in Canada it’s really not a bad thing, as it is an outstanding ETF.

The ETF aims to replicate the performance of the S&P/TSX Capped Information Technology Index, net of expenses. In reality, this ETF is more of an index fund and it is passively managed. It trades on the Toronto Stock Exchange and is the easiest avenue for exposure to the information technology sector.

XIT holdings

XIT is relatively small, containing only 24 holdings. At the time of writing out of those 24 holdings, only 13 of them had a weighting above 1%. The popular ETF contains many small allocations towards companies like Haivision Systems, VIQ Solutions, Alithya Group, and Quarterhill Inc.

However, the ETF also contains some of the largest giants in the country, including Constellation Software, Shopify, Lightspeed Commerce, Open Text, CGI Group, Blackberry, and Nuvei.

XIT is top-heavy, with Constellation Software and Shopify making up 47% of the total allocation. If we add in the 3rd and 4th largest holdings CGI and Open Text, the top 4 make up 72%.

One could take a positive or negative view with XIT’s concentration risk. For one, it’s exposed heavily to some of the best performers in the country. But on the other hand, it relies too much on the performance of few, and if a larger held company were to falter the ETF would face significant volatility. This might just not fit the mold of more conservative investment strategies.

XIT management fees and distributions

The management expense ratio for XIT comes in at 0.61%, meaning you’ll pay $6.61 per $1000 invested on an annual basis. Considering the fund’s performance, which we’ll get to in a bit, this isn’t expensive by any stretch of the imagination.

However, when we look to other passively managed index funds, the MER is quite a bit higher.

In terms of distributions, they’re practically non-existent. The fund has a yield of 0.03%, which is likely a result of some smaller-yielding companies in the portfolio like Open Text and Enghouse.

But let’s just say if you’re an experienced investor, or just learning how to buy stocks and looking for an ETF to set you up with a nice passive income stream, it won’t be XIT.

XIT performance

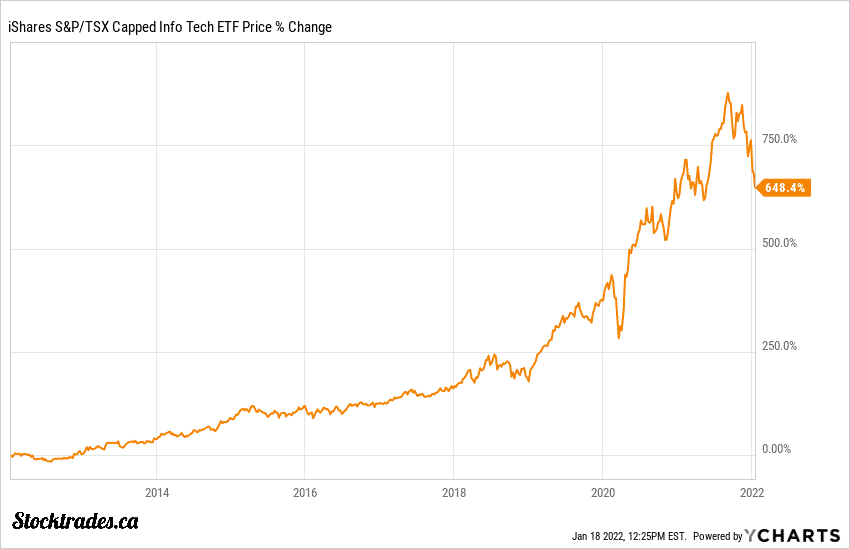

Now we’re moving on to the good stuff, and where XIT really shines. The ETF has been around for quite some time, debuting during the dot-com bubble in the early 2000’s. And over that time period it has returned 346%.

For a technology ETF, these returns may seem low, especially over a 20 year time period. However, it has been more recently that XIT has begun to shine, particularly because of the emergence of some major technology players here in Canada like Constellation Software and Shopify.

Over the last 15 years, the ETF has returned 12.17% annually, but if we look to the past 10, 5, and 3 year periods, it has returned 23.12%, 27.82%, and 36.22% on an annualized basis, respectively. These 10, 5, and 3-year return levels are higher than high-flying technology ETFs south of the border like QQQ, which tracks the NASDAQ 100.

XIT size and volume

Considering XIT is one of the best performing ETFs in Canada over the last while, it’s surprising its assets under management are only around $529M. Considering many major mutual funds and ETFs here in Canada have AUM in the multi-billion dollar range, we’re surprised that it hasn’t garnered more attention.

In terms of daily volume, you won’t have much problems in terms of liquidity. The ETF has 30-day average daily volume of around 31,000. And at the time of writing with a net asset value of $46.90, this is enough money moving around on a daily basis to satisfy most all retail investors.

And on a side note, XIT is exempt from many brokerage commissions, as it is on most all commission-free trading lists. Just make sure to check if your brokerage includes it.

Overall, this TSX capped info tech ETF is the go-to option for Canadians

No, this ETF doesn’t contain the likes of Amazon, or Apple such as in XEQT or XGRO, Alphabet, or Microsoft. But, it isn’t meant to. This is strictly an ETF that is supposed to give investors exposure to Canada’s ever-growing technology sector.

The fund has reasonable fees, strong liquidity, and contains almost every relevant Canadian tech company in the country. However, due to the limited amount of options, it does pose some concentration risk. If Shopify or Constellation Software were to falter, it would have a detrimental effect on the ETF’s performance.